Question: please solve this problem using excel or the formulas attached below. Thank you You bought a 21 -year, 8.8% semi-annual coupon bond today and the

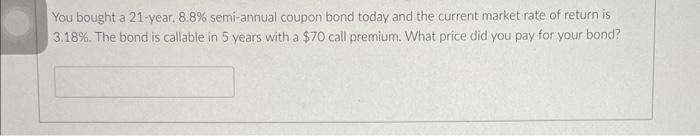

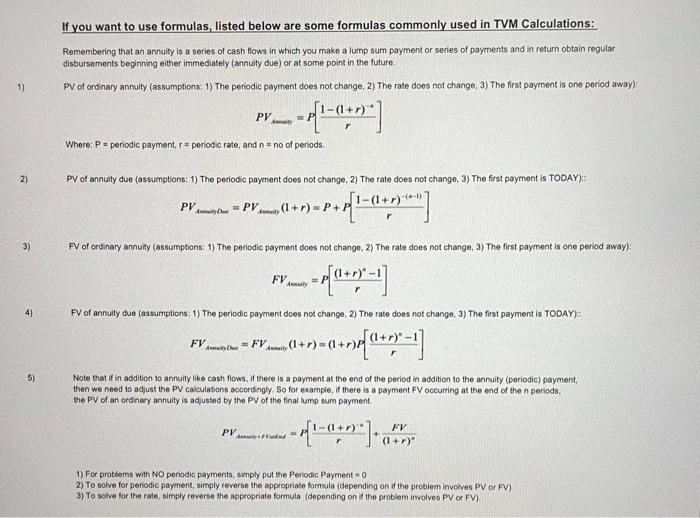

You bought a 21 -year, 8.8% semi-annual coupon bond today and the current market rate of return is 3.18%. The bond is callable in 5 years with a $70 call premium. What price did you pay for your bond? If you want to use formulas, listed below are some formulas commonly used in TVM Calculations: Remembering that an annuity is a series of cash flows in which you make a lump sum payment or serles of payments and in return obtain regular disbursements beginning either immediately (annuity due) or at some point in the future. PV of ordinary annuity (assumptions: 1) The periodic payment does not change, 2) The rate does not change, 3) The first payment is one period awa PVdwaip=P[r1(1+r)] Whece: P= periodic payment, r= periodic rate, and n= no of periods. PV of annuity due (assumptions: 1) The periodic payment does not change, 2) The rate does not change, 3) The first payment is TODAY): PViminin=PVAnaid(1+r)=P+P[r1(1+r)(n1)] FV of ordinary annuity (assumptions: 1) The periodic payment does not change. 2) The rate does not change, 3) The first payment is one period away FVAwaic=P[r(1+r)n1] FV of annuity due (assumptions: 1) The periodic payment does not change, 2) The fate does not change, 3) The first payment is TODAY): FVAmain0=FVAlmaib(1+r)=(1+r)P[r(1+r)n1] Note that if in addition to annuity like cash flows, if there is a payment at the end of the period in addition to the annuity (poriodic) payment, then we need to adjust the PV calculations acoordingly. So for example, if there is a payment FV occurring at the end of the n periods. the PV of an ortinacy annuity is adjusted by the PV of the final lump sum payment. 1) For problems with NO poriodic payments, smply put the Periodic Payment =0 2) To solve for perodic payment, simply revorse the appropriate formula (depending on athe problem invelves PV or FV) 3) To solve for the rate, simply reverse the appropriate formula (depending on it the problem imolves PV or FV)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts