Question: Please solve this question in the yellow highlighted cells. Please it's very important to reference how the solution came about and show the working of

Please solve this question in the yellow highlighted cells. Please it's very important to reference how the solution came about and show the working of how each answer was gotten. The question starts from the bottom

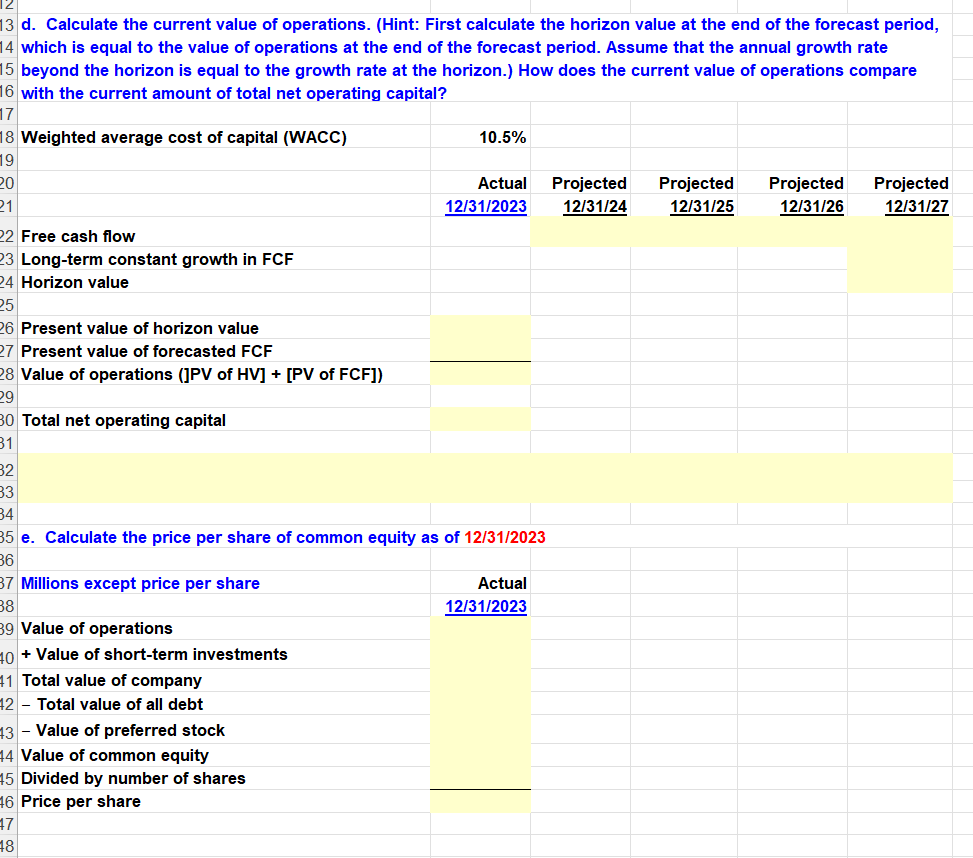

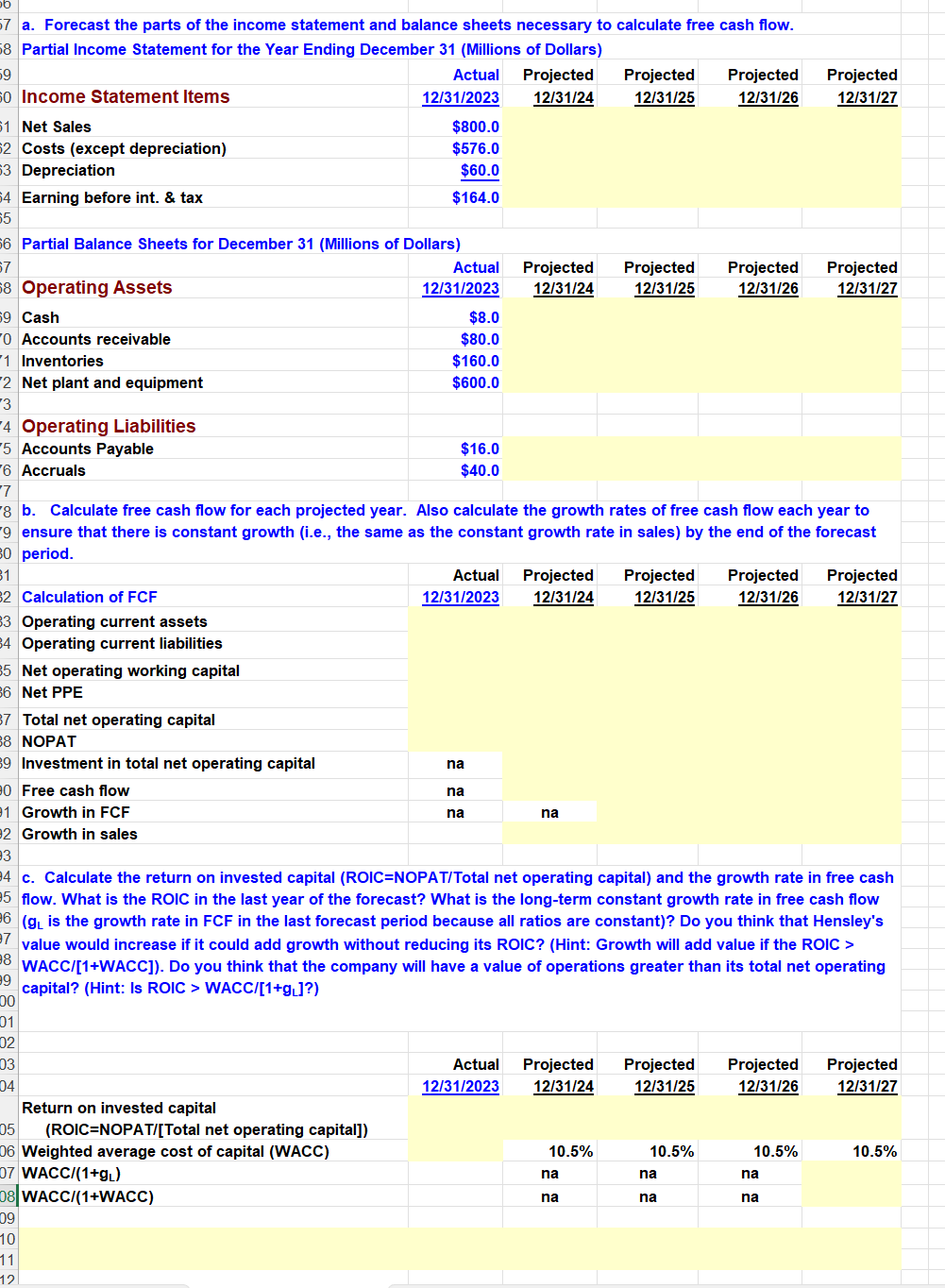

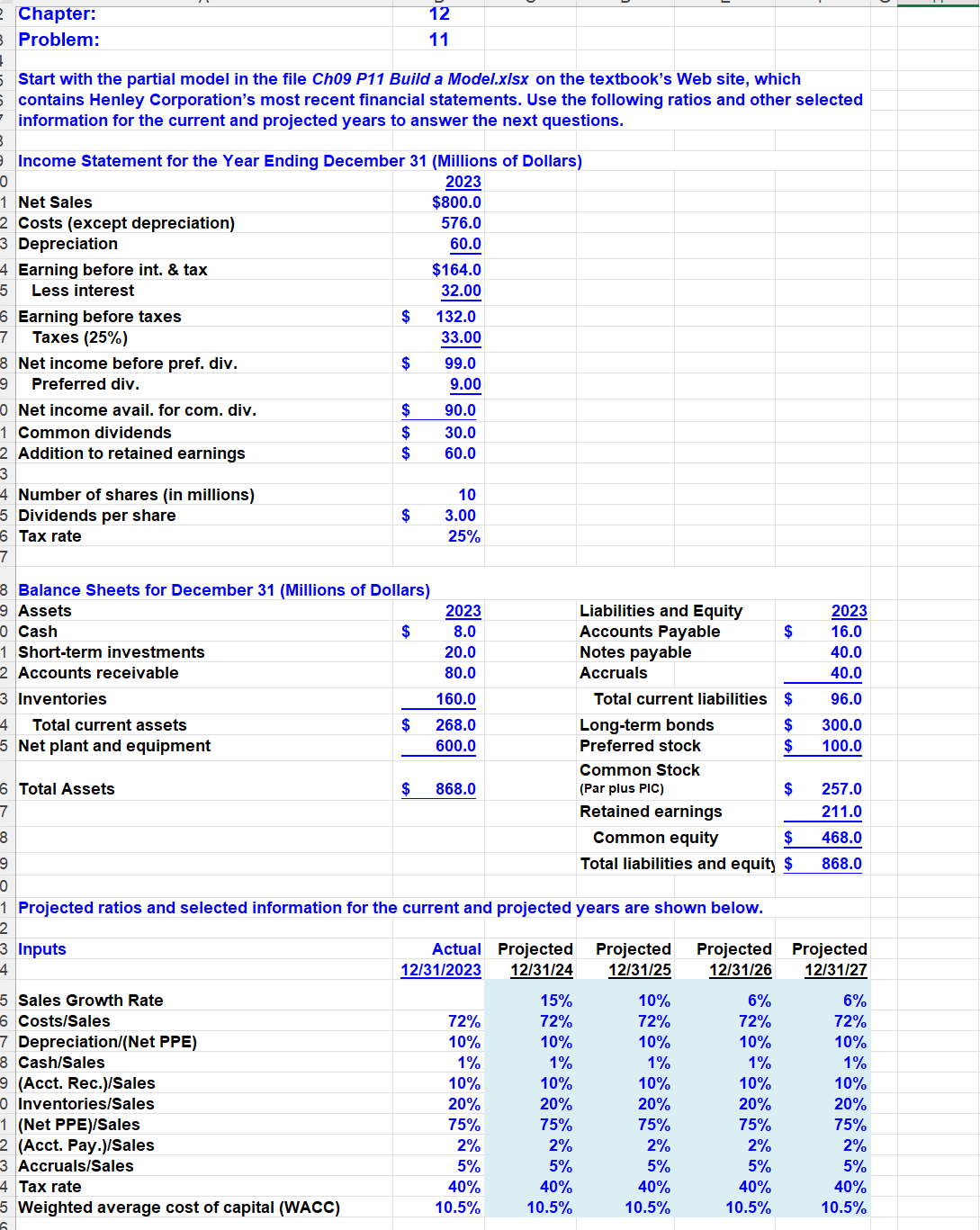

d. Calculate the current value of operations. (Hint: First calculate the horizon value at the end of the forecast period, which is equal to the value of operations at the end of the forecast period. Assume that the annual growth rate beyond the horizon is equal to the growth rate at the horizon.) How does the current value of operations compare with the current amount of total net operating capital? Weighted average cost of capital (WACC) 9 0 Free cash flow Long-term constant growth in FCF Horizon value Present value of horizon value Present value of forecasted FCF Value of operations (]PV of HV] + [PV of FCF]) Total net operating capital 10.5% \begin{tabular}{|r|r|r|r|r|} \hline Actual & Projected & Projected & Projected & Projected \\ \hline12/31/2023 & 12/31/24 & 12/31/25 & 12/31/26 & 12/31/27 \\ \hline \end{tabular} e. Calculate the price per share of common equity as of 12/31/2023 Millions except price per share Value of operations + Value of short-term investments Total value of company - Total value of all debt - Value of preferred stock Value of common equity Divided by number of shares Price per share Actual 12/31/2023 a. Forecast the parts of the income statement and balance sheets necessary to calculate free cash flow. Partial Income Statement for the Year Ending December 31 (Millions of Dollars) c. Calculate the return on invested capital (ROIC=NOPAT/Total net operating capital) and the growth rate in free cash flow. What is the ROIC in the last year of the forecast? What is the long-term constant growth rate in free cash flow ( gL is the growth rate in FCF in the last forecast period because all ratios are constant)? Do you think that Hensley's value would increase if it could add growth without reducing its ROIC? (Hint: Growth will add value if the ROIC > WACC/[1+WACC]). Do you think that the company will have a value of operations greater than its total net operating capital? (Hint: Is ROIC > WACC/[1+gL ] ?) Chapter: 12 Problem: 11 Start with the partial model in the file Ch09 P11 Build a Model.xlsx on the textbook's Web site, which contains Henley Corporation's most recent financial statements. Use the following ratios and other selected information for the current and projected years to answer the next questions. Income Statement for the Year Ending December 31 (Millions of Dollars) Projected ratios and selected information for the current and projected years are shown below. d. Calculate the current value of operations. (Hint: First calculate the horizon value at the end of the forecast period, which is equal to the value of operations at the end of the forecast period. Assume that the annual growth rate beyond the horizon is equal to the growth rate at the horizon.) How does the current value of operations compare with the current amount of total net operating capital? Weighted average cost of capital (WACC) 9 0 Free cash flow Long-term constant growth in FCF Horizon value Present value of horizon value Present value of forecasted FCF Value of operations (]PV of HV] + [PV of FCF]) Total net operating capital 10.5% \begin{tabular}{|r|r|r|r|r|} \hline Actual & Projected & Projected & Projected & Projected \\ \hline12/31/2023 & 12/31/24 & 12/31/25 & 12/31/26 & 12/31/27 \\ \hline \end{tabular} e. Calculate the price per share of common equity as of 12/31/2023 Millions except price per share Value of operations + Value of short-term investments Total value of company - Total value of all debt - Value of preferred stock Value of common equity Divided by number of shares Price per share Actual 12/31/2023 a. Forecast the parts of the income statement and balance sheets necessary to calculate free cash flow. Partial Income Statement for the Year Ending December 31 (Millions of Dollars) c. Calculate the return on invested capital (ROIC=NOPAT/Total net operating capital) and the growth rate in free cash flow. What is the ROIC in the last year of the forecast? What is the long-term constant growth rate in free cash flow ( gL is the growth rate in FCF in the last forecast period because all ratios are constant)? Do you think that Hensley's value would increase if it could add growth without reducing its ROIC? (Hint: Growth will add value if the ROIC > WACC/[1+WACC]). Do you think that the company will have a value of operations greater than its total net operating capital? (Hint: Is ROIC > WACC/[1+gL ] ?) Chapter: 12 Problem: 11 Start with the partial model in the file Ch09 P11 Build a Model.xlsx on the textbook's Web site, which contains Henley Corporation's most recent financial statements. Use the following ratios and other selected information for the current and projected years to answer the next questions. Income Statement for the Year Ending December 31 (Millions of Dollars) Projected ratios and selected information for the current and projected years are shown below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts