Question: Please solve this and do not copy other answers example it talks about Question #2: Using the example above, calculate the captured profit for your

Please solve this and do not copy other answers

example it talks about

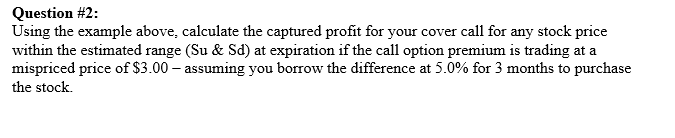

Question #2: Using the example above, calculate the captured profit for your cover call for any stock price within the estimated range (Su & Sd) at expiration if the call option premium is trading at a mispriced price of $3.00 - assuming you borrow the difference at 5.0% for 3 months to purchase the stock Question #1: XYZ's stock currently sells for $100. Over the 3 months, the stock price will either increase by 10% or decrease by 10%. The 3 month T-Bill rate is 5.0% annual rate). Suppose that the 3 month option price of XYZ is at 105. What will be the desired call option premium be traded

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts