Question: please solve this in detail, th Exercise 1: Assume a portfolio of three assets A, B and C having the following characteristics: The correlations are

please solve this in detail, th

please solve this in detail, th

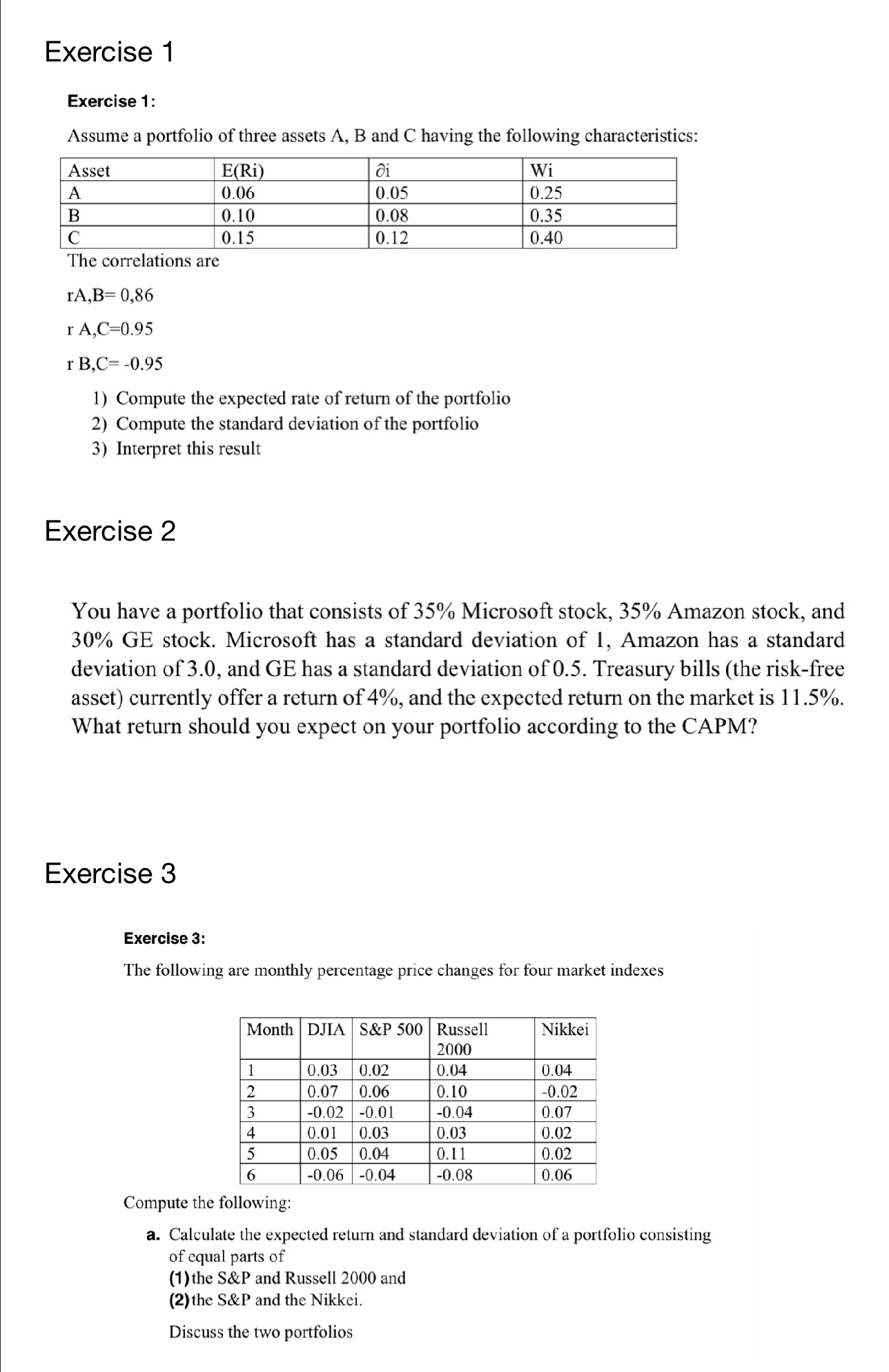

Exercise 1: Assume a portfolio of three assets A, B and C having the following characteristics: The correlations are rA,B=0,86rA,C=0.95rB,C=0.95 1) Compute the expected rate of return of the portfolio 2) Compute the standard deviation of the portfolio 3) Interpret this result Exercise 2 You have a portfolio that consists of 35% Microsoft stock, 35\% Amazon stock, and 30% GE stock. Microsoft has a standard deviation of 1, Amazon has a standard deviation of 3.0, and GE has a standard deviation of 0.5. Treasury bills (the risk-free asset) currently offer a return of 4%, and the expected return on the market is 11.5%. What return should you expect on your portfolio according to the CAPM? Exercise 3 Exercise 3: The following are monthly percentage price changes for four market indexes Compute the following: a. Calculate the expected return and standard deviation of a portfolio consisting of equal parts of (1) the S\&P and Russell 2000 and (2) the S\&P and the Nikkei. Discuss the two portfolios

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts