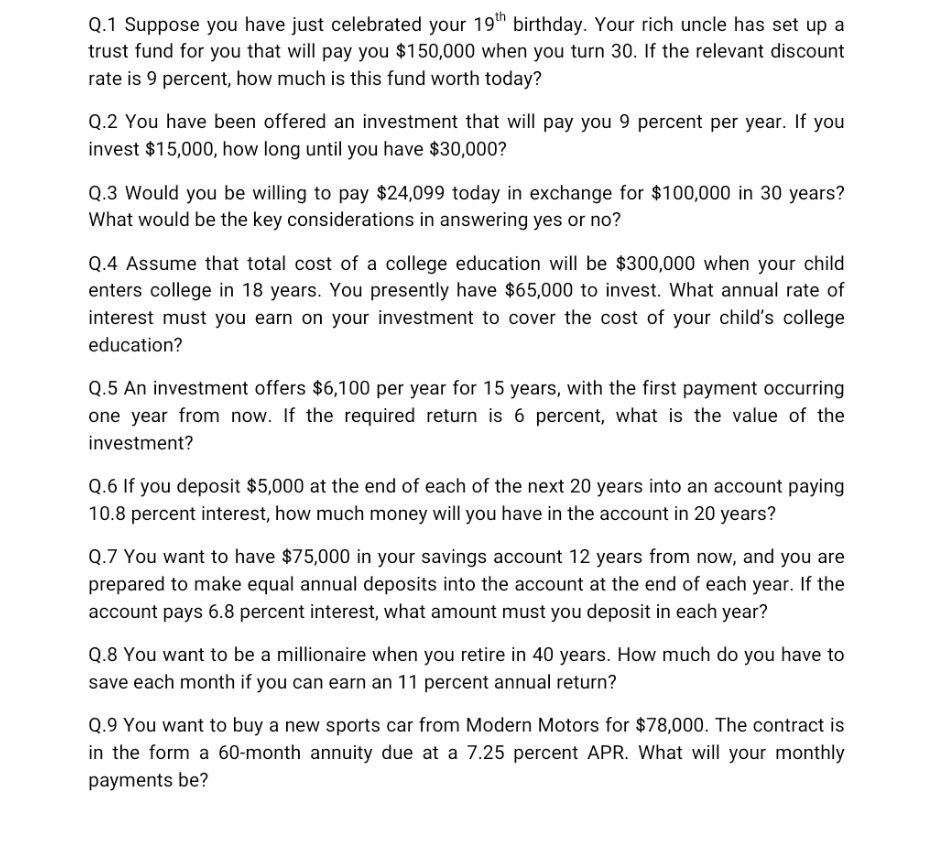

Question: please solve this using formulas not financial calculator and show all steps properly 0.1 Suppose you have just celebrated your 10th birthday. Your rich uncle

please solve this using formulas not financial calculator and show all steps properly

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock