Question: please solve this > Payback Period This is one useful non-discounting method for evaluating capital investment decisions. The particulars of the method vary depending on

please solve this >

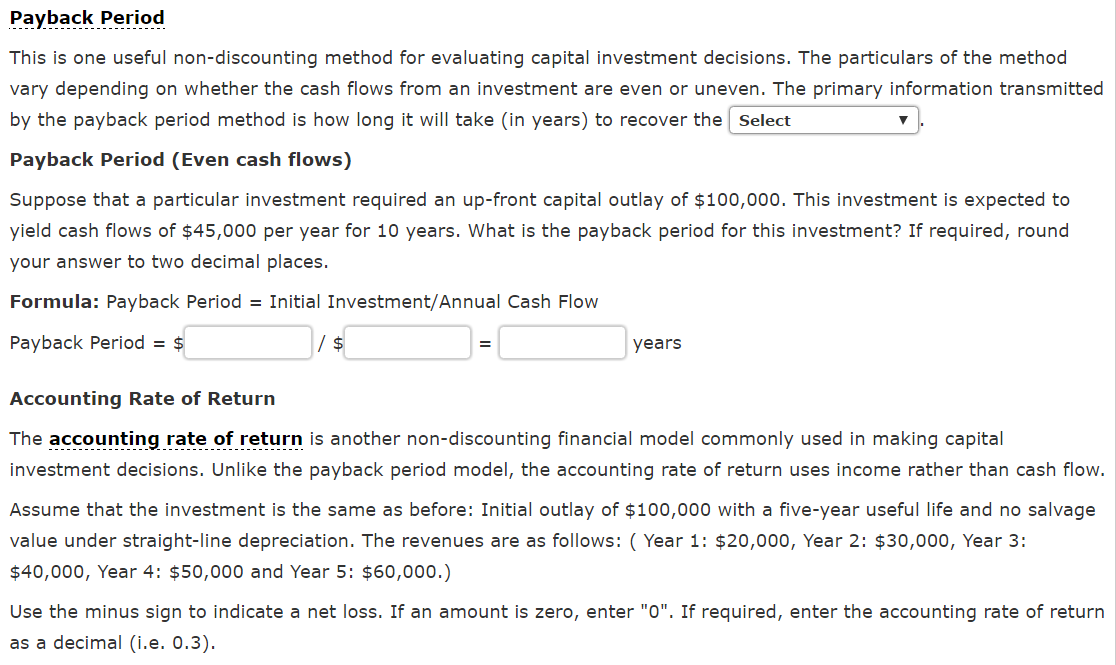

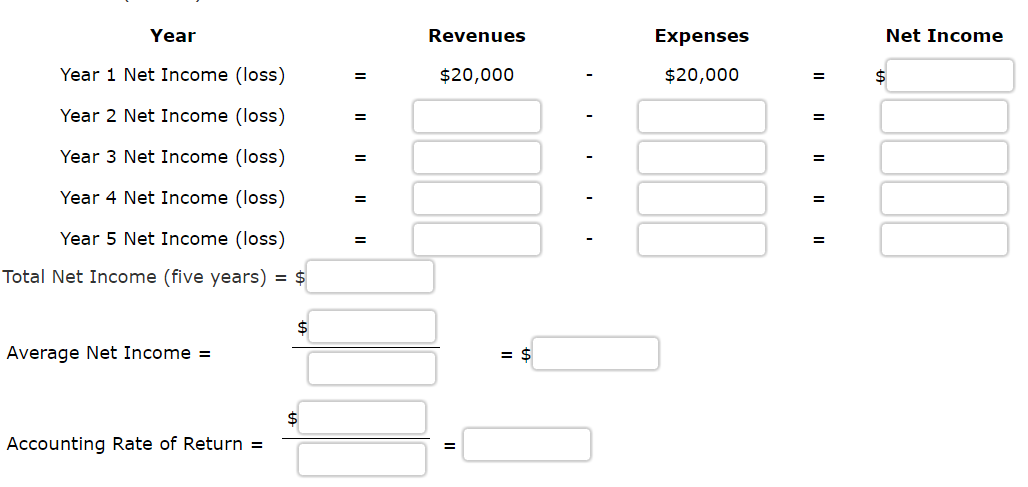

Payback Period This is one useful non-discounting method for evaluating capital investment decisions. The particulars of the method vary depending on whether the cash flows from an investment are even or uneven. The primary information transmitted by the payback period method is how long it will take (in years) to recover the Select Payback Period (Even cash flows) Suppose that a particular investment required an up-front capital outlay of $100,000. This investment is expected to yield cash flows of $45,000 per year for 10 years. What is the payback period for this investment? If required, round your answer to two decimal places. Formula: Payback Period Initial Investment/Annual Cash Flow Payback Period $ years Accounting Rate of Return The accounting rate of return is another non-discounting financial model commonly used in making capital investment decisions. Unlike the payback period model, the accounting rate of return uses income rather than cash flow. Assume that the investment is the same as before: Initial outlay of $100,000 with a five-year useful life and no salvage value under straight-line depreciation. The revenues are as follows: ( Year 1: $20,000, Year 2: $30,000, Year 3: $40,000, Year 4: $50,000 and Year 5: $60,000.) Use the minus sign to indicate a net loss. If an amount is zero, enter "O". If required, enter the accounting rate of return as a decimal (i.e. 0.3)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts