Question: Please solve this Supply chain management question on the basis of below mentioned case that is Out of the three suggestions like a ) long

Please solve this Supply chain management question on the basis of below mentioned case that is Out of the three suggestions like along standing one bone with reservation units

and cbuyback decision

which contract to choose??

Summary of the Sattva eTech Case Study

Company Background:

Sattva eTech is an Indian embedded new product development firm established in

They specialize in design, development, and manufacturing for clients in various sectors like medical, industrial, and defense.

The company is known for its quality certifications and R&D capabilities.

Product Design and Manufacturing Process:

Sattva collaborates with clients to define product specifications.

Design engineers develop hardwaresoftware architecture, testing procedures, and Bill of Materials BOM

Based on BOM, components are sourced from approved vendors.

Sattva uses a "Made to Stock" strategy for frequently used bulk components.

Component Sourcing Challenges:

Sattva faces high demand volatility for final products, leading to volatile component needs.

They stock bulk components like ACDC power modules but risk obsolescence.

Longterm contracts with Maxtronics Taiwanese supplier offer lower prices but large order quantities, leading to leftover inventory at obsolescence.

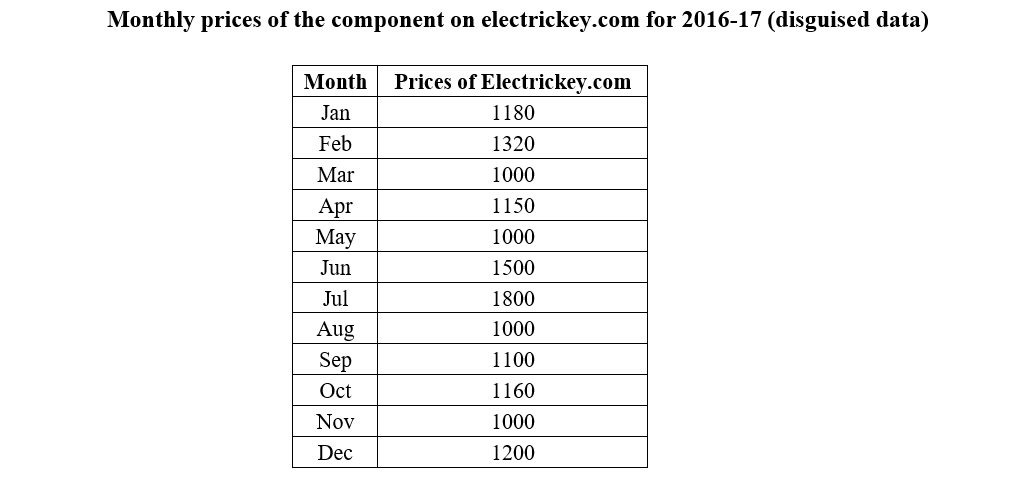

Shortterm sourcing through electrickey.com is expensive due to volatile pricing.

The Case of ACDC Power Modules:

Sattva sources ACDC power modules from Maxtronics in year bulk orders due to supplier minimum quantity requirements.

This coincides with the average lifespan of the component, leading to obsolescence of leftover inventory.

Sattva wants to optimize procurement costs and minimize inventory risks.

Maxtronics' Proposed Contract:

Maxtronics suggests a new contract with capacity reservation.

Sattva pays a reservation fee unit to secure capacity without purchase obligation.

Sattva confirms the order quantity later at a higher price unit based on actual demand.

This reduces Sattva's inventory risk but increases perunit cost compared to the old contract.

Nagesh's Proposed Buyback Contract:

Nagesh proposes a contract with a buyback option.

Sattva commits to a specific quantity at a negotiated price unit

Sattva can return excess components at a lower buyback price target unit

This reduces inventory risk but requires negotiation with Maxtronics for an attractive buyback price.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock