Question: please solve this with in 1 hour Question 1 4 points The fundamental law of active management (only one possible answer) assumes active management will

please solve this with in 1 hour

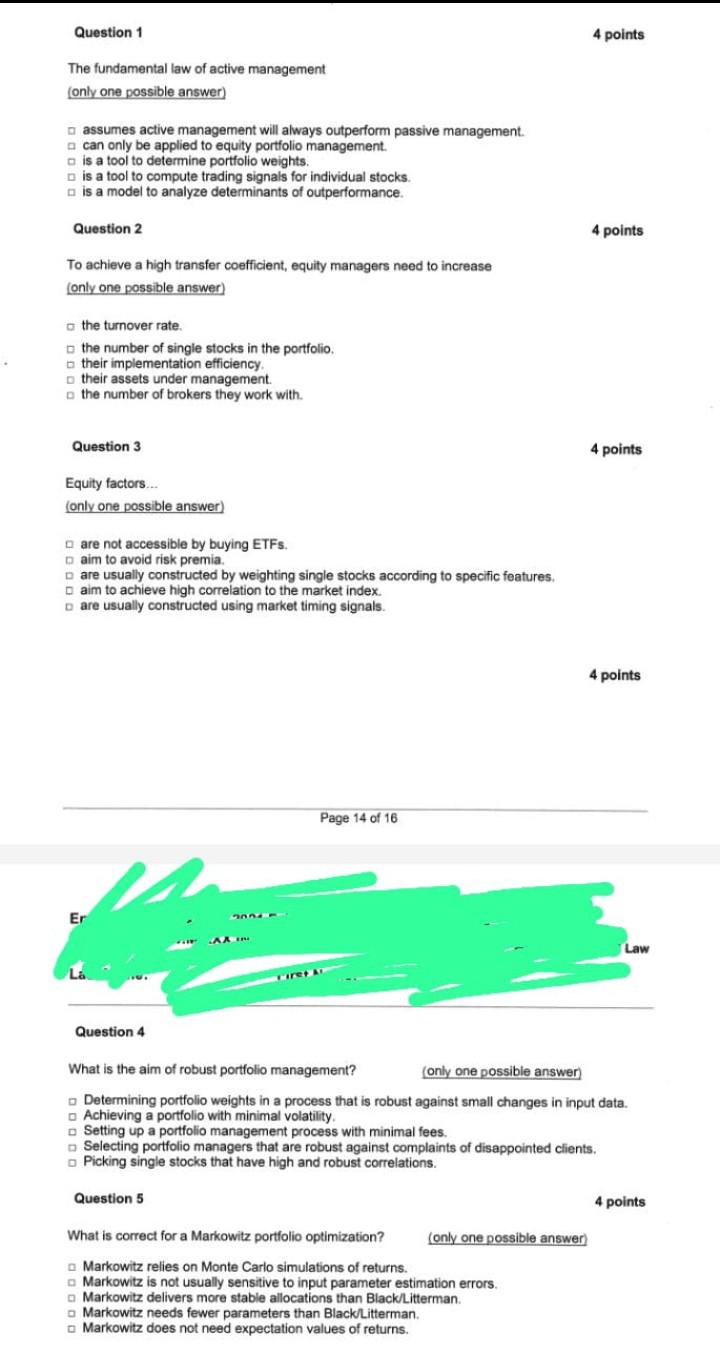

Question 1 4 points The fundamental law of active management (only one possible answer) assumes active management will always outperform passive management. a can only be applied to equity portfolio management. b is a tool to determine portfolio weights. b is a tool to compute trading signals for individual stocks. a is a model to analyze determinants of outperformance. Question 2 4 points To achieve a high transfer coefficient, equity managers need to increase (only one possible answer) the turnover rate. the number of single stocks in the portfolio. a their implementation efficiency. - their assets under management. the number of brokers they work with. Question 3 4 points Equity factors... (only one possible answer) - are not accessible by buying ETFs. aim to avoid risk premia. are usually constructed by weighting single stocks according to specific features. aim to achieve high correlation to the market index. b are usually constructed using market timing signals. 4 points Question 4 What is the aim of robust portfolio management? (only one possible answer) Determining portfolio weights in a process that is robust against small changes in input data. - Achieving a portfolio with minimal volatility. - Setting up a portfolio management process with minimal fees. - Selecting portfolio managers that are robust against complaints of disappointed clients. - Picking single stocks that have high and robust correlations. Question 5 4 points What is correct for a Markowitz portfolio optimization? Markowitz relies on Monte Carlo simulations of returns. - Markowitz is not usually sensitive to input parameter estimation errors. - Markowitz delivers more stable allocations than Black/Litterman. - Markowitz needs fewer parameters than Black/Litterman. Markowitz does not need expectation values of returns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts