Question: Please solve this accounting project like this example shown below THIS IS THE EXAMPLE: - BASIC ACCOUNTING - A company has the following elements in

Please solve this accounting project like this example shown below

THIS IS THE EXAMPLE:

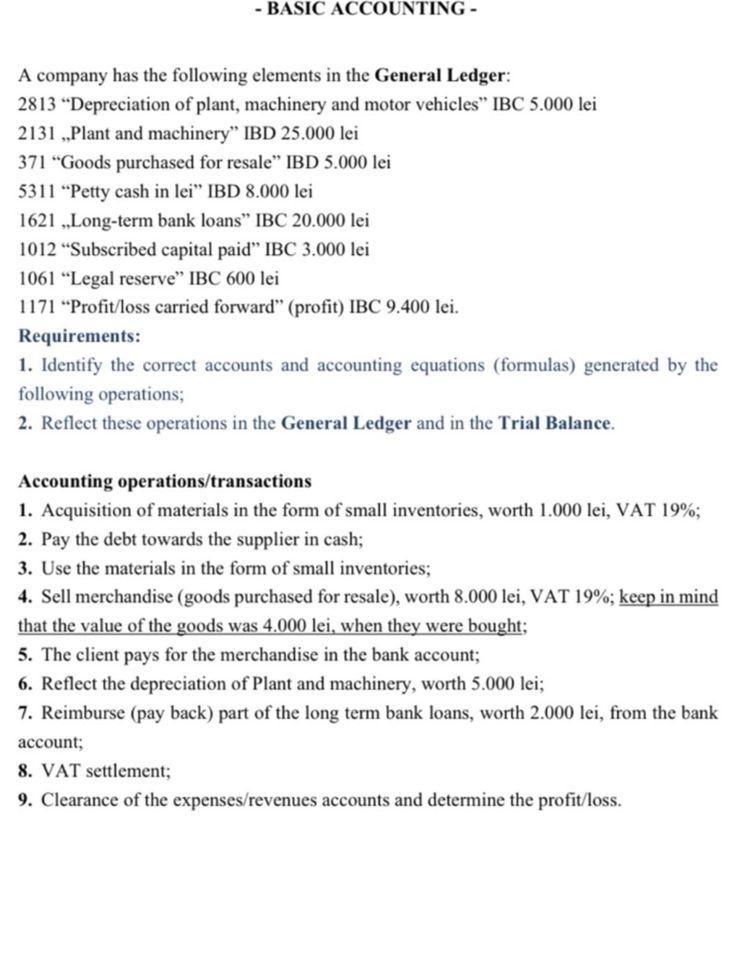

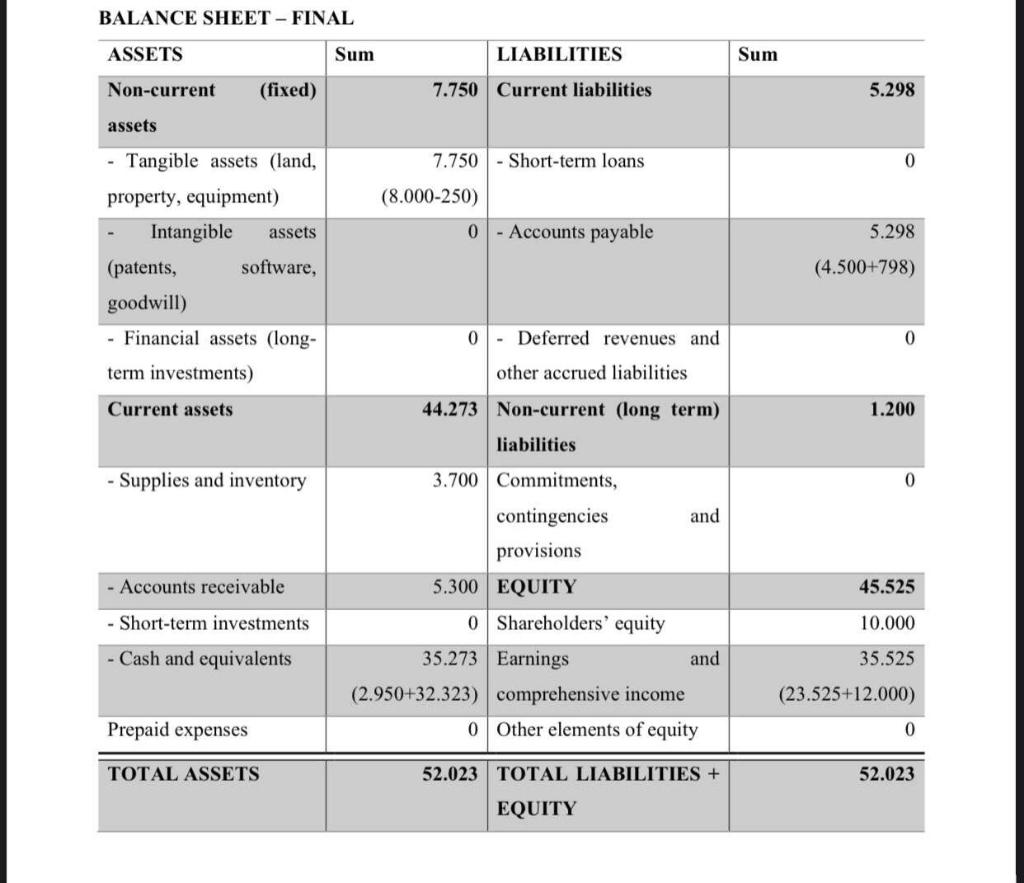

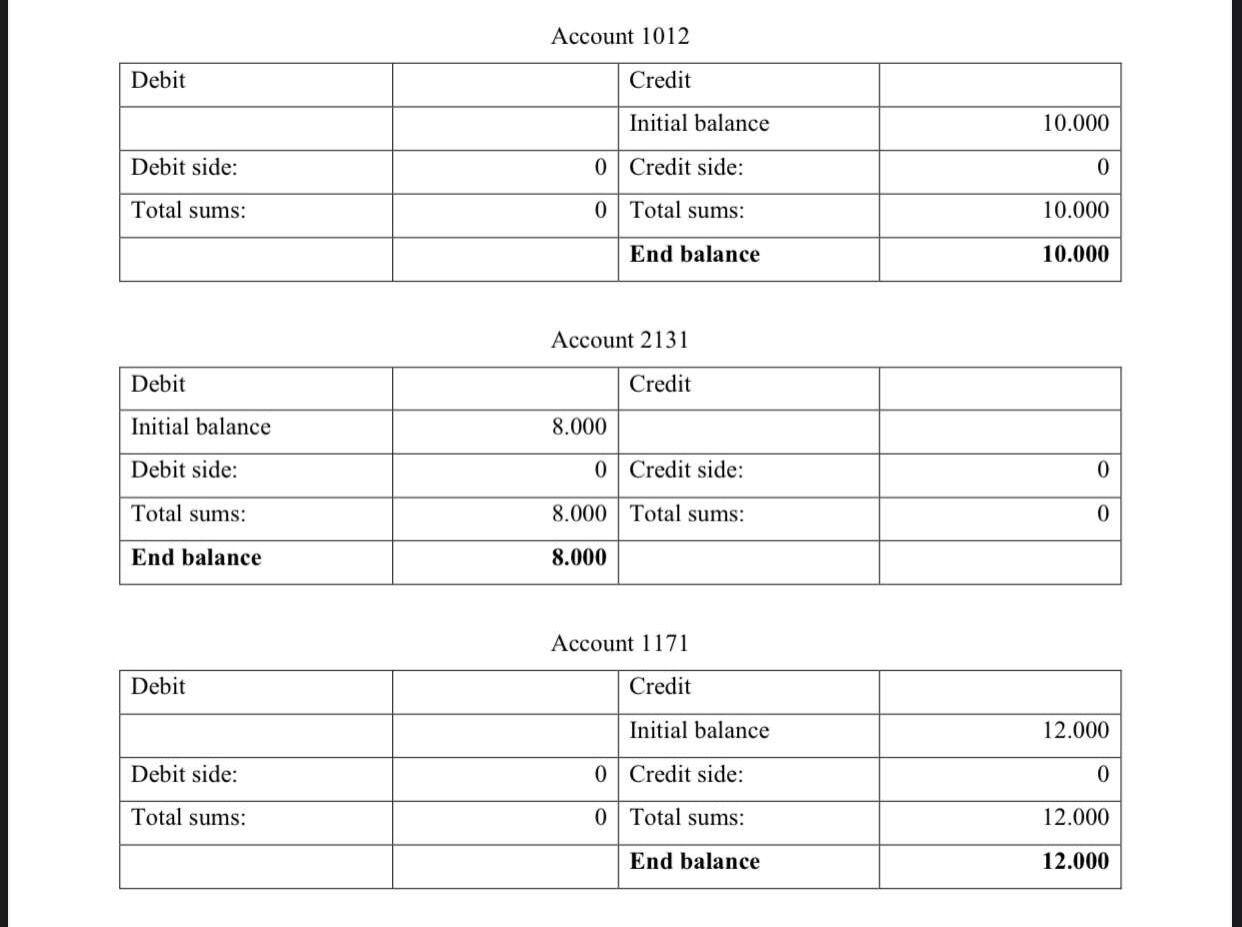

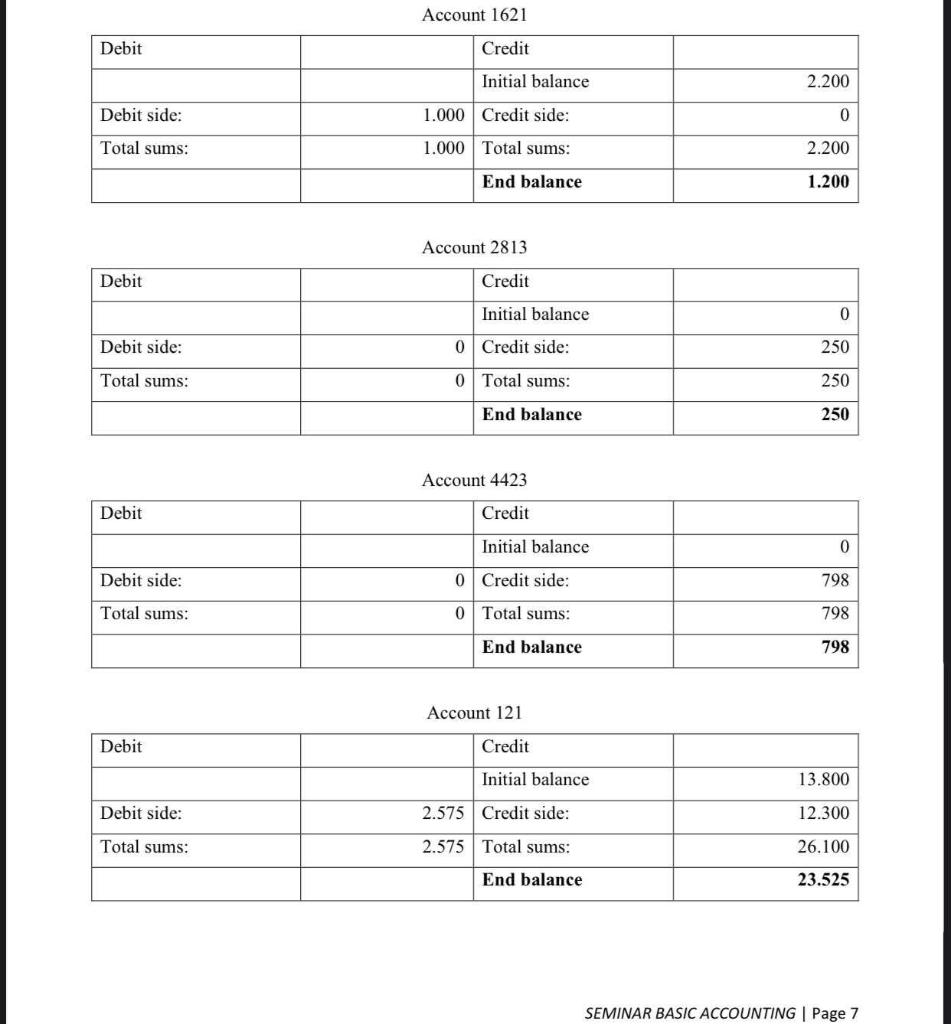

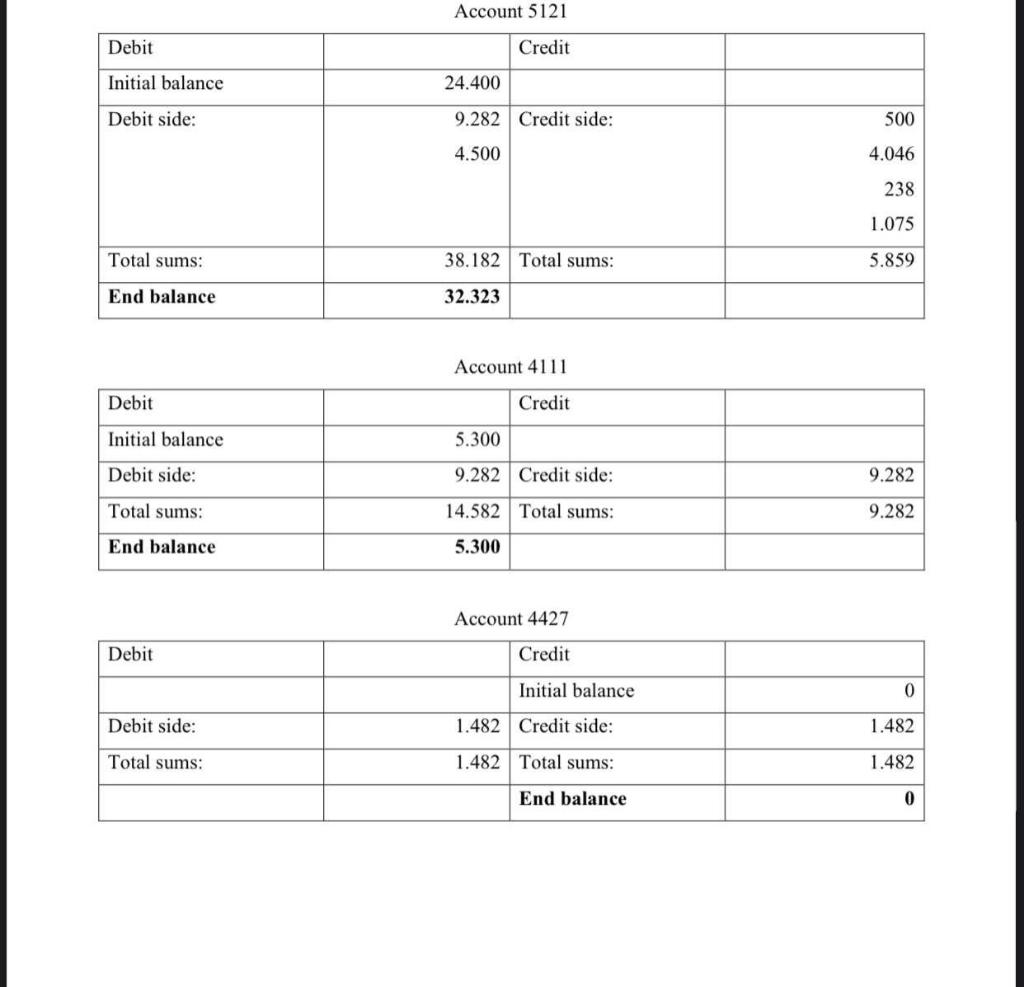

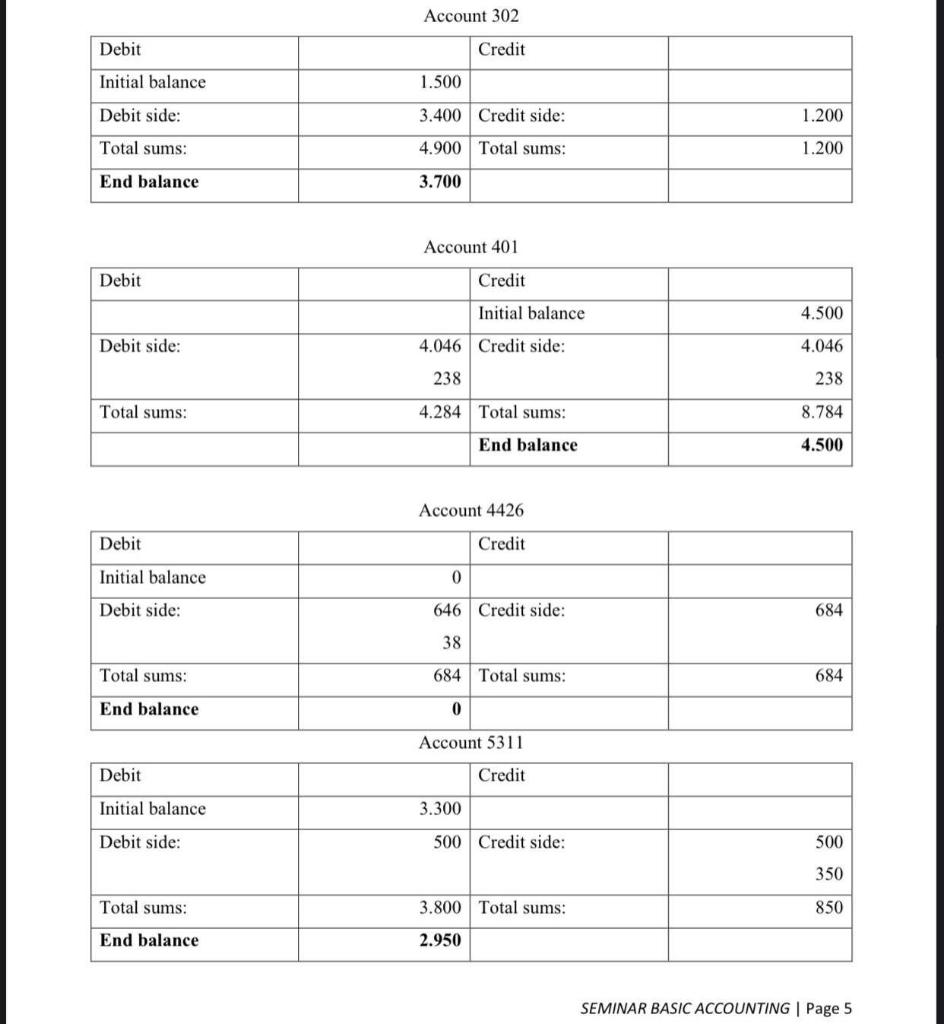

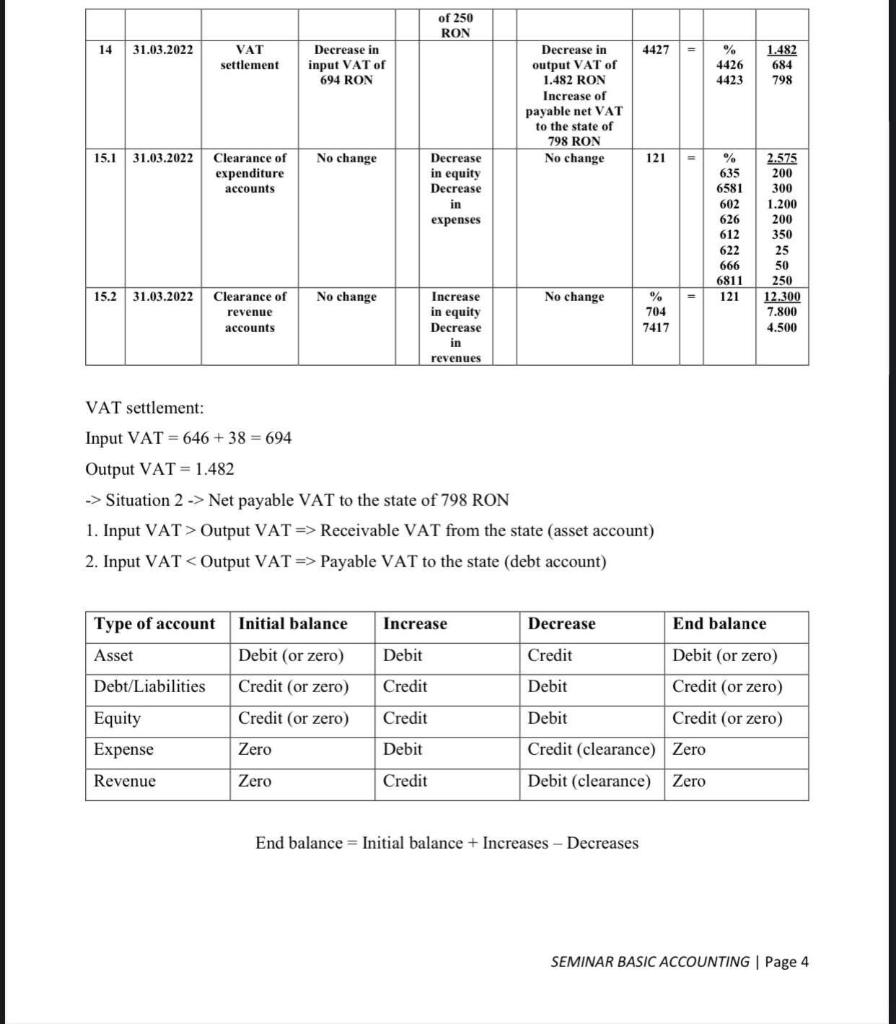

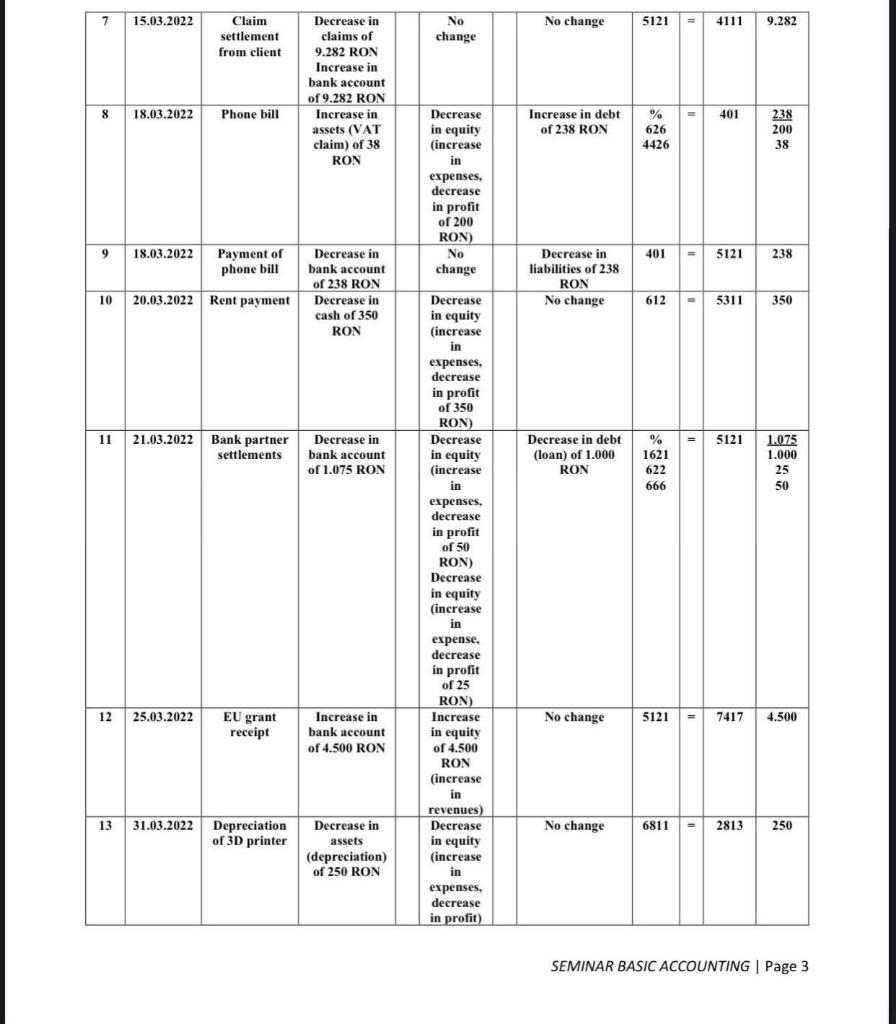

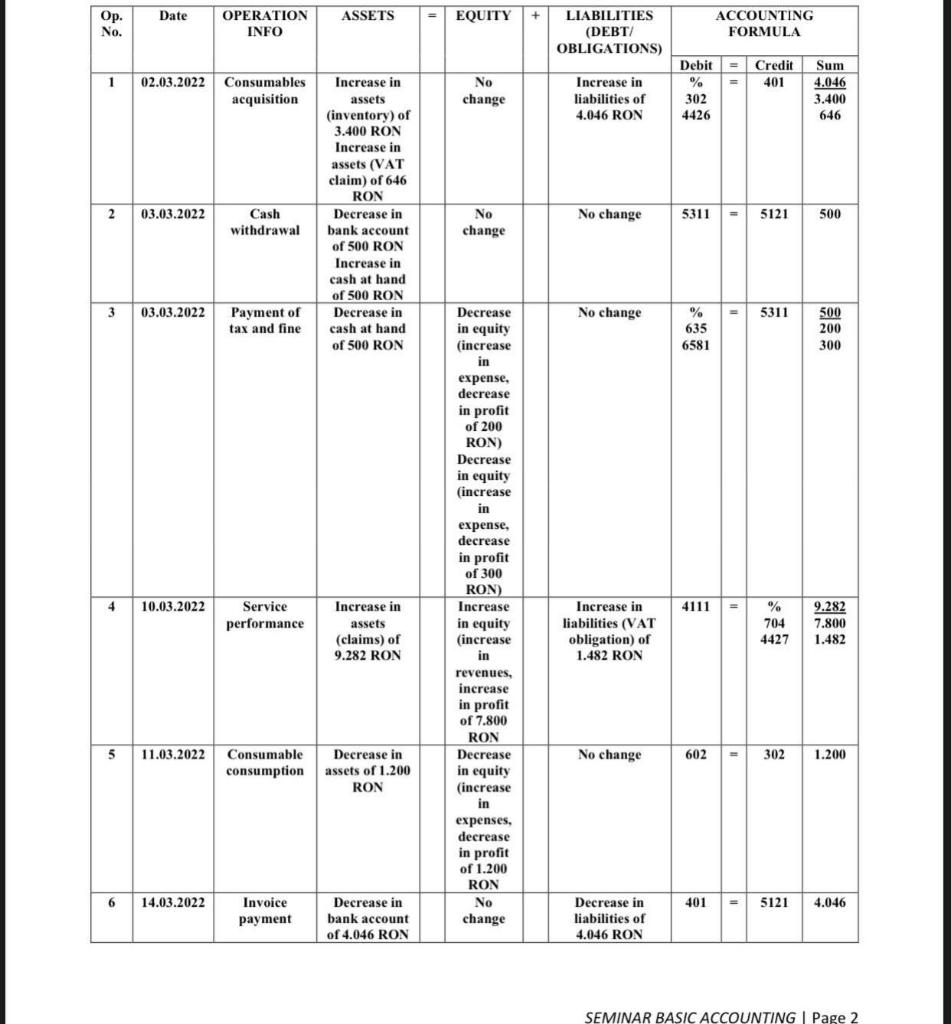

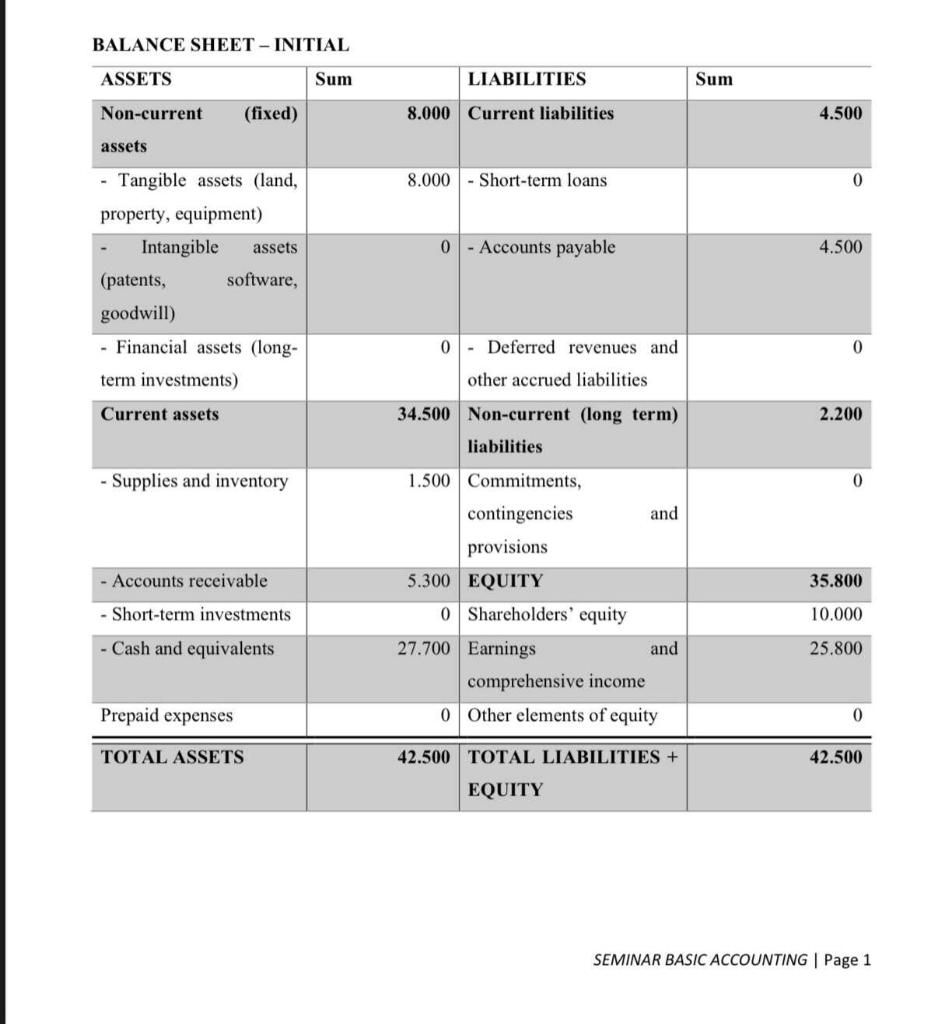

- BASIC ACCOUNTING - A company has the following elements in the General Ledger: 2813 "Depreciation of plant, machinery and motor vehicles" IBC 5.000 lei 2131 ,,Plant and machinery" IBD 25.000 lei 371 "Goods purchased for resale" IBD 5.000 lei 5311 "Petty cash in lei" IBD 8.000 lei 1621 ,,Long-term bank loans" IBC 20.000 lei 1012 "Subscribed capital paid" IBC 3.000 lei 1061 "Legal reserve" IBC 600 lei 1171 "Profit/loss carried forward" (profit) IBC 9.400 lei. Requirements: 1. Identify the correct accounts and accounting equations (formulas) generated by the following operations; 2. Reflect these operations in the General Ledger and in the Trial Balance. Accounting operations/transactions 1. Acquisition of materials in the form of small inventories, worth 1.000 lei, VAT 19%; 2. Pay the debt towards the supplier in cash; 3. Use the materials in the form of small inventories; 4. Sell merchandise (goods purchased for resale), worth 8.000 lei, VAT 19%; keep in mind that the value of the goods was 4.000 lei, when they were bought; 5. The client pays for the merchandise in the bank account; 6. Reflect the depreciation of Plant and machinery, worth 5.000 lei; 7. Reimburse (pay back) part of the long term bank loans, worth 2.000 lei, from the bank account; 8. VAT settlement; 9. Clearance of the expenses/revenues accounts and determine the profit/loss. BALANCE SHEET - FINAL ASSETS Sum Non-current (fixed) assets Tangible assets (land, property, equipment) Intangible assets (patents, software, goodwill) - Financial assets (long- term investments) Current assets - Supplies and inventory Accounts receivable - Short-term investments - Cash and equivalents Prepaid expenses TOTAL ASSETS LIABILITIES 7.750 Current liabilities 7.750-Short-term loans 0 - Accounts payable 0 Deferred revenues and other accrued liabilities 44.273 Non-current (long term) liabilities 3.700 Commitments, contingencies and provisions 5.300 EQUITY 0 35.273 (2.950+32.323) 0 52.023 (8.000-250) Shareholders' equity Earnings comprehensive income Other elements of equity TOTAL LIABILITIES + EQUITY and Sum 5.298 0 5.298 (4.500+798) 0 1.200 0 45.525 10.000 35.525 (23.525+12.000) 0 52.023 Debit Debit side: Total sums: Debit Initial balance Debit side: Total sums: End balance Debit Debit side: Total sums: Account 1012 Credit Initial balance Credit side: Total sums: End balance 0 0 Account 2131 Credit 8.000 0 Credit side: 8.000 Total sums: 8.000 Account 1171 Credit Initial balance 0 Credit side: 0 Total sums: End balance 10.000 0 10.000 10.000 0 0 12.000 0 12.000 12.000 Debit Debit side: Total sums: Debit Debit side: Total sums: Debit Debit side: Total sums: Debit Debit side: Total sums: Account 1621 Credit Initial balance 1.000 Credit side: 1.000 Total sums: End balance Account 2813 Credit Initial balance Credit side: Total sums: End balance 0 0 Account 4423 Credit Initial balance. Credit side: Total sums: End balance 0 0 2.200 0 2.200 1.200 0 250 250 250 0 798 798 798 13.800 12.300 26.100 23.525 SEMINAR BASIC ACCOUNTING | Page 7 Account 121 Credit Initial balance 2.575 Credit side: 2.575 Total sums: End balance Debit Initial balance Debit side: Total sums: End balance Debit Initial balance Debit side: Total sums: End balance Debit Debit side: Total sums: Account 5121 Credit 24.400 9.282 Credit side: 4.500 38.182 Total sums: 32.323 Account 4111 Credit 5.300 9.282 Credit side: 14.582 Total sums: 5.300 Account 4427 Credit Initial balance 1.482 Credit side: 1.482 Total sums: End balance 500 4.046 238 1.075 5.859 9.282 9.282 0 1.482 1.482 0 Debit Initial balance Debit side: Total sums: End balance Debit Debit side: Total sums: Debit Initial balance Debit side: Total sums: End balance Debit Initial balance Debit side: Total sums: End balance Account 302 Credit 1.500 3.400 Credit side: 4.900 Total sums: 3.700 Account 401 Credit Initial balance 4.046 Credit side: 238 4.284 Total sums: End balance Account 4426 Credit 0 646 Credit side: 38 684 Total sums: 0 Account 5311 Credit 3.300 500 Credit side: 3.800 Total sums: 2.950 1.200 1.200 4.500 4.046 238 8.784 4.500 684 684 500 350 850 SEMINAR BASIC ACCOUNTING | Page 5 of 250 RON 14 31.03.2022 VAT settlement 15.1 31.03.2022 121 = Clearance of expenditure. accounts Decrease in equity Decrease in expenses 15.2 31.03.2022 Clearance of % Increase in equity Decrease revenue accounts 704 7417 in revenues VAT settlement: Input VAT 646 + 38 = 694 Output VAT 1.482 -> Situation 2 -> Net payable VAT to the state of 798 RON 1. Input VAT > Output VAT => Receivable VAT from the state (asset account) 2. Input VAT Payable VAT to the state (debt account) Initial balance Increase Type of account Asset Decrease Credit Debit (or zero) Debit Debt/Liabilities Credit (or zero) Credit Debit Equity Credit (or zero) Credit Debit Expense Zero Debit Credit (clearance) Revenue Zero Credit Debit (clearance) End balance Initial balance + Increases - Decreases Decrease in input VAT of 694 RON No change No change Decrease in output VAT of 1.482 RON Increase of payable net VAT to the state of 798 RON No change No change 4427 % 4426 4423 % 635 6581 602 626 612 622 666 6811 121 1.482 684 798 2.575 200 300 1.200 200 350 25 50 50 250 12.300 7.800 4.500 End balance Debit (or zero) Credit (or zero) Credit (or zero) Zero Zero SEMINAR BASIC ACCOUNTING | Page 4 7 8 9 10 11 12 13 15.03.2022 Claim settlement from client 18.03.2022 Phone bill 18.03.2022 Payment of phone bill 20.03.2022 Rent payment 21.03.2022 Bank partner settlements 25.03.2022 EU grant receipt 31.03.2022 Depreciation of 3D printer Decrease in claims of 9.282 RON Increase in bank account of 9.282 RON Increase in assets (VAT claim) of 38 RON Decrease in bank account of 238 RON Decrease in cash of 350 RON Decrease in bank account of 1.075 RON Increase in bank account of 4.500 RON Decrease in assets (depreciation) of 250 RON No change Decrease in equity (increase in expenses, decrease in profit of 200 RON) No change Decrease in equity (increase in expenses. decrease in profit of of 350 RON) Decrease in equity (increase in expenses, decrease in profit of 50 RON) Decrease. in equity (increase in expense, decrease in profit of 25 RON) Increase in equity of 4.500 RON (increase in revenues) Decrease in equity (increase in expenses, decrease in profit) 5121 4111 9.282 % 401 238 626 200 4426 38 401 238 612 350 % 1621 1.075 1.000 622 25 666 50 No change 5121 7417 4.500 No change 6811 = 2813 250 SEMINAR BASIC ACCOUNTING | Page 3 No change Increase in debt of 238 RON Decrease in liabilities of 238 RON No change Decrease in debt (loan) of 1.000 RON = 5121 5311 " "] 5121 Op. Date OPERATION INFO No. 1 02.03.2022 Consumables acquisition 2 03.03.2022 Cash withdrawal 3 03.03.2022 Payment of tax and fine 4 10.03.2022 Service performance Increase in assets (claims) of 9.282 RON 5 11.03.2022 Consumable Decrease in consumption assets of 1.200 RON 6 14.03.2022 Invoice payment Decrease in bank account of 4.046 RON ASSETS Increase in assets (inventory) of 3.400 RON Increase in assets (VAT claim) of 646 RON Decrease in bank account of 500 RON Increase in cash at hand of 500 RON Decrease in cash at hand of 500 RON EQUITY No change No change Decrease in equity (increase in expense, decrease in profit of 200 RON) Decrease in equity (increase in expense, decrease in profit of 300 RON) Increase in equity (increase in C revenues, vende increase in profit of 7.800 RON Decrease in equity (increase in expenses, decrease in profit of 1.200 RON No change + LIABILITIES (DEBT/ OBLIGATIONS) Increase in liabilities of 4.046 RON No change No change Debit % 302 4426 5311 % 635 6581 4111 ACCOUNTING FORMULA Credit Sum 4.046 3.400 646 500 500 200 300 Increase in % 9.282 704 7.800 liabilities (VAT obligation) of 1.482 RON 4427 1.482 No change. 602 = 302 1.200 401 = 5121 4.046 Decrease in liabilities of 4.046 RON SEMINAR BASIC ACCOUNTING | Page 2 = 401 5121 5311 BALANCE SHEET-INITIAL ASSETS Sum Non-current (fixed) assets Tangible assets (land, property, equipment) Intangible assets (patents, software, goodwill) - Financial assets (long- term investments) Current assets - Supplies and inventory Accounts receivable - Short-term investments - Cash and equivalents Prepaid expenses TOTAL ASSETS LIABILITIES 8.000 Current liabilities 8.000 Short-term loans 0 - Accounts payable 0 - Deferred revenues and other accrued liabilities 34.500 Non-current (long term) liabilities 1.500 Commitments, and contingencies provisions 5.300 EQUITY 27.700 4.500 0 4.500 0 2.200 0 35.800 10.000 25.800 0 42.500 SEMINAR BASIC ACCOUNTING | Page 1 0 Shareholders' equity Earnings comprehensive income 0 Other elements of equity 42.500 TOTAL LIABILITIES + EQUITY Sum and

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts