Question: please solve this question completely correctly and clearly thankyou ! 3 The following transactions and adjusting entries were completed by Gravure Graphics International, a paper-packaging

please solve this question completely correctly and clearly thankyou !

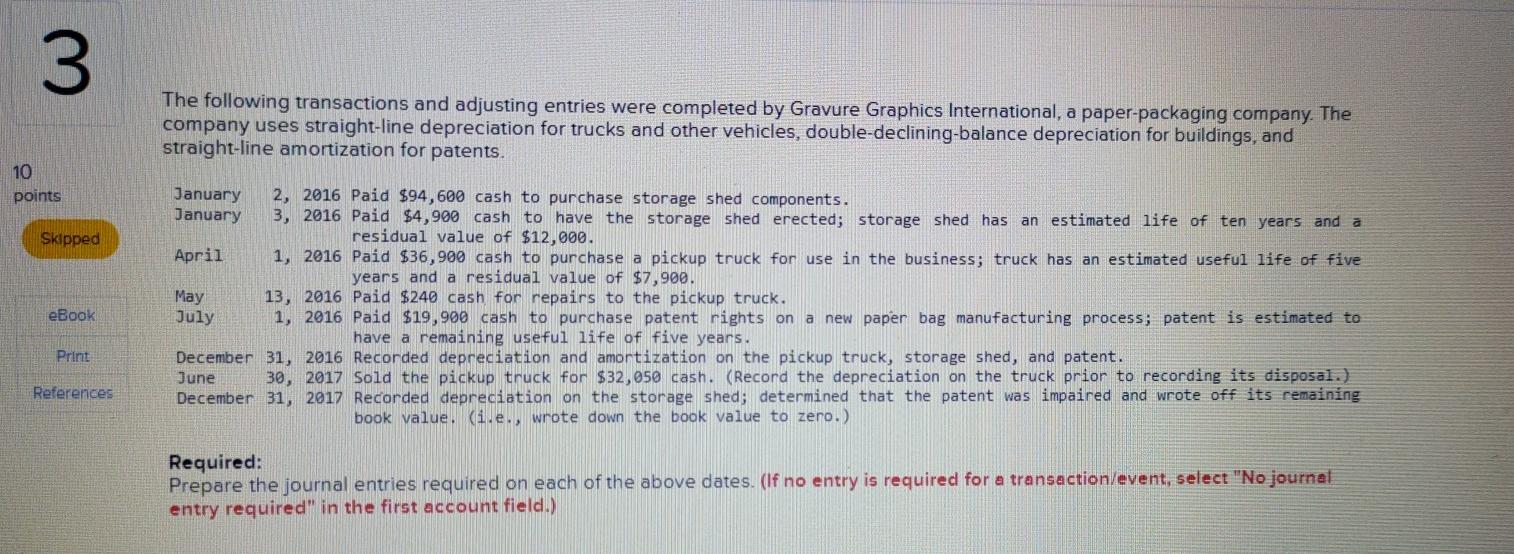

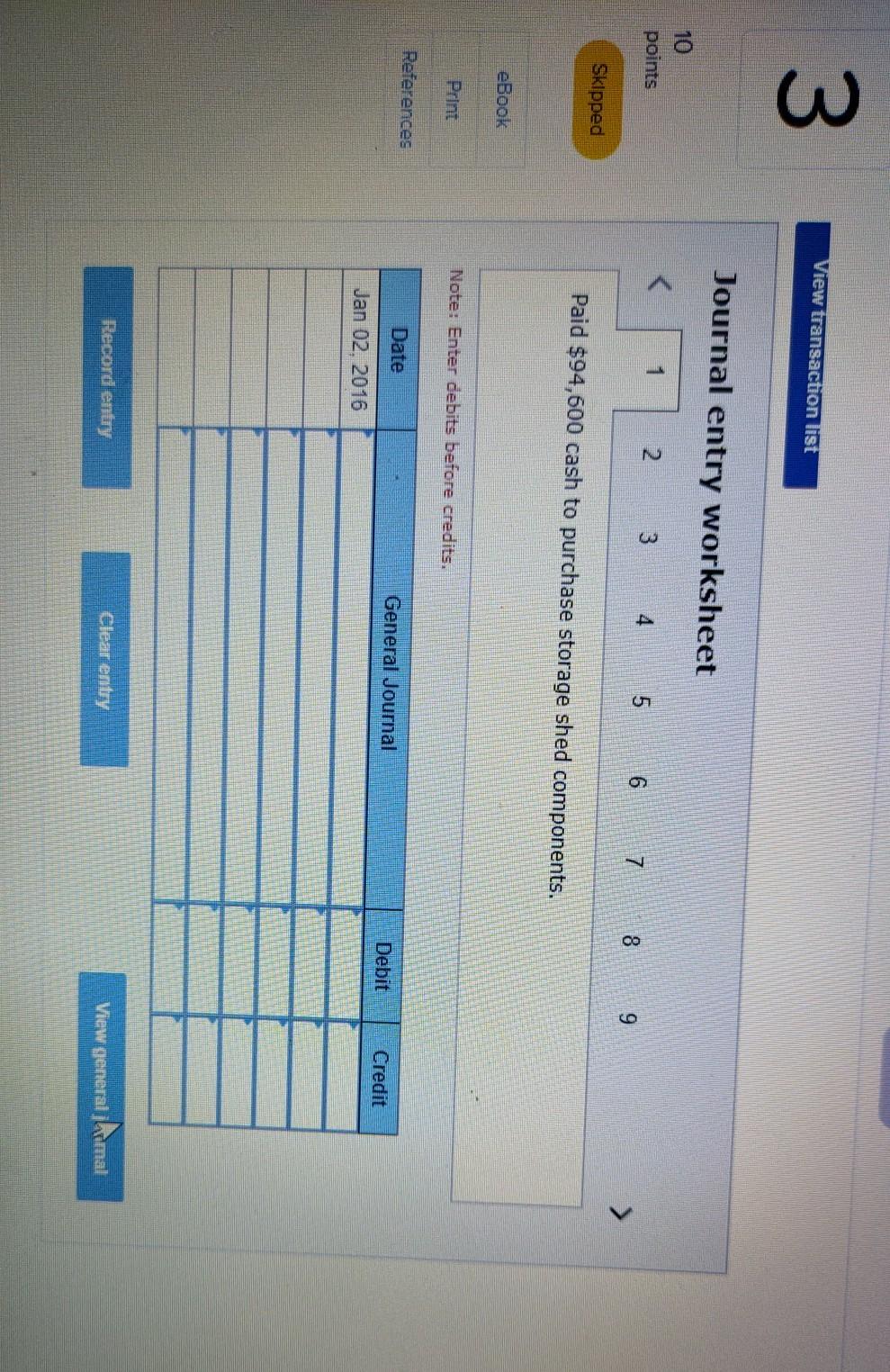

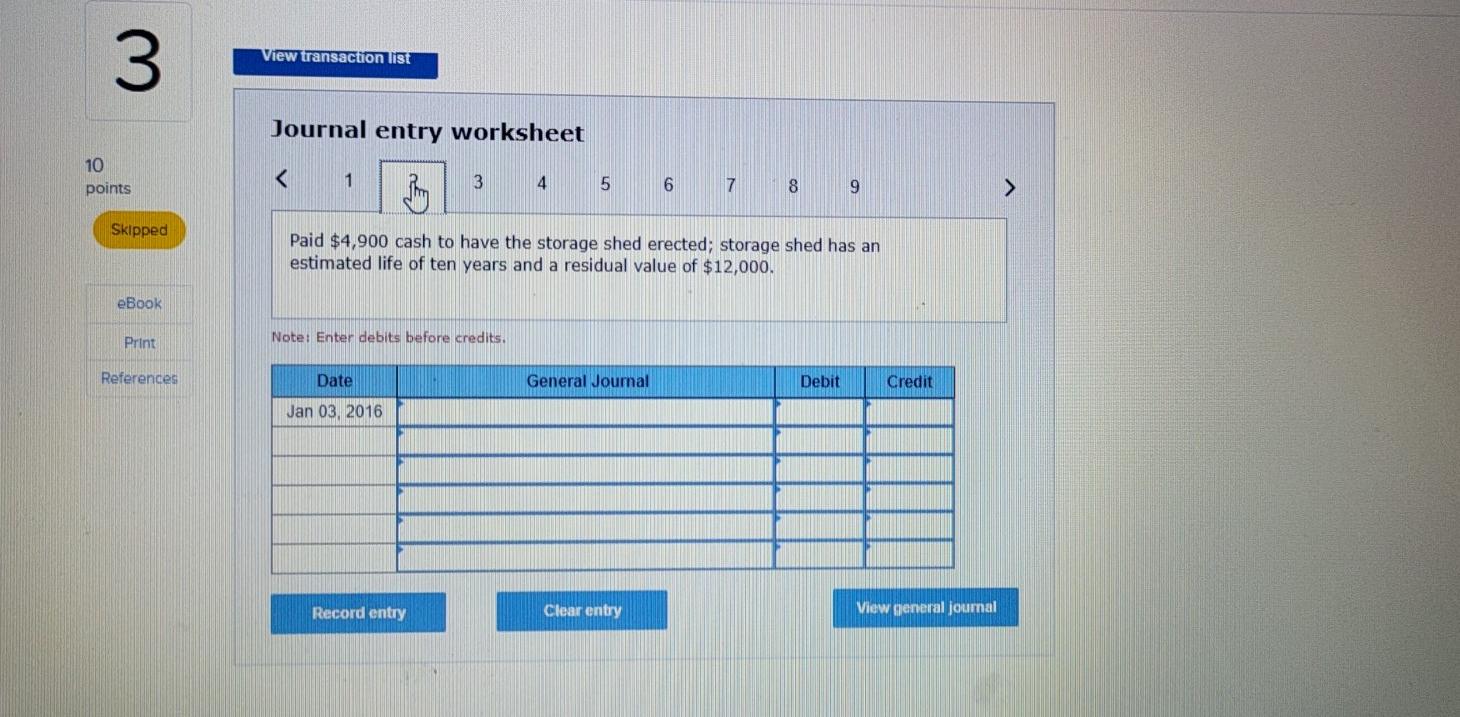

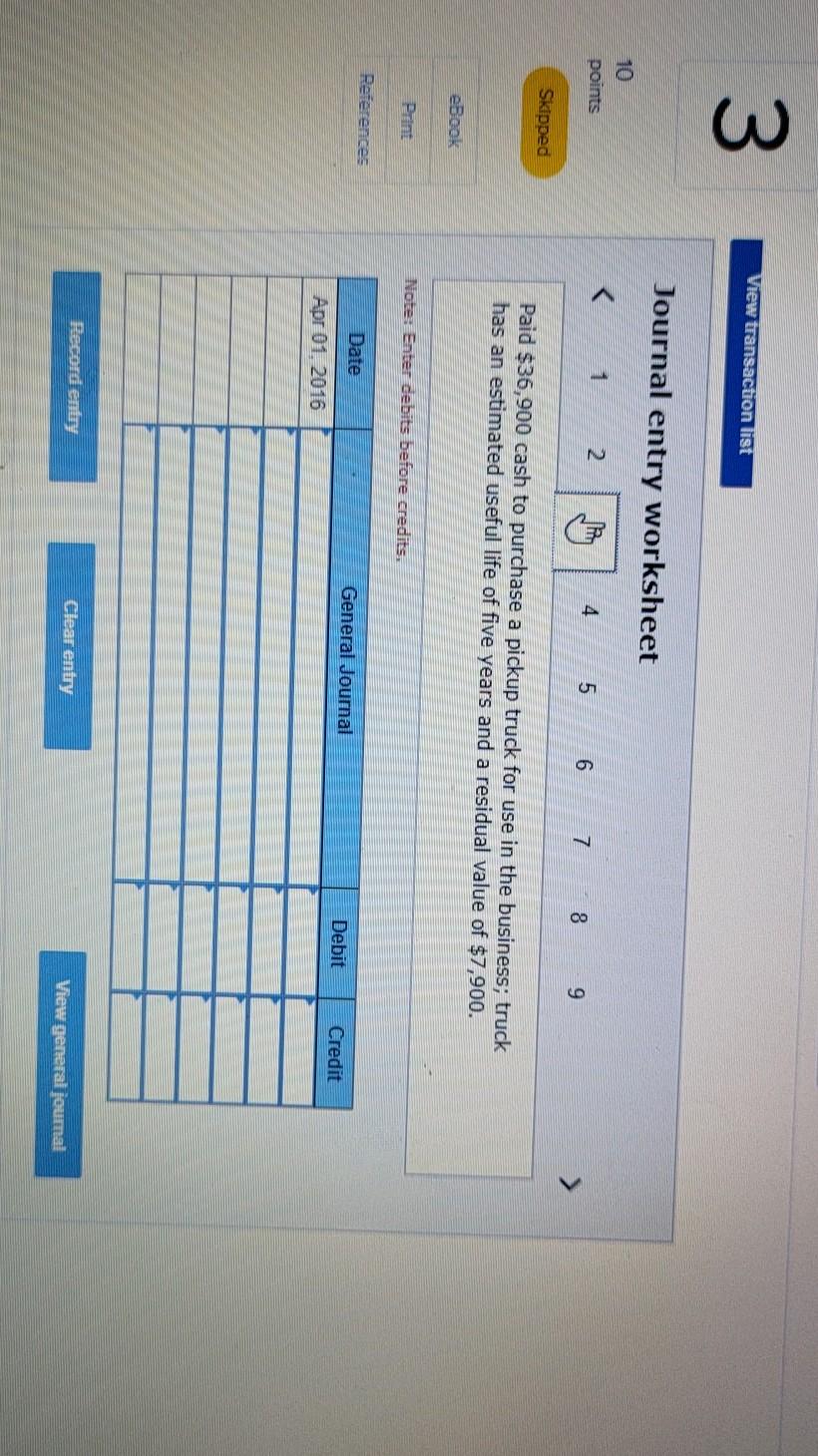

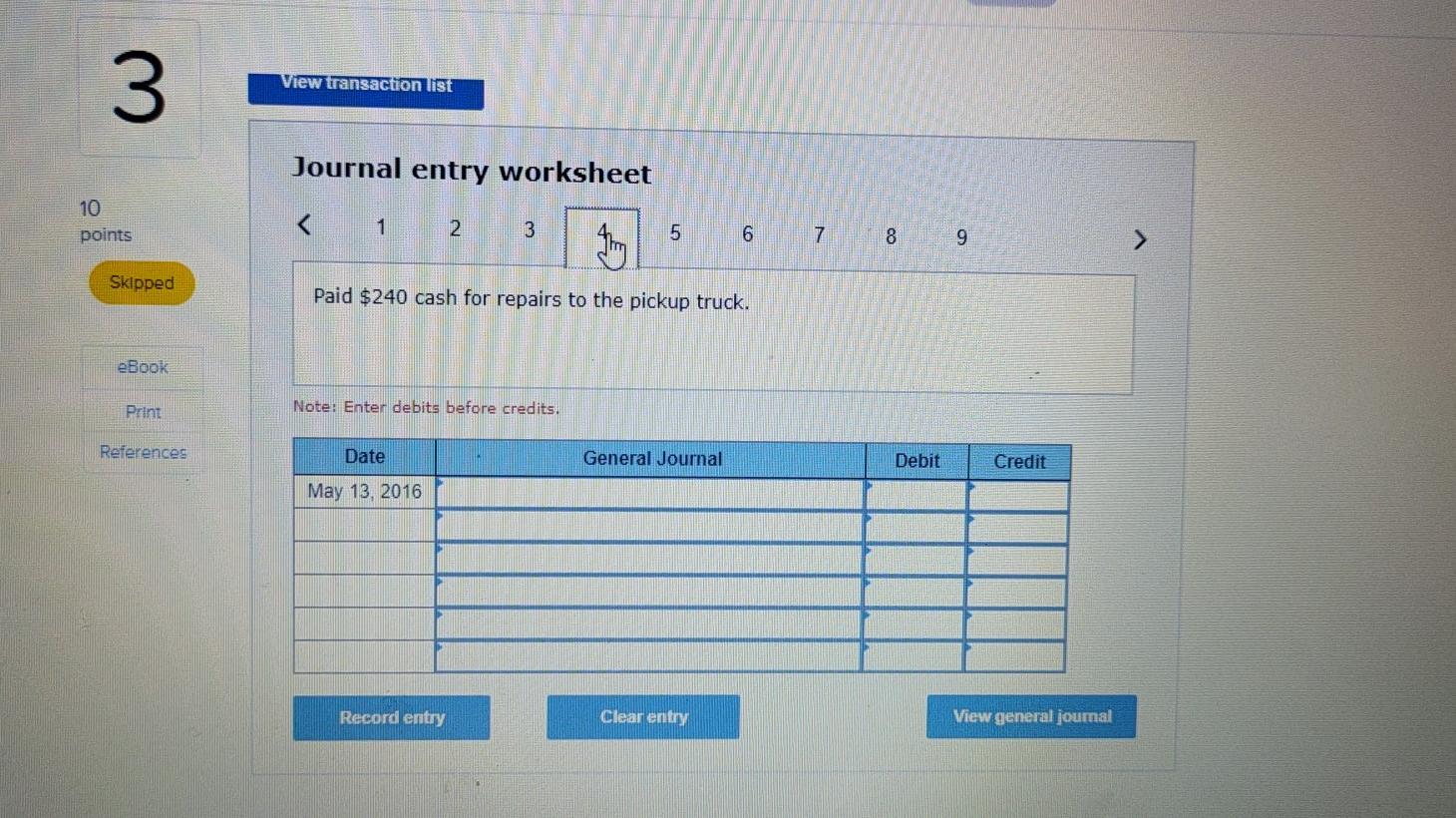

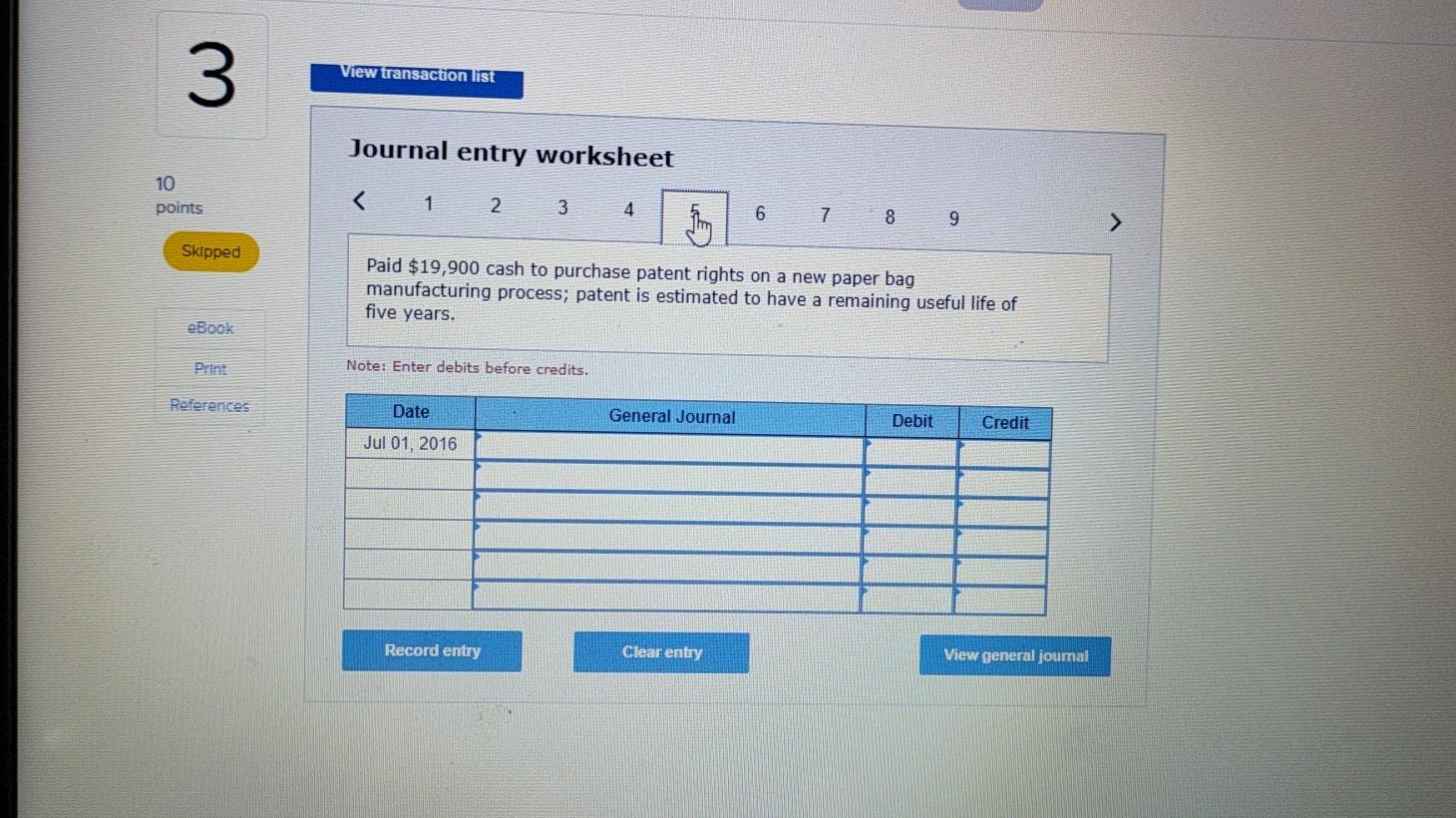

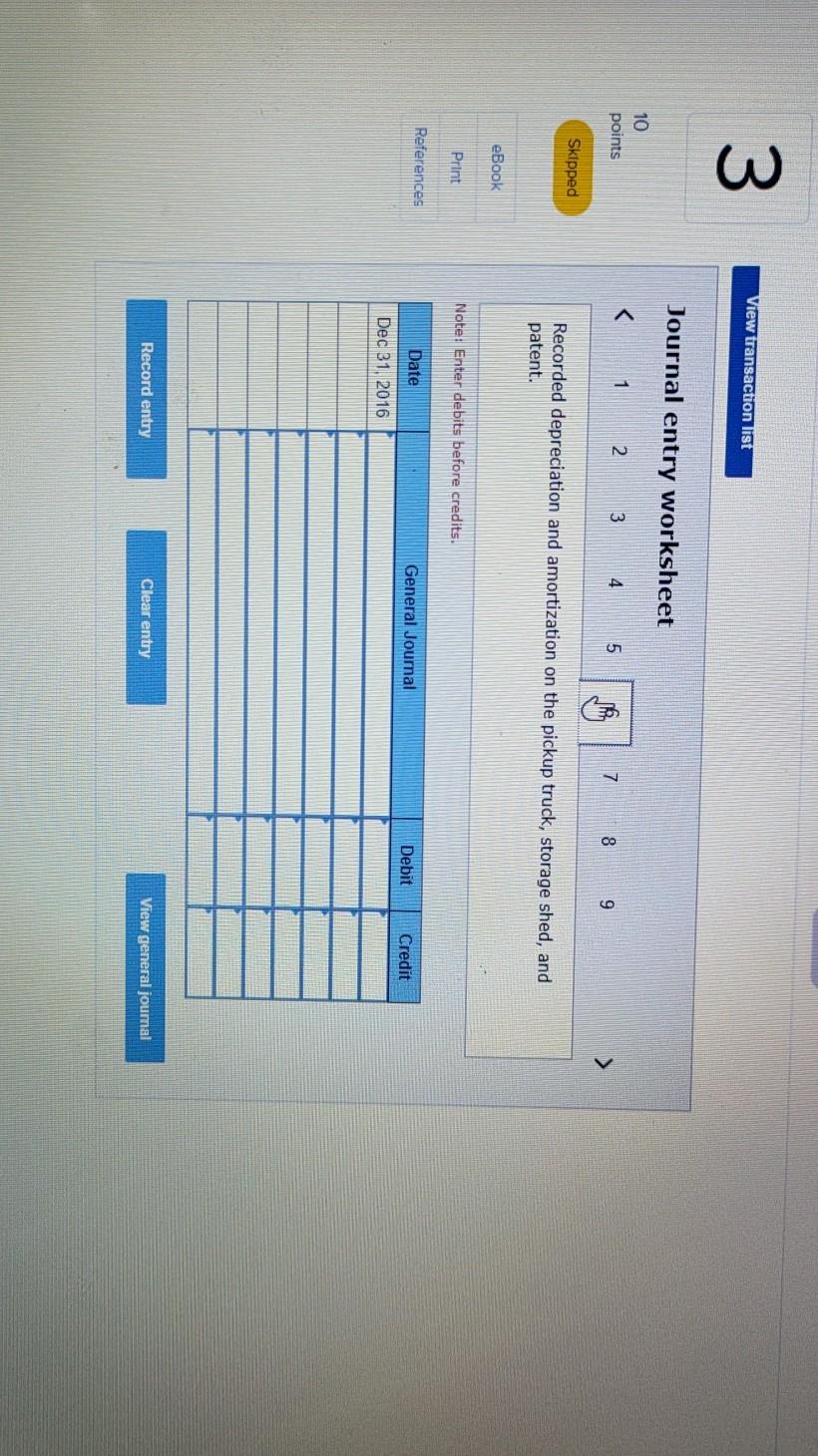

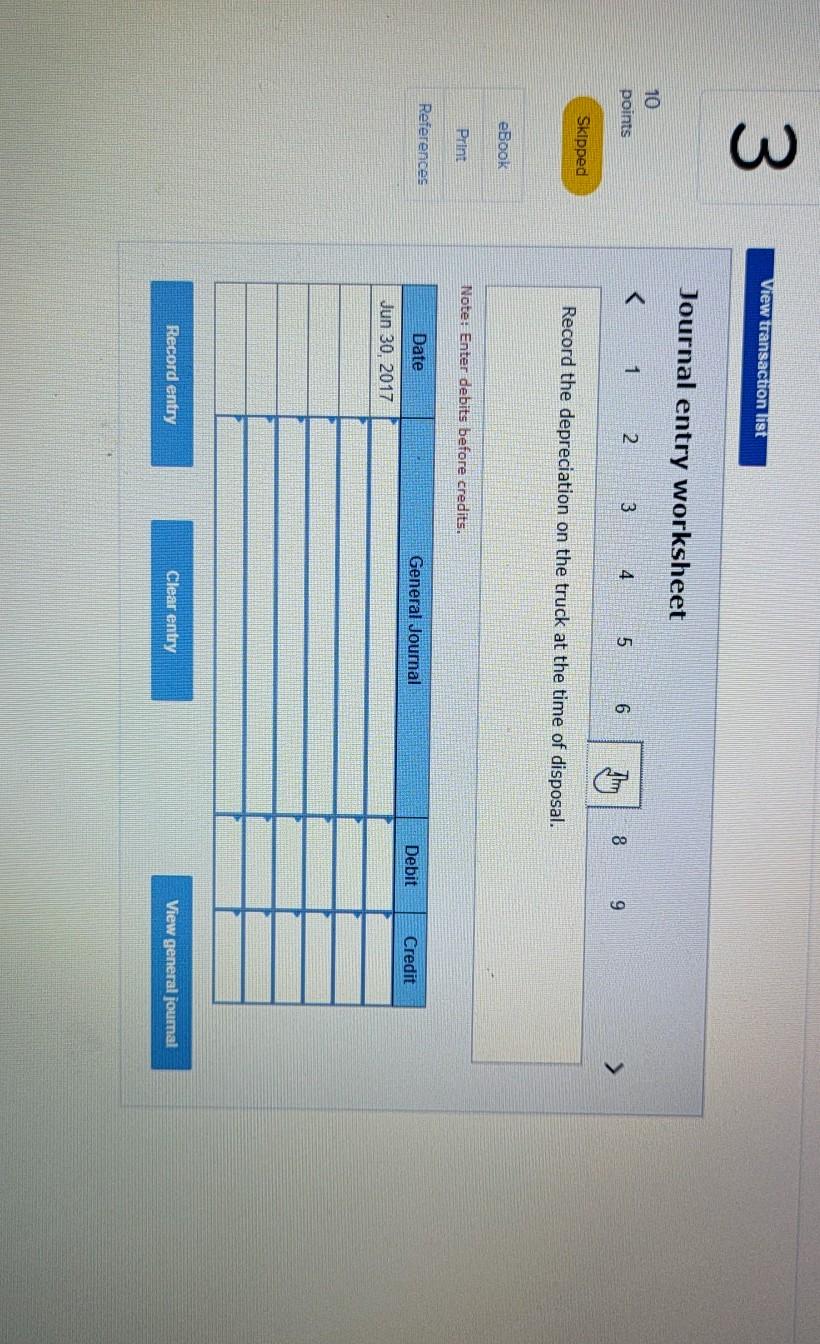

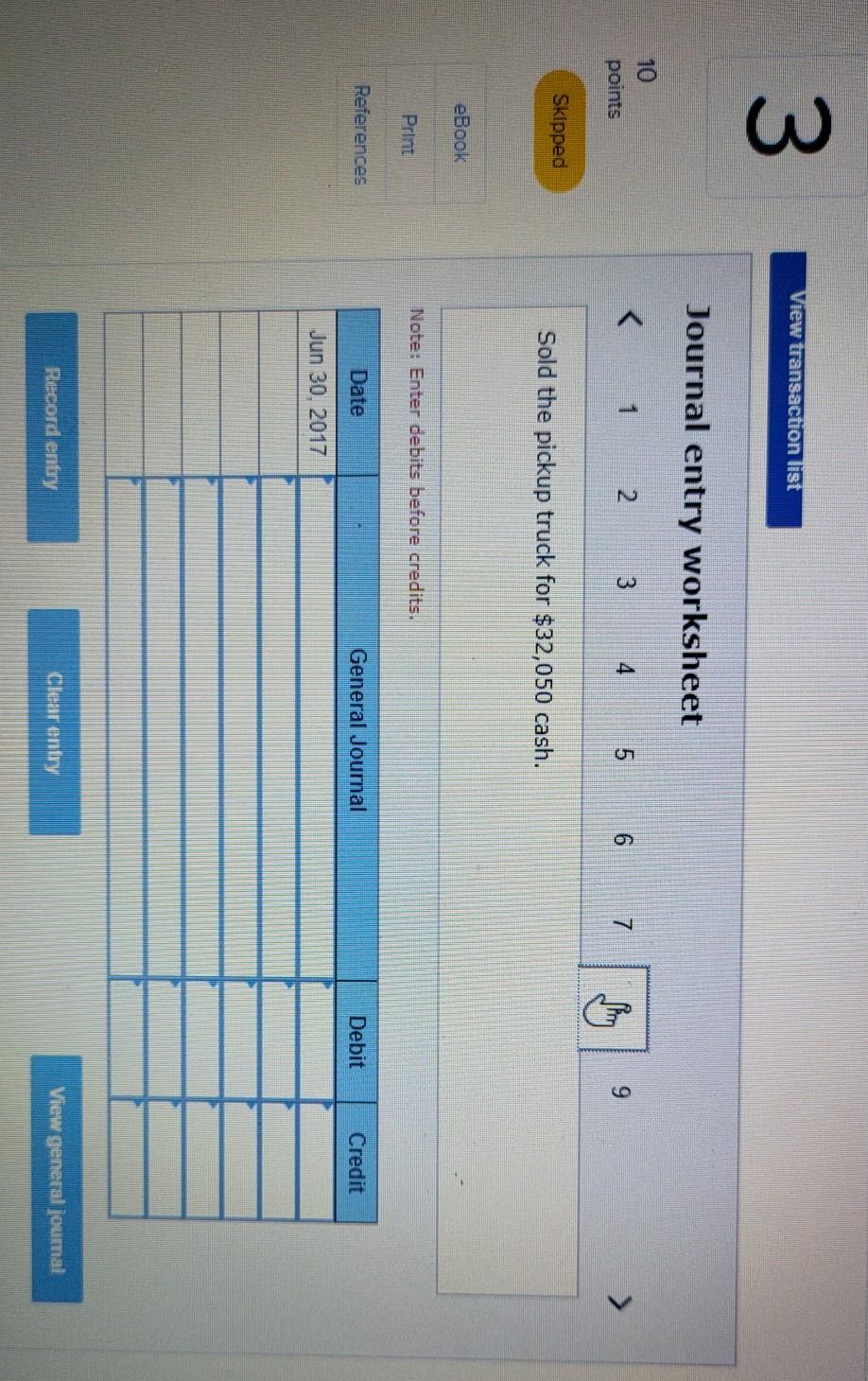

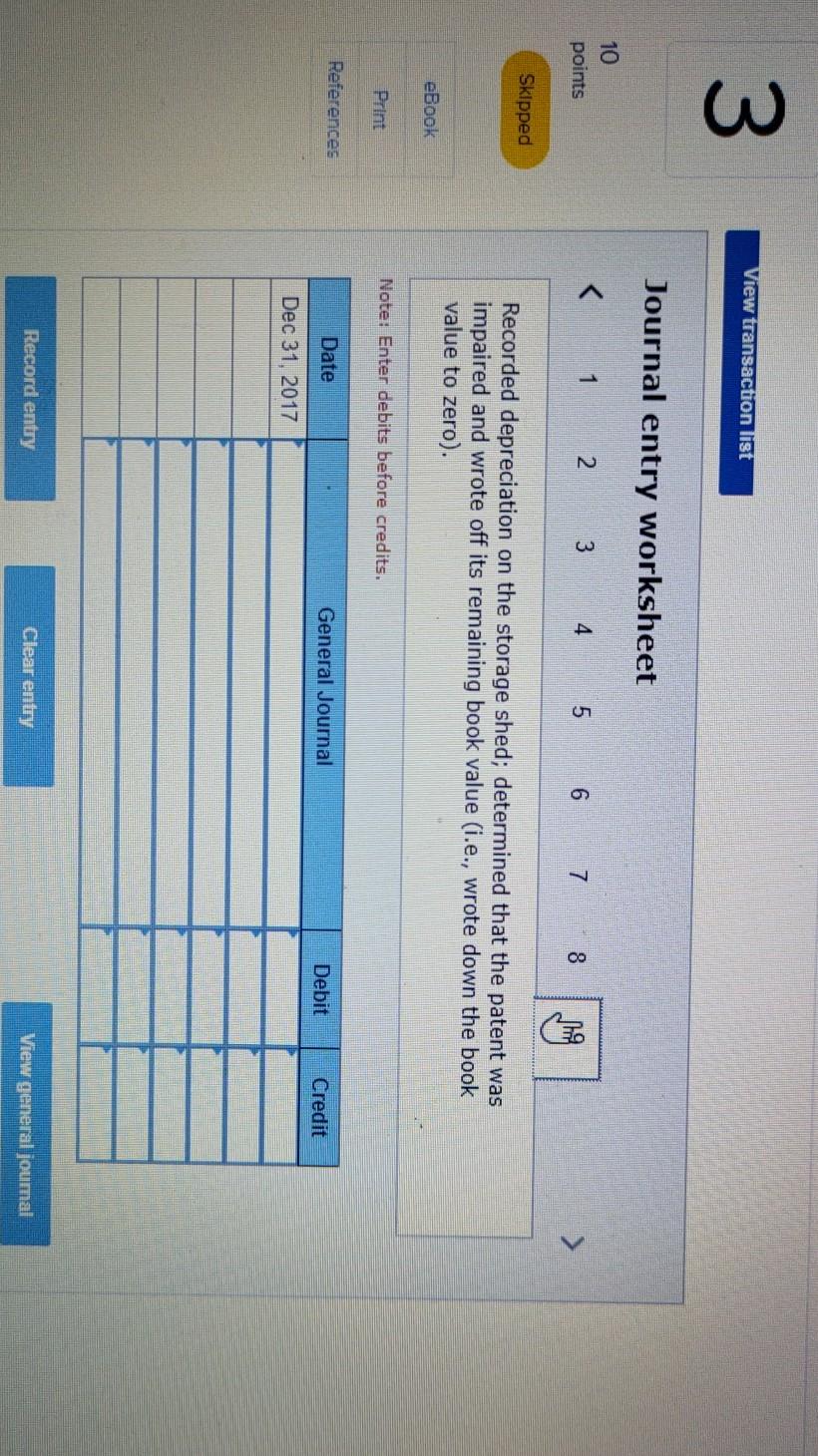

3 The following transactions and adjusting entries were completed by Gravure Graphics International, a paper-packaging company. The company uses straight-line depreciation for trucks and other vehicles, double-declining-balance depreciation for buildings, and straight-line amortization for patents. 10 points Skipped May January 2, 2016 Paid $94,600 cash to purchase storage shed components. January 3, 2016 Paid $4,900 cash to have the storage shed erected; storage shed has an estimated life of ten years and a residual value of $12,000. April 1, 2016 Paid $36,900 cash to purchase a pickup truck for use in the business; truck has an estimated useful life of five years and a residual value of $7,900. 13, 2016 Paid $240 cash for repairs to the pickup truck. July 1, 2016 Paid $19,900 cash to purchase patent rights on a new paper bag manufacturing process; patent is estimated to have a remaining useful life of five years. December 31, 2016 Recorded depreciation and amortization on the pickup truck, storage shed, and patent. June 30, 2017 Sold the pickup truck for $32,058 cash. (Record the depreciation on the truck prior to recording its disposal.) December 31, 2017 Recorded depreciation on the storage shed; determined that the patent was impaired and wrote off its remaining book value. i.e., wrote down the book value to zero.) eBook Print References Required: Prepare the journal entries required on each of the above dates. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 3 View transaction list Journal entry worksheet 10 points

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts