Question: Please solve these questions step by step and explain why have this step on this questionand expand what knowledge pointalso are there any trends in

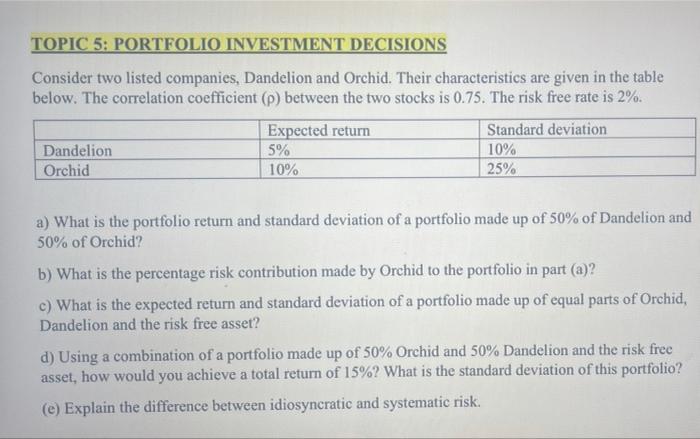

TOPIC 5: PORTFOLIO INVESTMENT DECISIONS Consider two listed companies, Dandelion and Orchid. Their characteristics are given in the table below. The correlation coefficient (p) between the two stocks is 0.75. The risk free rate is 2%. Expected return Standard deviation Dandelion 5% 10% Orchid 10% 25% a) What is the portfolio return and standard deviation of a portfolio made up of 50% of Dandelion and 50% of Orchid? b) What is the percentage risk contribution made by Orchid to the portfolio in part (a)? c) What is the expected return and standard deviation of a portfolio made up of equal parts of Orchid, Dandelion and the risk free asset? d) Using a combination of a portfolio made up of 50% Orchid and 50% Dandelion and the risk free asset, how would you achieve a total return of 15%? What is the standard deviation of this portfolio? (e) Explain the difference between idiosyncratic and systematic risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts