Question: Please Solve this tax problem preferably uploading irs forms with answers or in excel. Dear Team, As you know the deadline for completing our client,

Please Solve this tax problem preferably uploading irs forms with answers or in excel.

Dear Team,

As you know the deadline for completing our client, Best Pets, Inc.s tax return is soon.

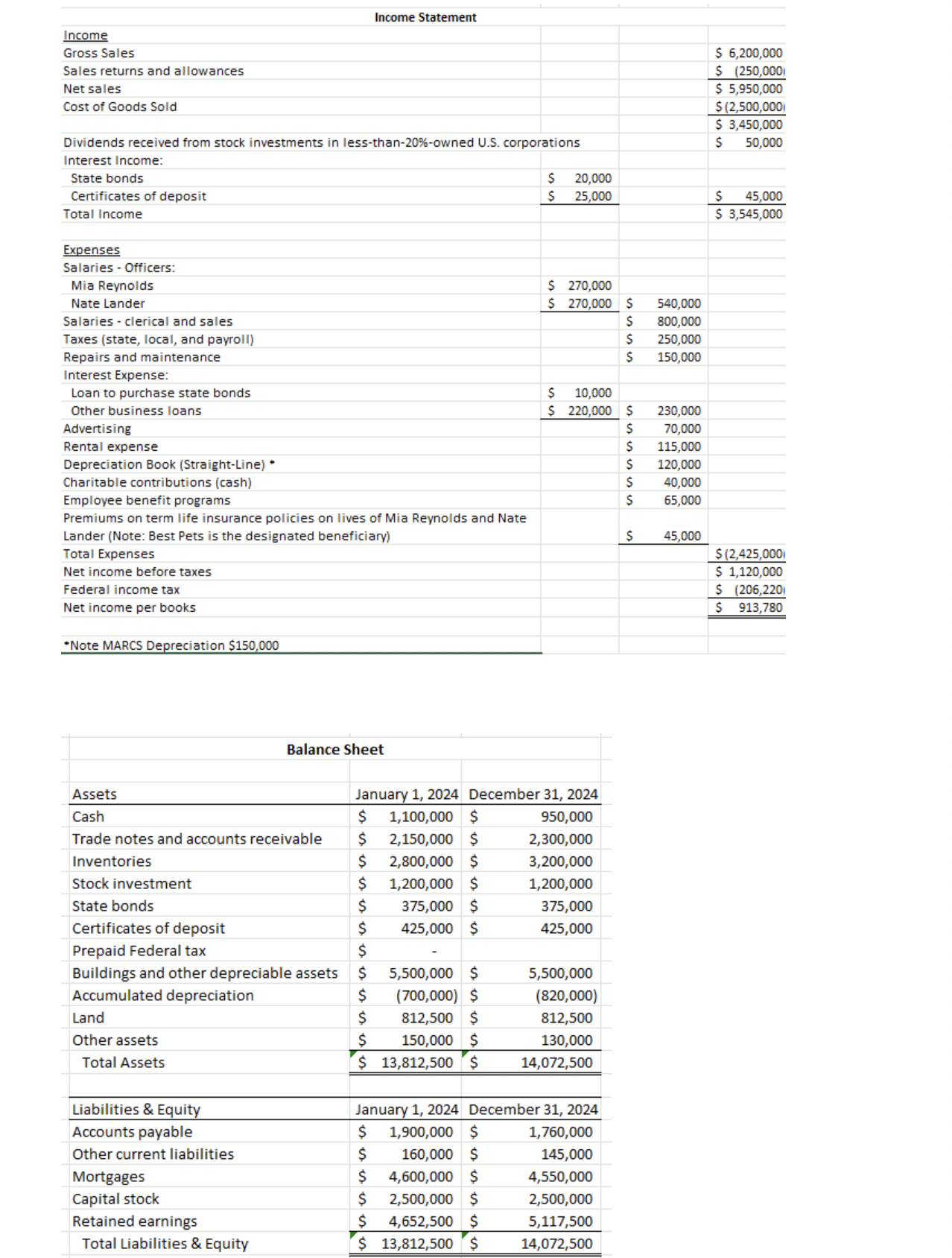

I have given you what I believe is all the necessary information to complete the returns. The

audit department has completed their work, and the financial statements have been

issued.

To remind you of the background of our client's company and to give you the required

information necessary for the return remember that Mia Reynolds and Nate Lander

formed Best Pets, Inc. on October They had been friends since first grade and

decided to open a pet supply company which operates at Pet Way, Amherst, MA phone:

email: petbestlife@pet The EIN is You should continue to

use as the business activity code.

Mia and Nate continue to own shares each of the shares of outstanding common

stock; and Mia continues to serve as the President and Nate continues to serve as the Vice

president of the company. Mia and Nate both work fulltime for Best Pets; Mia's Social

Security number is and Nate's Social Security number is

Background and Financials:

Company Name: Best Pets, Inc.

EIN:

Address: Pet Way, Amherst, MA

Principal Business Code:

Ownership: by Mia Reynolds President and Nate Lander VP

Tax YearEnd: December

The company uses the accrual method, FIFO inventory, and MACRS depreciation for tax

purposes. Straightline is used on the books. Best Pets, Inc. made $ in cash

dividend distributions in The company made $ in estimated tax payments per

quarter during the year.

Please prepare the federal corporate tax return and any related schedules and forms

for our client, Best Pets, Inc., using the financial and background information below. You

are required to compute taxable income, determine corporate income tax liability, and

prepare relevant Schedules M and M for Form

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock