Question: please solve this, and can you explain how you got the answer Shamrock, Inc.'s general ledger at April 30, 2022, included the following: Cash $5,400,

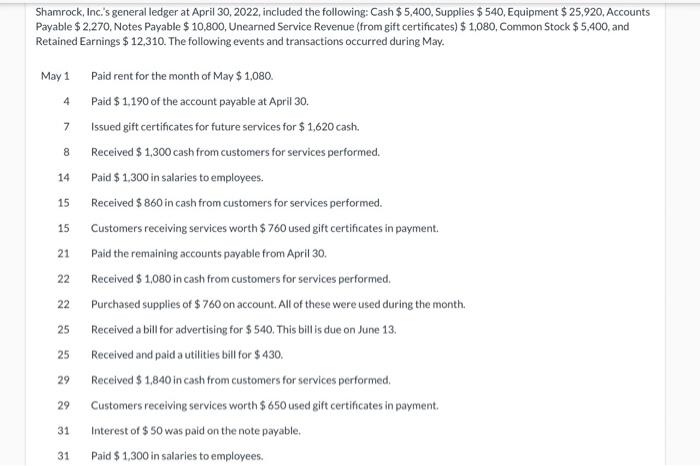

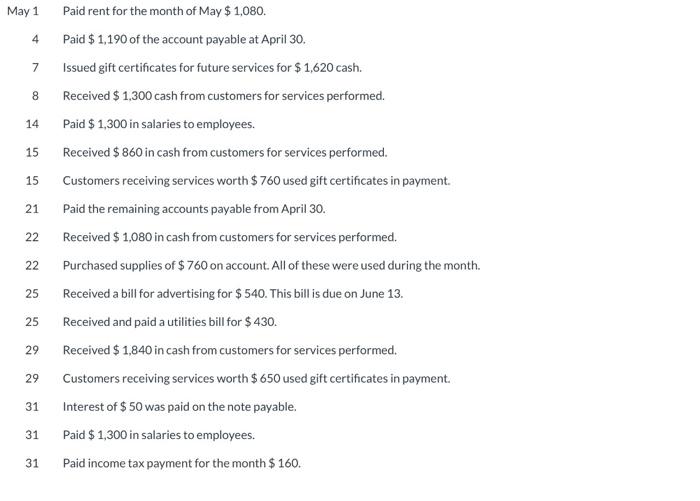

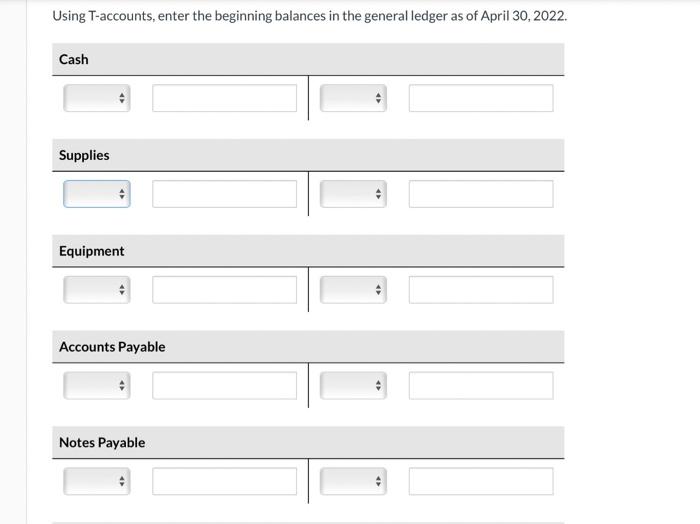

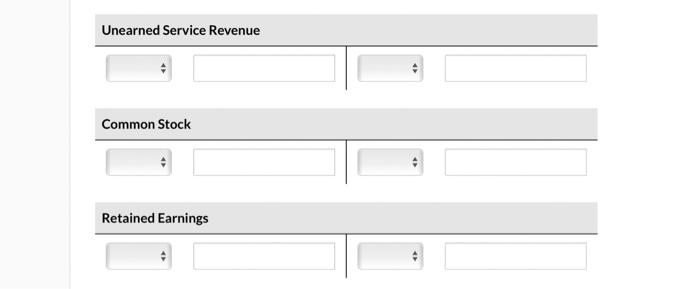

Shamrock, Inc.'s general ledger at April 30, 2022, included the following: Cash $5,400, Supplies $540, Equipment $ 25,920, Accounts Payable $ 2.270, Notes Payable $ 10,800, Unearned Service Revenue (from gift certificates) $ 1,080, Common Stock $ 5,400, and Retained Earnings $ 12,310. The following events and transactions occurred during May. May 1 4 7 8 14 15 15 21 Paid rent for the month of May $ 1,080 Paid $ 1.190 of the account payable at April 30. Issued gift certificates for future services for $1,620 cash. Received $ 1,300 cash from customers for services performed. 1 Paid $ 1.300 in salaries to employees. Received $ 860 in cash from customers for services performed. Customers receiving services worth $ 760 used gift certificates in payment. Paid the remaining accounts payable from April 30. Received $ 1,080 in cash from customers for services performed. Purchased supplies of $ 760 on account. All of these were used during the month. Received a bill for advertising for $ 540. This billis due on June 13. Received and paid a utilities bill for $430, Received $ 1.840 in cash from customers for services performed Customers receiving services worth $ 650 used gift certificates in payment Interest of $ 50 was paid on the note payable. Paid $ 1,300 in salaries to employees 22 22 25 25 29 29 31 31 May 1 4 7 8 14 15 15 21 22 Paid rent for the month of May $ 1,080. Paid $ 1,190 of the account payable at April 30. Issued gift certificates for future services for $ 1,620 cash. Received $ 1,300 cash from customers for services performed. Paid $ 1,300 in salaries to employees. Received $ 860 in cash from customers for services performed. Customers receiving services worth $ 760 used gift certificates in payment. Paid the remaining accounts payable from April 30. Received $ 1,080 in cash from customers for services performed. Purchased supplies of $ 760 on account. All of these were used during the month. Received a bill for advertising for $ 540. This bill is due on June 13. Received and paid a utilities bill for $430. Received $ 1,840 in cash from customers for services performed. Customers receiving services worth $ 650 used gift certificates in payment. Interest of $ 50 was paid on the note payable. Paid $ 1,300 in salaries to employees. Paid income tax payment for the month $160. 22 25 25 29 29 31 31 31 Using T-accounts, enter the beginning balances in the general ledger as of April 30, 2022. Cash Supplies Equipment Accounts Payable Notes Payable Unearned Service Revenue Common Stock Retained Earnings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts