Question: Please solve this problem showing the calculations steps. Thank you 4. Hubbard Industries is an all-equity firm whose shares have an expected return of 10.9%,

Please solve this problem showing the calculations steps. Thank you

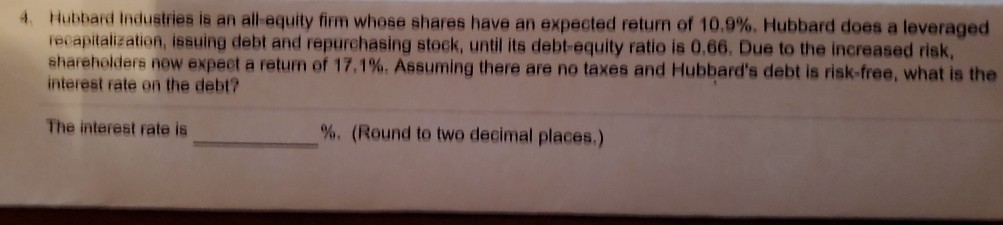

4. Hubbard Industries is an all-equity firm whose shares have an expected return of 10.9%, Hubbard does a leveraged recapitalization, issuing debt and repurchasing stock, until its debt-equity ratio is 0,66. Due to the increased risk, shareholders now expect a retum of 17.1%. Assuming there are no taxes and Hubbard's debt is risk-free, what is the interest rate on the debt? The interest rate is %. (Round to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts