Question: please solve this question ! Required information In wisely planning for your retirement, you invest $16,000 per year for 20 years into a 401K tax-deferred

please solve this question

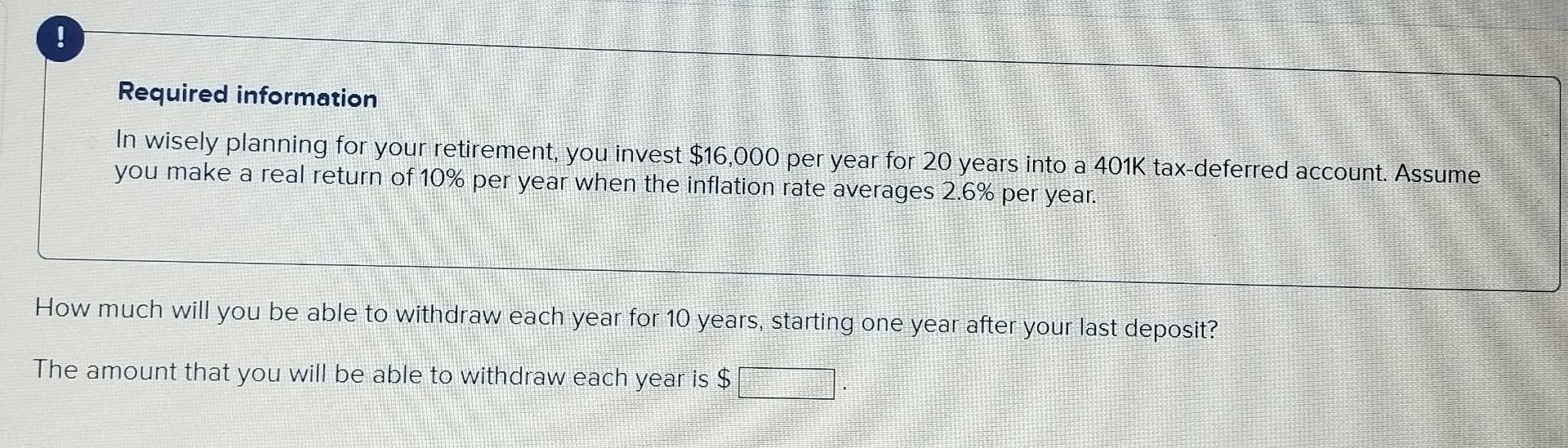

! Required information In wisely planning for your retirement, you invest $16,000 per year for 20 years into a 401K tax-deferred account. Assume you make a real return of 10% per year when the inflation rate averages 2.6% per year. How much will you be able to withdraw each year for 10 years, starting one year after your last deposit? The amount that you will be able to withdraw each year is $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock