Question: please solve this problem lish Inc. was incorporated in 2019 to operate as a computer software service firm, with an accounting fiscal year ending August

please solve this problem

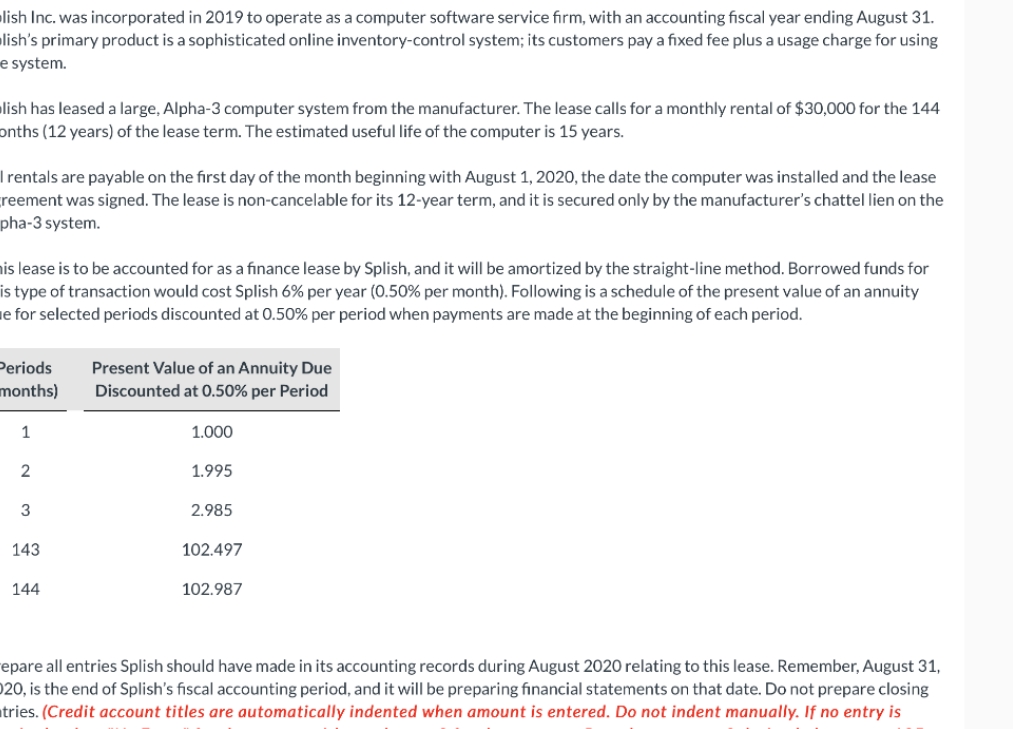

lish Inc. was incorporated in 2019 to operate as a computer software service firm, with an accounting fiscal year ending August 31. lish's primary product is a sophisticated online inventory-control system; its customers pay a fixed fee plus a usage charge for using e system. lish has leased a large, Alpha-3 computer system from the manufacturer. The lease calls for a monthly rental of $30,000 for the 144 onths (12 years) of the lease term. The estimated useful life of the computer is 15 years. rentals are payable on the first day of the month beginning with August 1, 2020, the date the computer was installed and the lease reement was signed. The lease is non-cancelable for its 12-year term, and it is secured only by the manufacturer's chattel lien on the pha-3 system. is lease is to be accounted for as a finance lease by Splish, and it will be amortized by the straight-line method. Borrowed funds for is type of transaction would cost Splish 6% per year (0.50% per month). Following is a schedule of the present value of an annuity e for selected periods discounted at 0.50% per period when payments are made at the beginning of each period. Periods Present Value of an Annuity Due months) Discounted at 0.50% per Period 1 1.000 2 1.995 3 2.985 143 102.497 144 102.987 epare all entries Splish should have made in its accounting records during August 2020 relating to this lease. Remember, August 31, 20, is the end of Splish's fiscal accounting period, and it will be preparing financial statements on that date. Do not prepare closing tries. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts