Question: please solve this problem as soon as possible 3. Your sister-in-law, a stockbroker at Invest Inc., is trying to sell you a stock with a

please solve this problem as soon as possible

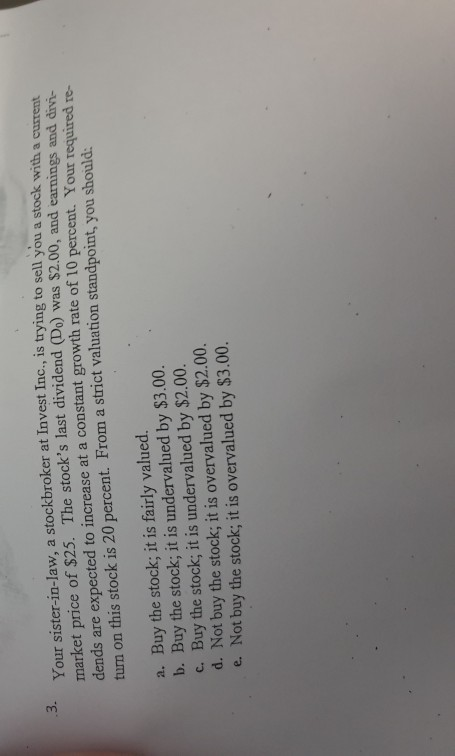

3. Your sister-in-law, a stockbroker at Invest Inc., is trying to sell you a stock with a current market price of $25. The stock's last dividend (Do) was $2.00, and earnings and divi- dends are expected to increase at a constant growth rate of 10 turm on this stock is percent. Your required re- 20 percent. From a strict valuation standpoint, you should: a. Buy the stock; it is fairly valued. b. Buy the stock; it is undervalued by $3.00. c. Buy the stock; it is undervalued by $2.00. d. Not buy the stock; it is overvalued by $2.00. e. Not buy the stock; it is overvalued by $3.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts