Question: please solve this question from A to C please! 7) (15 Points) XYZ Corporation is expected to pay a dividend of $1.00 in the upcoming

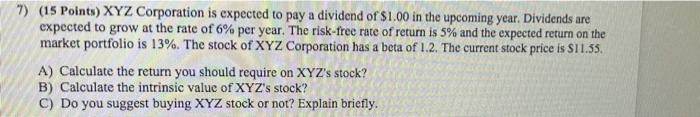

7) (15 Points) XYZ Corporation is expected to pay a dividend of $1.00 in the upcoming year. Dividends are expected to grow at the rate of 6% per year. The risk-free rate of return is 5% and the expected return on the market portfolio is 13%. The stock of XYZ Corporation has a beta of 1.2. The current stock price is $11.55 A) Calculate the return you should require on XYZ's stock? B) Calculate the intrinsic value of XYZ's stock? C) Do you suggest buying XYZ stock or not? Explain briefly

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts