Question: Please solve this with clear steps. (*) Problem 8. (Ross, Westerfield & Jaffe) National Electricity Company (NEC) is considering a S20 million modermization expansion project

Please solve this with clear steps.

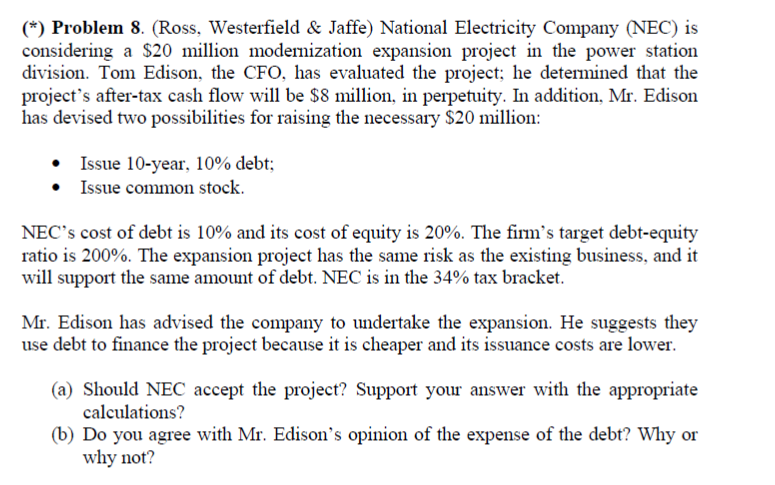

(*) Problem 8. (Ross, Westerfield & Jaffe) National Electricity Company (NEC) is considering a S20 million modermization expansion project in the power station division. Tom Edison, the CFO, has evaluated the project; he detemined that the project's after-tax cash flow will be $8 million, in perpetuity. In addition, Mr. Edison has devised two possibilities for raising the necessary $20 million: Issue 10-year, 10% debt; Issue common stock. NEC's cost of debt is 10% and its cost of equity is 20%. The firm's target debt-equity ratio is 200%. The expansion project has the same risk as the existing business, and it will support the same amount of debt. NEC is in the 34% tax bracket. Mr. Edison has advised the company to undertake the expansion. He suggests they use debt to finance the project because it is cheaper and its issuance costs are lower. (a) Should NEC accept the project? Support your answer with the appropriate calculations? (b) Do you agree with Mr. Edison's opinion of the expense of the debt? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts