Question: Please solve this problem using FINANCIAL CALCULATOR ! Question 20 3.3334 / 3.3334 points A new molding machine is expected to produce operating cash flows

Please solve this problem using FINANCIAL CALCULATOR!

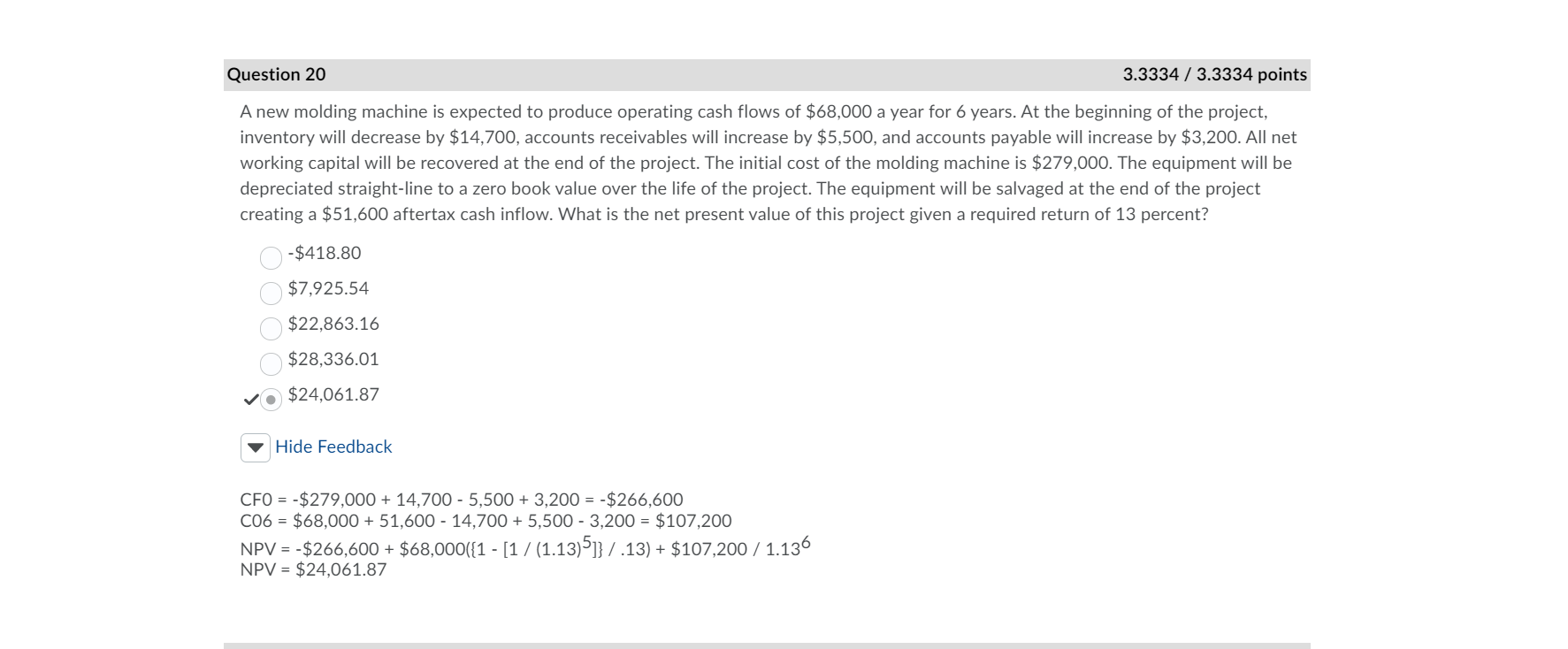

Question 20 3.3334 / 3.3334 points A new molding machine is expected to produce operating cash flows of $68,000 a year for 6 years. At the beginning of the project, inventory will decrease by $14,700, accounts receivables will increase by $5,500, and accounts payable will increase by $3,200. All net working capital will be recovered at the end of the project. The initial cost of the molding machine is $279,000. The equipment will be depreciated straight-line to a zero book value over the life of the project. The equipment will be salvaged at the end of the project creating a $51,600 aftertax cash inflow. What is the net present value of this project given a required return of 13 percent? -$418.80 $7,925.54 $22,863.16 $28,336.01 $24,061.87 Hide Feedback CFO = -$279,000 + 14,700 - 5,500 + 3,200 = -$266,600 C06 = $68,000 + 51,600 - 14,700 + 5,500 - 3,200 = $107,200 NPV = - $266,600 + $68,000({1 - [1 / (1.13)51} /.13) + $107,200 / 1.136 NPV = $24,061.87 Question 20 3.3334 / 3.3334 points A new molding machine is expected to produce operating cash flows of $68,000 a year for 6 years. At the beginning of the project, inventory will decrease by $14,700, accounts receivables will increase by $5,500, and accounts payable will increase by $3,200. All net working capital will be recovered at the end of the project. The initial cost of the molding machine is $279,000. The equipment will be depreciated straight-line to a zero book value over the life of the project. The equipment will be salvaged at the end of the project creating a $51,600 aftertax cash inflow. What is the net present value of this project given a required return of 13 percent? -$418.80 $7,925.54 $22,863.16 $28,336.01 $24,061.87 Hide Feedback CFO = -$279,000 + 14,700 - 5,500 + 3,200 = -$266,600 C06 = $68,000 + 51,600 - 14,700 + 5,500 - 3,200 = $107,200 NPV = - $266,600 + $68,000({1 - [1 / (1.13)51} /.13) + $107,200 / 1.136 NPV = $24,061.87

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts