Question: please solve this problem without using Excel and show all steps Common stock ABC pays a dividend of 100 at the end of the first

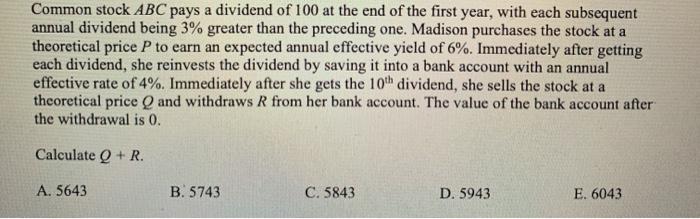

Common stock ABC pays a dividend of 100 at the end of the first year, with each subsequent annual dividend being 3% greater than the preceding one. Madison purchases the stock at a theoretical price P to earn an expected annual effective yield of 6%. Immediately after getting each dividend, she reinvests the dividend by saving it into a bank account with an annual effective rate of 4%. Immediately after she gets the 10th dividend, she sells the stock at a theoretical price and withdraws R from her bank account. The value of the bank account after the withdrawal is 0. Calculate + R. A. 5643 B. 5743 C. 5843 D. 5943 E. 6043

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts