Question: Please solve this question from A to I please! and provide step by step solution please! thank you in advance. The financial statements of Black

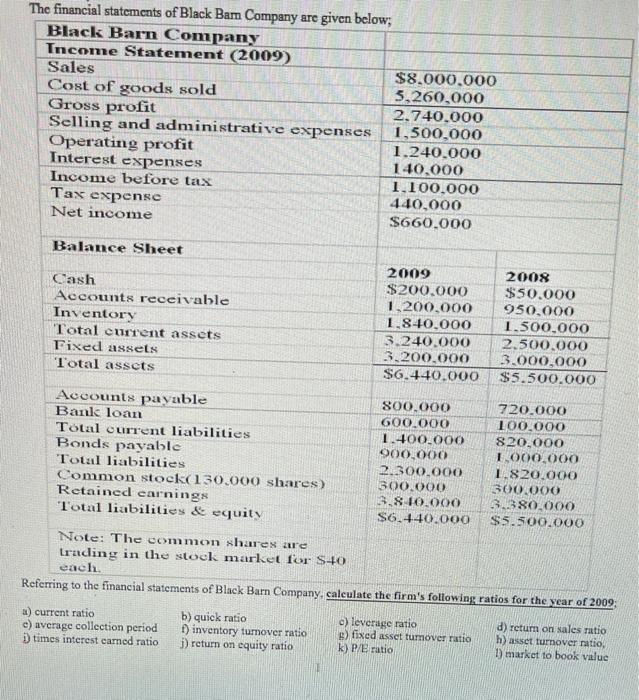

The financial statements of Black Bam Company are given below, Black Barn Company Income Statement (2009) Sales $8.000.000 Cost of goods sold 3,260,000 Gross profit 2.740.000 Selling and administrative expenses 1,500,000 Operating profit 1.240.000 Interest expenses 140.000 Income before tax 1.100.000 Tax expense 440,000 Net income $660.000 Balance Sheet Cash Accounts receivable Inventory Total current assets Fixed assets Total assets 2009 $200.000 1.200,000 1.810,000 3.240.000 3.200.000 $6.440.000 2008 $50.000 950.000 1.500.000 2.500.000 3.000.000 $5.500.000 Accounts payable Bank loan Total current liabilities Bonds payable Total liabilities Common stock(130.000 shares) Retained earnings Total liabilities & equity 800.000 600.000 1.400.000 900.000 2.300.000 300.000 3.8 80.000 $6.740.000 720.000 100.000 820,000 1.000.000 1.820.000 300.000 3.380.000 $5.500.000 Note: The common shares are trading in the stock market for S40 each Referring to the financial statements of Black Barn Company, calculate the firm's following ratios for the year of 2009; a) current ratio e) average collection period i times interest earned ratio b) quick ratio f) inventory tumover ratio j) return on equity ratio e) leverage ratio B) fixed asset tumover ratio k) P/B ratio d) return on sales ratio h) asset turnover ratio, 1) market to book value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts