Question: Please solve this problem (4) question 1 and 22 which is referred is attached. (4) Draw a price vs. yield curve for Bond B in

Please solve this problem (4) question 1 and 22 which is referred is attached.

(4) Draw a price vs. yield curve for Bond B in question 1 and the zero-coupon bond in question 2. Plot the price on the Y-axis and the yield-to-maturity on the X-axis. Start with an interest rate of 0.0% and move up in increments of 0.5% until you get to 25%. Best to use Excel for this problem.

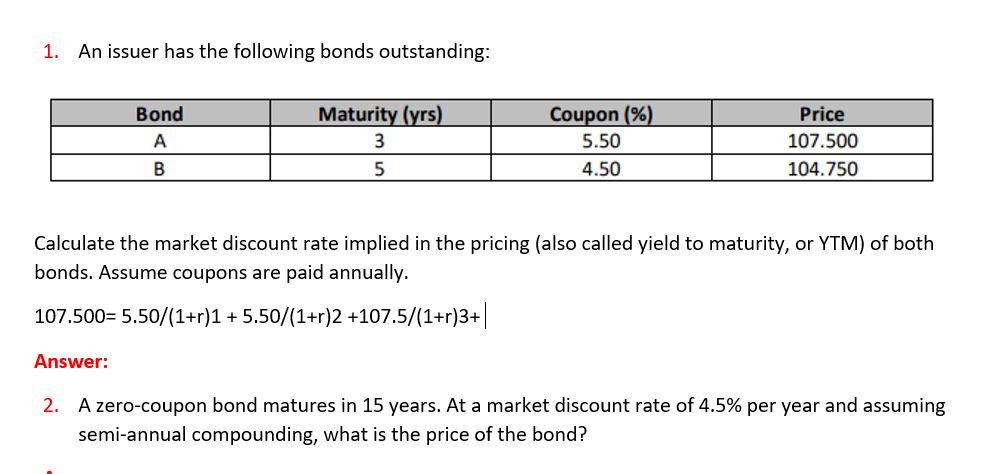

1. An issuer has the following bonds outstanding: Bond A B Maturity (yrs) 3 Coupon (%) 5.50 4.50 Price 107.500 104.750 5 Calculate the market discount rate implied in the pricing (also called yield to maturity, or YTM) of both bonds. Assume coupons are paid annually. 107.500= 5.50/(1+r)1 + 5.50/(1+r)2 +107.5/(1+r)3+| Answer: 2. A zero-coupon bond matures in 15 years. At a market discount rate of 4.5% per year and assuming semi-annual compounding, what is the price of the bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts