Question: please solve this question:- prepare journal entries and adjusting entries. missing information in this picture is below:- -donald gee paid 345$ per day -residential value

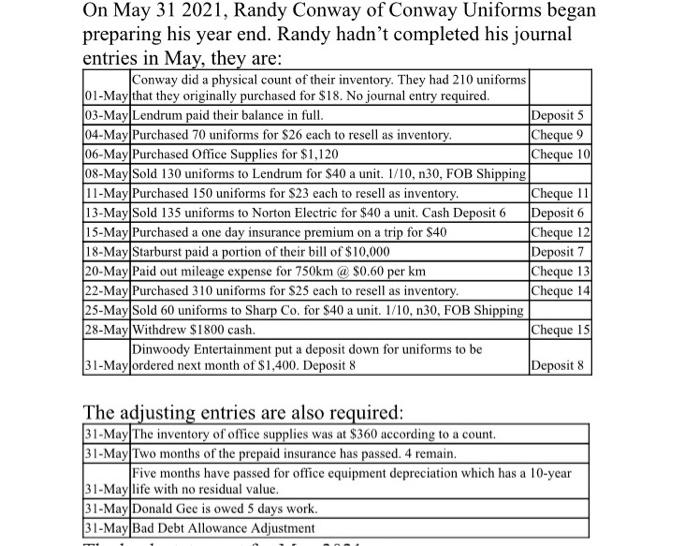

On May 31 2021, Randy Conway of Conway Uniforms began preparing his year end. Randy hadn't completed his journal entries in May, they are: Conway did a physical count of their inventory. They had 210 uniforms 01-May that they originally purchased for $18. No journal entry required. 03-May Lendrum paid their balance in full. Deposit 5 04-May Purchased 70 uniforms for $26 each to resell as inventory Cheque 9 06-May Purchased Office Supplies for $1,120 Cheque 102 08-May Sold 130 uniforms to Lendrum for $40 a unit. 1/10,n30, FOB Shipping 11-May Purchased 150 uniforms for S23 each to resell as inventory. Cheque 11 13-May Sold 135 uniforms to Norton Electric for $40 a unit. Cash Deposit 6 Deposit 6 15-May Purchased a one day insurance premium on a trip for S40 Cheque 12 18-May Starburst paid a portion of their bill of $10,000 Deposit 7 20-May Paid out mileage expense for 750km @ $0.60 per km Cheque 13 22-May Purchased 310 uniforms for S25 each to resell as inventory. Cheque 14 25-May Sold 60 uniforms to Sharp Co. for $40 a unit. 1/10,n30, FOB Shipping 28-May Withdrew $1800 cash. Cheque 15 Dinwoody Entertainment put a deposit down for uniforms to be 31-May|ordered next month of $1,400. Deposit 8 Deposit 8 The adjusting entries are also required: 31-May The inventory of office supplies was at $360 according to a count 31-May Two months of the prepaid insurance has passed. 4 remain. Five months have passed for office equipment depreciation which has a 10-year 31-May life with no residual value. 31-May Donald Gee is owed 5 days work. 31-May Bad Debt Allowance Adjustment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts