Question: please solve this Q( annual worth by excel) and use Excel financial functions i need solve like second picture first picture is my question second

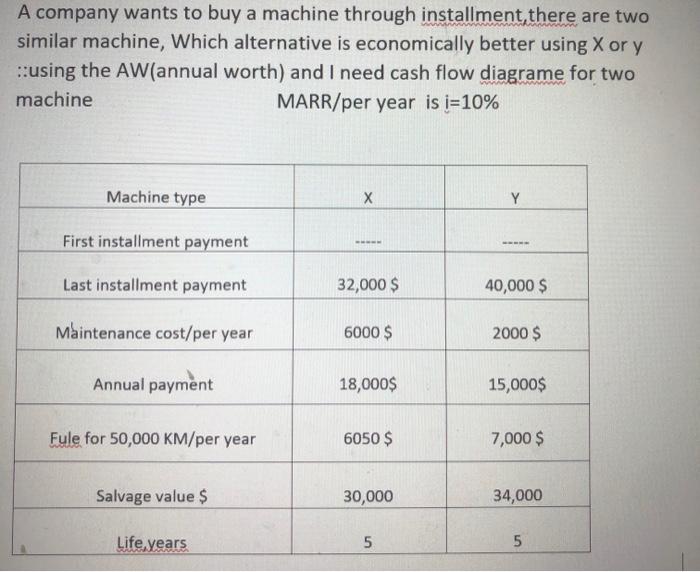

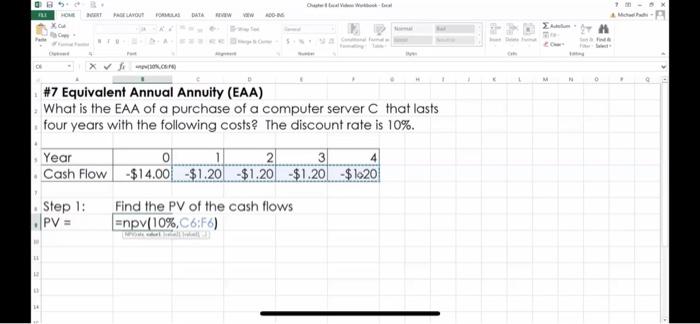

A company wants to buy a machine through installment there are two similar machine, Which alternative is economically better using X or y using the AW(annual worth) and I need cash flow diagrame for two machine MARR/per year is i=10% Machine type X Y First installment payment B Last installment payment 32,000 $ 40,000 $ Maintenance cost/per year 6000 $ 2000 $ Annual payment 18,000$ 15,000$ Fule for 50,000 KM/per year 6050 $ 7,000 $ Salvage value $ 30,000 34,000 Life years 5 5 WWW- XV. M N #7 Equivalent Annual Annuity (EAA) What is the EAA of a purchase of a computer server C that lasts four years with the following costs? The discount rate is 10%. Year 3 Cash Flow -$14.00 $1.20-$1.20 -$1.20 $ 1.20 Step 1: PV = Find the PV of the cash flows Enpy(10%, C6:F6)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts