Question: please solve this question with all the steps in it and like the given E | 2. Project P has a cost of $1,000 and

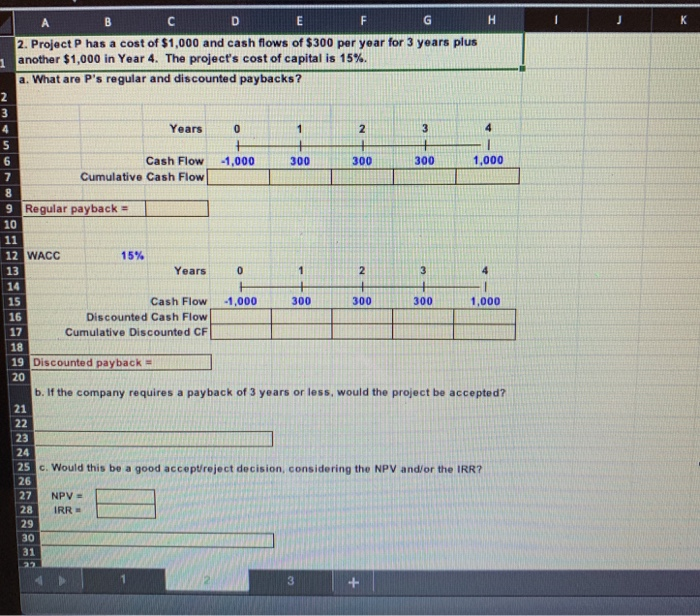

E | 2. Project P has a cost of $1,000 and cash flows of $300 per year for 3 years plus another $1,000 in Year 4. The project's cost of capital is 15%. a. What are P's regular and discounted paybacks? uw Years -1,000 300 300 1,000 Cash Flow Cumulative Cash Flow 9 Regular payback = 10 12 WACC 15% Years -1,000 300 300 300 1,000 Cash Flow Discounted Cash Flow Cumulative Discounted CF 19 Discounted payback b. If the company requires a payback of 3 years or less, would the project be accepted? 25 c. Would this be a good accept reject decision, considering the NPV and/or the IRR? NPV = IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts