Question: Please solve this ASAP. Answer must be rounded to the nearest dollar. Thank you! Hazem has a house that he rents to tenants occasionally. This

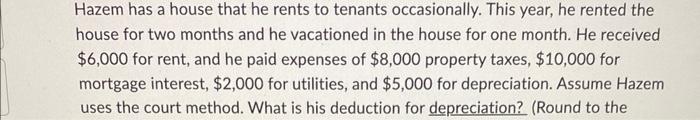

Hazem has a house that he rents to tenants occasionally. This year, he rented the house for two months and he vacationed in the house for one month. He received $6,000 for rent, and he paid expenses of $8,000 property taxes, $10,000 for mortgage interest, $2,000 for utilities, and $5,000 for depreciation. Assume Hazem uses the court method. What is his deduction for depreciation? (Round to the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts