Question: Please Solve These Questions From E4-12 to E4-14 E4-12 Max Weinberg Company discovered the following errors made in January 2010. 1. A payment of Salaries

Please Solve These Questions From E4-12 to E4-14

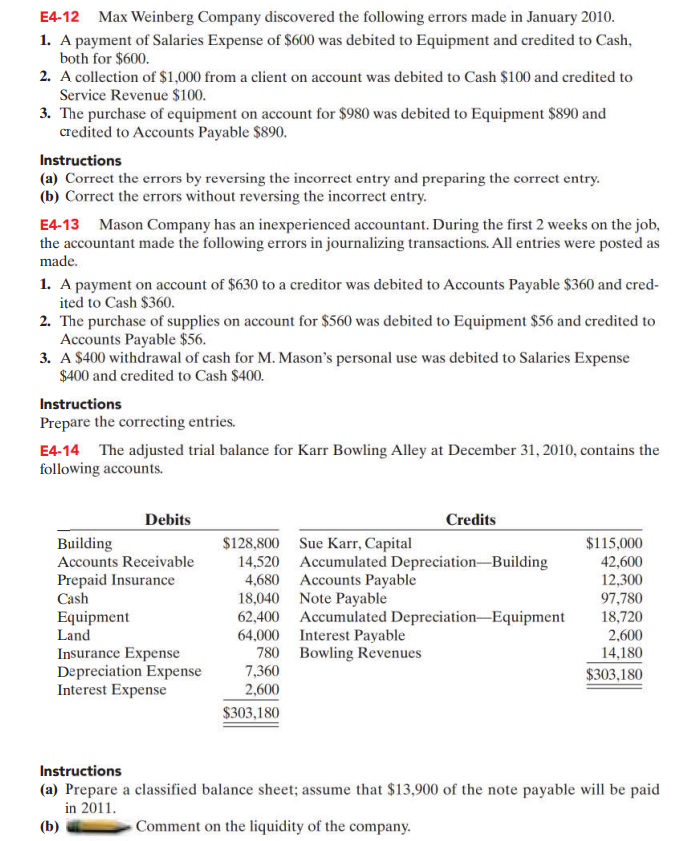

E4-12 Max Weinberg Company discovered the following errors made in January 2010. 1. A payment of Salaries Expense of $600 was debited to Equipment and credited to Cash, both for $600. 2. A collection of $1,000 from a client on account was debited to Cash $100 and credited to Service Revenue $100. 3. The purchase of equipment on account for $980 was debited to Equipment $890 and credited to Accounts Payable $890. Instructions (a) Correct the errors by reversing the incorrect entry and preparing the correct entry. (b) Correct the errors without reversing the incorrect entry. E4-13 Mason Company has an inexperienced accountant. During the first 2 weeks on the job, the accountant made the following errors in journalizing transactions. All entries were posted as made. 1. A payment on account of $630 to a creditor was debited to Accounts Payable $360 and cred- ited to Cash $360 2. The purchase of supplies on account for $560 was debited to Equipment $56 and credited to Accounts Payable $56. 3. A $400 withdrawal of cash for M. Mason's personal use was debited to Salaries Expense $400 and credited to Cash $400. Instructions Prepare the correcting entries. E4-14 The adjusted trial balance for Karr Bowling Alley at December 31, 2010, contains the following accounts. Debits Building Accounts Receivable Prepaid Insurance Cash Equipment Land Insurance Expense Depreciation Expense Interest Expense Credits $128,800 Sue Karr, Capital 14,520 Accumulated Depreciation-Building 4,680 Accounts Payable 18,040 Note Payable 62,400 Accumulated Depreciation Equipment 64.000 Interest Payable 780 Bowling Revenues 7,360 2,600 $303,180 $115,000 42,600 12,300 97,780 18,720 2.600 14,180 $303,180 Instructions (a) Prepare a classified balance sheet; assume that $13,900 of the note payable will be paid in 2011. (b) Comment on the liquidity of the company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts