Question: Please Solve these questions From E4-17 to E4-19 E4-17 These financial statement items are for B. Snyder Company at year-end, July 31, 2010. Salaries payable

Please Solve these questions From E4-17 to E4-19

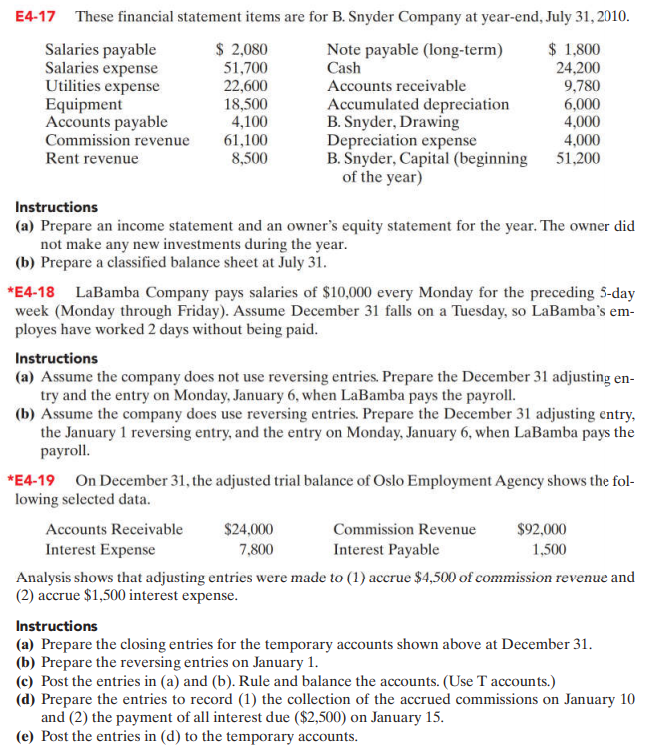

E4-17 These financial statement items are for B. Snyder Company at year-end, July 31, 2010. Salaries payable $ 2,080 Note payable (long-term) $ 1,800 Salaries expense 51,700 Cash 24,200 Utilities expense 22,600 Accounts receivable 9,780 Equipment 18,500 Accumulated depreciation 6,000 Accounts payable 4,100 B. Snyder, Drawing 4,000 Commission revenue 61,100 Depreciation expense 4,000 Rent revenue 8,500 B. Snyder, Capital (beginning 51,200 of the year) Instructions (a) Prepare an income statement and an owner's equity statement for the year. The owner did not make any new investments during the year. (b) Prepare a classified balance sheet at July 31. *E4-18 LaBamba Company pays salaries of $10,000 every Monday for the preceding 5-day week (Monday through Friday). Assume December 31 falls on a Tuesday, so LaBamba's em- ployes have worked 2 days without being paid. Instructions (a) Assume the company does not use reversing entries. Prepare the December 31 adjusting en- try and the entry on Monday, January 6, when LaBamba pays the payroll. (b) Assume the company does use reversing entries. Prepare the December 31 adjusting entry, the January 1 reversing entry, and the entry on Monday, January 6, when LaBamba pays the payroll. *E4-19 On December 31, the adjusted trial balance of Oslo Employment Agency shows the fol- lowing selected data. Accounts Receivable $24,000 Commission Revenue $92,000 Interest Expense 7.800 Interest Payable 1,500 Analysis shows that adjusting entries were made to (1) accrue $4,500 of commission revenue and (2) accrue $1,500 interest expense. Instructions (a) Prepare the closing entries for the temporary accounts shown above at December 31. (b) Prepare the reversing entries on January 1. (c) Post the entries in (a) and (b). Rule and balance the accounts. (Use T accounts.) (d) Prepare the entries to record (1) the collection of the accrued commissions on January 10 and (2) the payment of all interest due ($2,500) on January 15. (e) Post the entries in (d) to the temporary accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts