Question: Please solve this problem urgently I A taxable person is a person who is registered for purposes of the Value Added Tax Act, 2013 Act

Please solve this problem urgently I

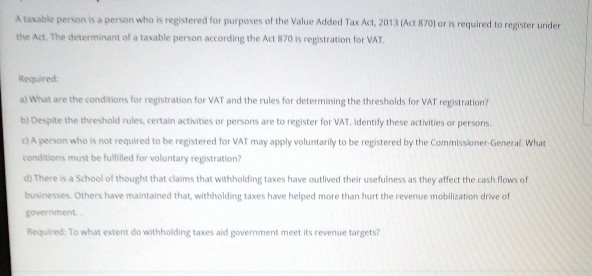

A taxable person is a person who is registered for purposes of the Value Added Tax Act, 2013 Act 870) or is required to register under the Act. The determinant of a taxable person according the Act 870 is registration for VAT Required a) What are the conditions for registration for VAT and the rules for determining the thresholds for VAT registration? Despite the threshold rules certain activities or persons are to register for VAT. Identify these activities or persons c) A person who is not required to be registered for VAT may apply voluntarily to be registered by the Commissioner General. What conditions must be fulfilled for voluntary registration? di There is a School of thought that claims that withholding taxes have outlived their usefulness as they affect the cash flows of businesses. Others have maintained that, withholding taxes have helped more than hurt the revenue mobilization drive of government Required: To what extent do withholding taxes and government meet its revenue targets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts