Question: please solve this problem Appendix Four (Equipment Replacement Decision) objective: The proposed manufacturing plant has a food packaging equipment. The analysis would provide steven with

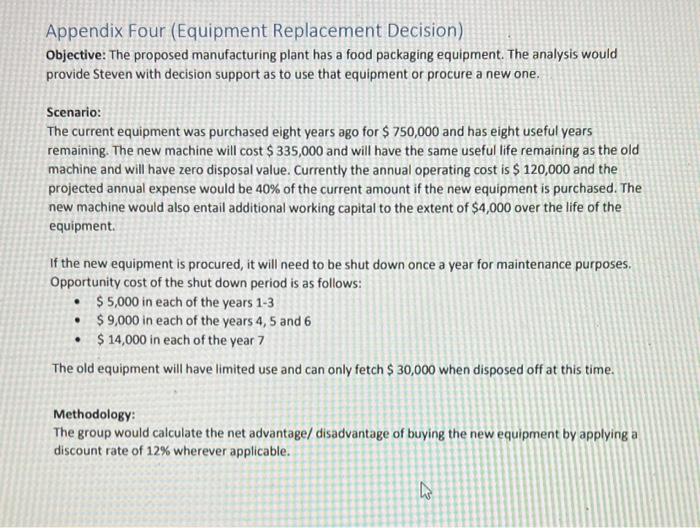

Appendix Four (Equipment Replacement Decision) objective: The proposed manufacturing plant has a food packaging equipment. The analysis would provide steven with decision support as to use that equipment or procure a new one. Scenario: The current equipment was purchased eight years ago for $750,000 and has eight useful years remaining. The new machine will cost $335,000 and will have the same useful life remaining as the old machine and will have zero disposal value. Currently the annual operating cost is $120,000 and the projected annual expense would be 40% of the current amount if the new equipment is purchased. The new machine would also entail additional working capital to the extent of $4,000 over the life of the equipment. If the new equipment is procured, it will need to be shut down once a year for maintenance purposes. Opportunity cost of the shut down period is as follows: - $5,000 in each of the years 13 - $9,000 in each of the years 4,5 and 6 - $14,000 in each of the year 7 The old equipment will have limited use and can only fetch $30,000 when disposed off at this time. Methodology: The group would calculate the net advantage/ disadvantage of buying the new equipment by applying a discount rate of 12% wherever applicable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts