Question: Please solve this correctly. Thank you. Instructions: An excerpt from Section 1 0 . 2 of the Management Discussion and Analysis in the 2 0

Please solve this correctly. Thank you. Instructions:

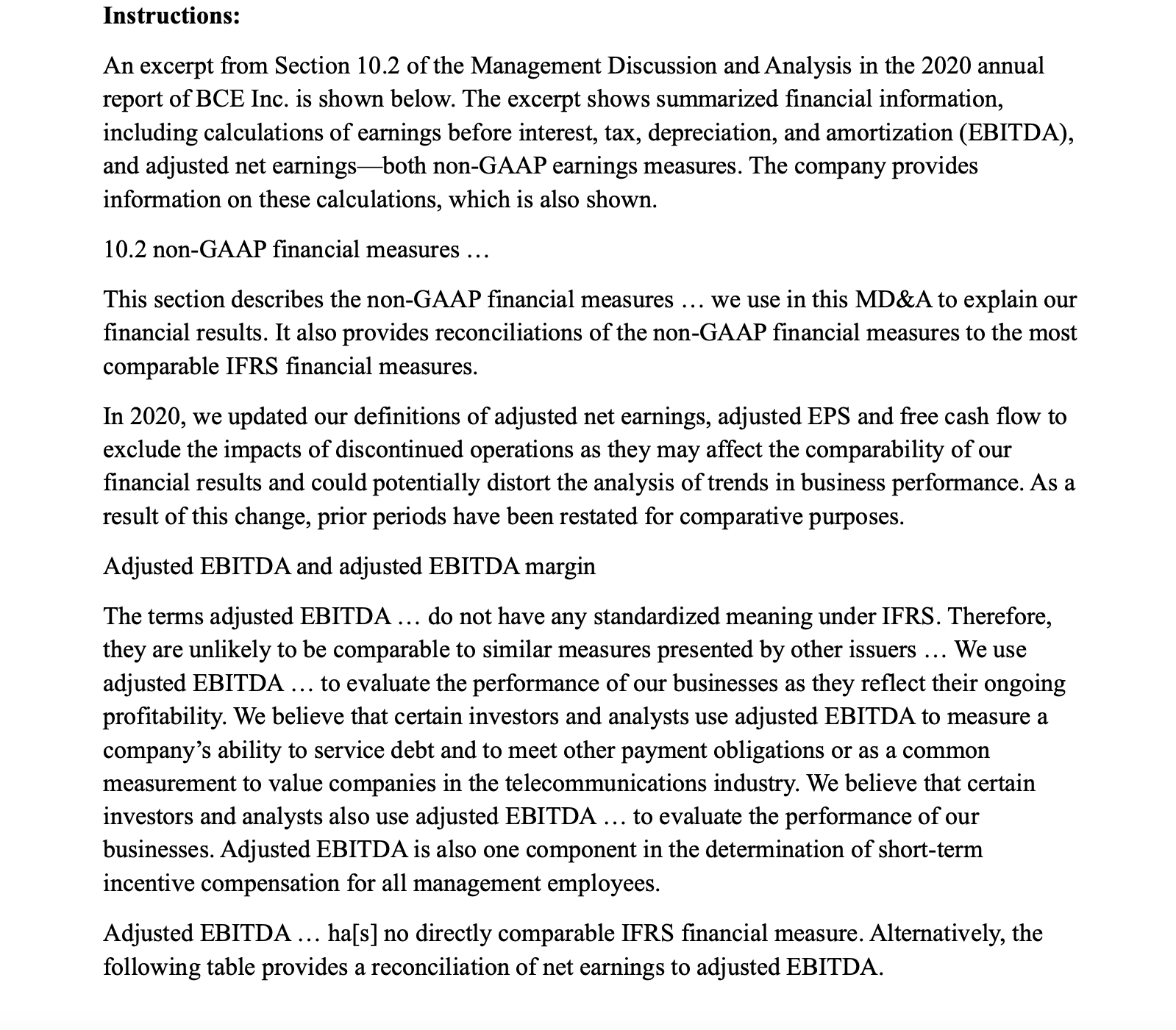

An excerpt from Section of the Management Discussion and Analysis in the annual report of BCE Inc. is shown below. The excerpt shows summarized financial information, including calculations of earnings before interest, tax, depreciation, and amortization EBITDA and adjusted net earningsboth nonGAAP earnings measures. The company provides information on these calculations, which is also shown.

nonGAAP financial measures

This section describes the nonGAAP financial measures we use in this MD&A to explain our financial results. It also provides reconciliations of the nonGAAP financial measures to the most comparable IFRS financial measures.

In we updated our definitions of adjusted net earnings, adjusted EPS and free cash flow to exclude the impacts of discontinued operations as they may affect the comparability of our financial results and could potentially distort the analysis of trends in business performance. As a result of this change, prior periods have been restated for comparative purposes.

Adjusted EBITDA and adjusted EBITDA margin

The terms adjusted EBITDA do not have any standardized meaning under IFRS. Therefore, they are unlikely to be comparable to similar measures presented by other issuers... We use adjusted EBITDA to evaluate the performance of our businesses as they reflect their ongoing profitability. We believe that certain investors and analysts use adjusted EBITDA to measure a company's ability to service debt and to meet other payment obligations or as a common measurement to value companies in the telecommunications industry. We believe that certain investors and analysts also use adjusted EBITDA to evaluate the performance of our businesses. Adjusted EBITDA is also one component in the determination of shortterm incentive compensation for all management employees.

Adjusted EBITDA has no directly comparable IFRS financial measure. Alternatively, the following table provides a reconciliation of net earnings to adjusted EBITDA.

Adjusted net earnings and adjusted EPS

The terms adjusted net earnings and adjusted EPS do not have any standardized meaning under IFRS. Therefore, they are unlikely to be comparable to similar measures presented by other issuers.

We define adjusted net earnings as net earnings attributable to common shareholders before severance, acquisition and other costs, net marktomarket losses gains on derivates used to economically hedge equity settled sharebased compensation plans, net losses gains on investments, early debt redemption costs, impairment of assets and discontinued operations, net of tax and NCI. We define adjusted EPS as adjusted net earnings per BCE common share.

We use adjusted net earnings and adjusted EPS, and we believe that certain investors and analysts use these measures, among other ones, to assess the performance of our businesses without the effects of severance, acquisition and other costs, net marktomarket losses gains on derivative used to economically hedge equity settled sharebased compensation plans, net losses gains on investments, early debt redemption costs, impairment of assets and discontinued operations, net of tax and NCI. We exclude these items because they affect the comparability of our financial results and could potentially distort the analysis of trends in business performance. Excluding these items does not imply they are nonrecurring.

The most comparable IFRS financial measures are net earnings attributable to common shareholders and EPS. The following table is a reconciliation of net earnings attributable to common shareholders and EPS to adjusted net earnings on a consolidated basis and per BCE common share adjusted EPS respectively.

Part A: Instructions marks

Read the excerpts below. In part A of your group project, include requirements a to d

a Provide an overview of the Financial Accounting Reporting environment of BCE Inc. pages

b Discussion Statement of Financial Performance presentation and disclosure requirements applicable to BCE Inc. page

c Discuss the pros and cons of management's decision to report additional earnings numbers outside of the traditional audited financial statements. Include an ethical perspective in your discussion pages

d Do you think that BCE's presentation provides a faithful representation of information? Justify your opinion. pages

Part B: Instructions marks

Based on the industry provided in Part A you are to find another company to benchmark the financial reporting practices.

e Make a comparative analysis of Statement of Financial Performance presentation and disclosure of BCE and the peer company. pages

f Make a comparative analysis of earning per share presentation of BCE and the peer company. pages

g Make an investment recommendations for prospective investors. The assessment should include a review of the financial information for both

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock