Question: Please solve this question with proper explanation without using excel. A private equity firm is evaluating two alternative investments. Although the returns are random, each

Please solve this question with proper explanation without using excel.

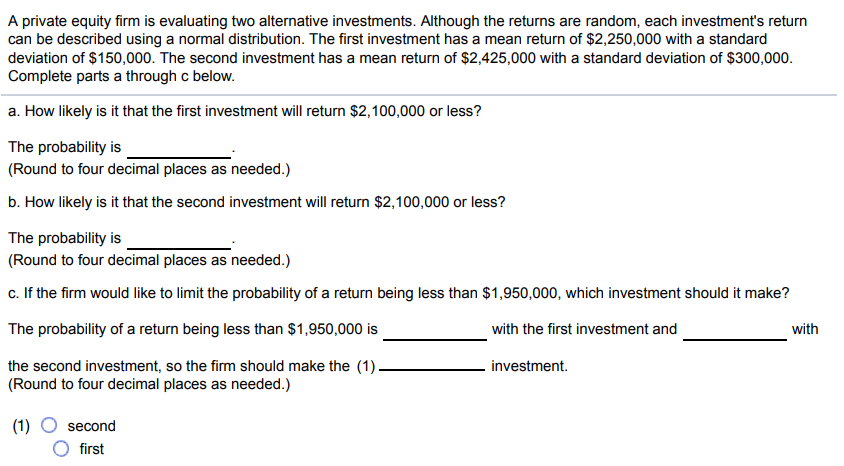

A private equity firm is evaluating two alternative investments. Although the returns are random, each investment's return can be described using a normal distribution. The first investment has a mean return of $2,250,000 with a standard deviation of $150,000. The second investment has a mean return of $2,425,000 with a standard deviation of $300,000. Complete parts a through c below. a. How likely is it that the first investment will return $2, 100,000 or less? The probability is (Round to four decimal places as needed.) b. How likely is it that the second investment will return $2, 100,000 or less? The probability is (Round to four decimal places as needed.) c. If the firm would like to limit the probability of a return being less than $1,950,000, which investment should it make? The probability of a return being less than $1,950,000 is with the first investment and with the second investment, so the firm should make the (1) . investment. (Round to four decimal places as needed.) (1) O second O first

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts