Question: Please solve this problem following the order these steps: 1) FIND THE COSTS (cost of common stock, preferred stock, debt) When finding the cost of

Please solve this problem following the order these steps:

Please solve this problem following the order these steps:

1) FIND THE COSTS (cost of common stock, preferred stock, debt) When finding the cost of debt of two bonds, please first list out the FV, PV, PMT, N, then do the calculations of YMT.

2) FIND THE MARKET VALUE

3) FIND THE WACC

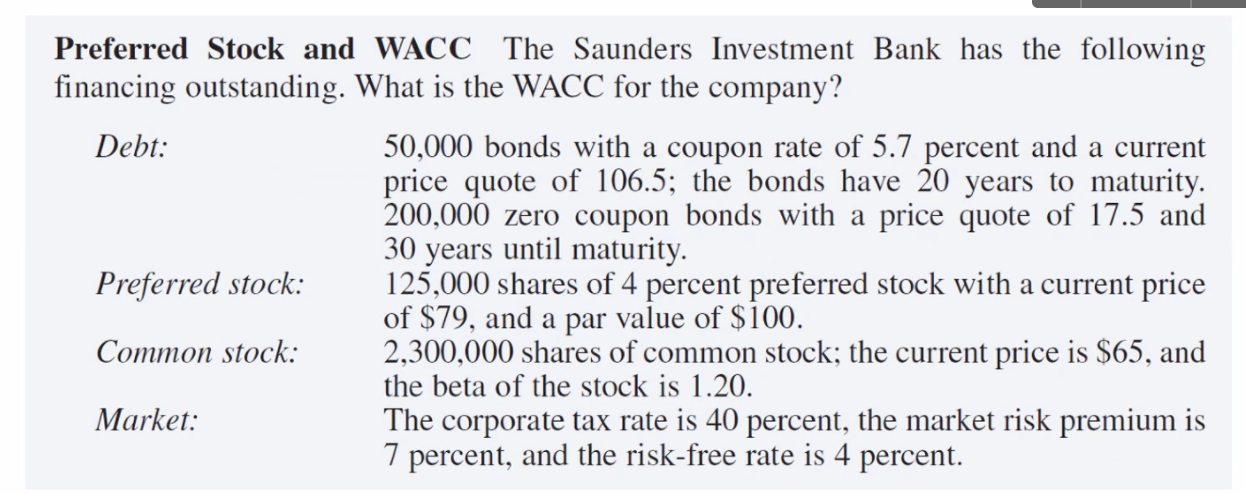

Preferred Stock and WACC The Saunders Investment Bank has the following financing outstanding. What is the WACC for the company? Debt: 50,000 bonds with a coupon rate of 5.7 percent and a current price quote of 106.5; the bonds have 20 years to maturity. 200,000 zero coupon bonds with a price quote of 17.5 and 30 years until maturity. Preferred stock: 125,000 shares of 4 percent preferred stock with a current price of $79, and a par value of $100. Common stock: 2,300,000 shares of common stock; the current price is $65, and the beta of the stock is 1.20. Market: The corporate tax rate is 40 percent, the market risk premium is 7 percent, and the risk-free rate is 4 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts