Question: please solve this question, it would be very helpful Whispering Winds industries had sales in 2021 of $5,616,000 and gross profit of $1,090,000. Management is

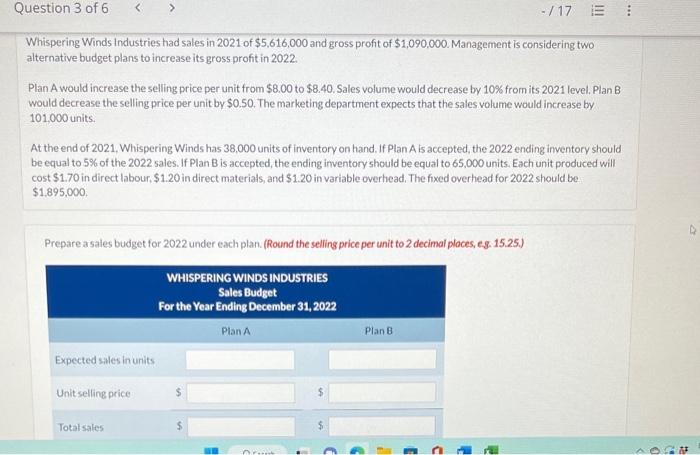

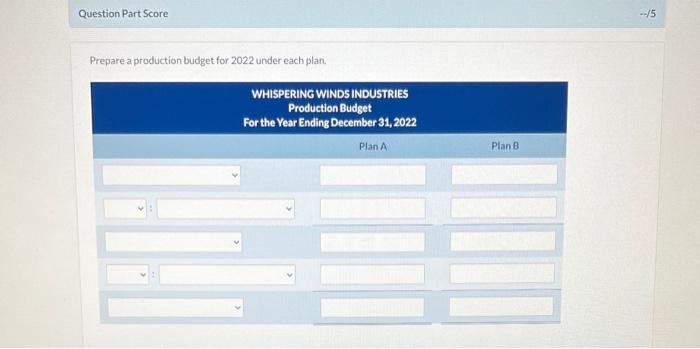

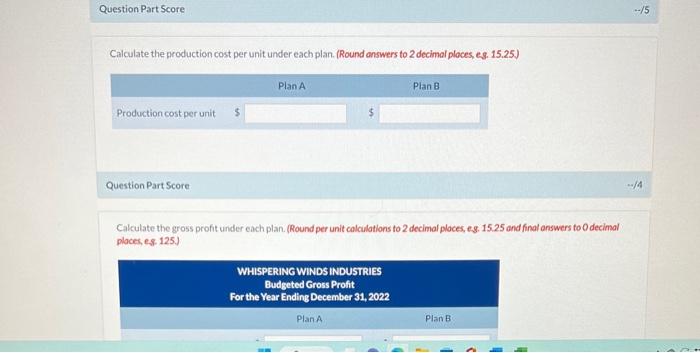

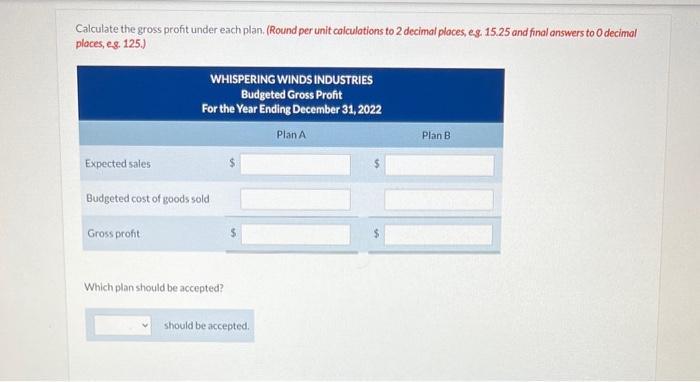

Whispering Winds industries had sales in 2021 of $5,616,000 and gross profit of $1,090,000. Management is considering two alternative budget plans to increase its gross profit in 2022. Plan A would increase the selling price per unit from $8.00 to $8.40. Sales volume would decrease by 10% from its 2021 level. Plan B would decrease the selling price per unit by $0.50. The marketing department expects that the sales volume would increase by 101,000 units. At the end of 2021. Whispering Winds has 38,000 units of inventory on hand. If Plan A is accepted, the 2022 ending inventory should be equal to 5% of the 2022 sales. If Plan B is accepted, the ending inventory should be equal to 65,000 units. Each unit produced will cost $1.70 in direct labour, $1.20 in direct materials, and $1.20 in variable overhead. The fixed overhead for 2022 should be $1,895,000, Prepare a sales budget for 2022 under each plan. (Round the selling price per unit to 2 decimal ploces, eg. 15.25.) Prepare a production budget for 2022 under each plan. Calculate the production cost per unit under each plan. (Round answers to 2 decimal ploces, eg. 15.25) Question Part Score Calculate the gross profit under each plan. (Round per unit calculations to 2 decimal ploces, es. 15.25 and final answers to 0 decimal places, es. 125.) Calculate the gross profit under each plan, (Round per unit calculations to 2 decimal ploces, eg. 15.25 and final answers to 0 decimal places, eg. 125.) Which plan should be accepted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts