Question: Please solve this without using chatgpt, and please don't just paste other chegg solutions if they exist. Give me the FULL solutions with COMPLETE calculations.

Please solve this without using chatgpt, and please don't just paste other chegg solutions if they exist. Give me the FULL solutions with COMPLETE calculations. Also, please make sure that your answer actually makes sense logically, and is not just a bunch of illogical calculations like I received mulitple times on this site. Otherwise, I would have to downvote. Thank you, and I hope you could help me out here.

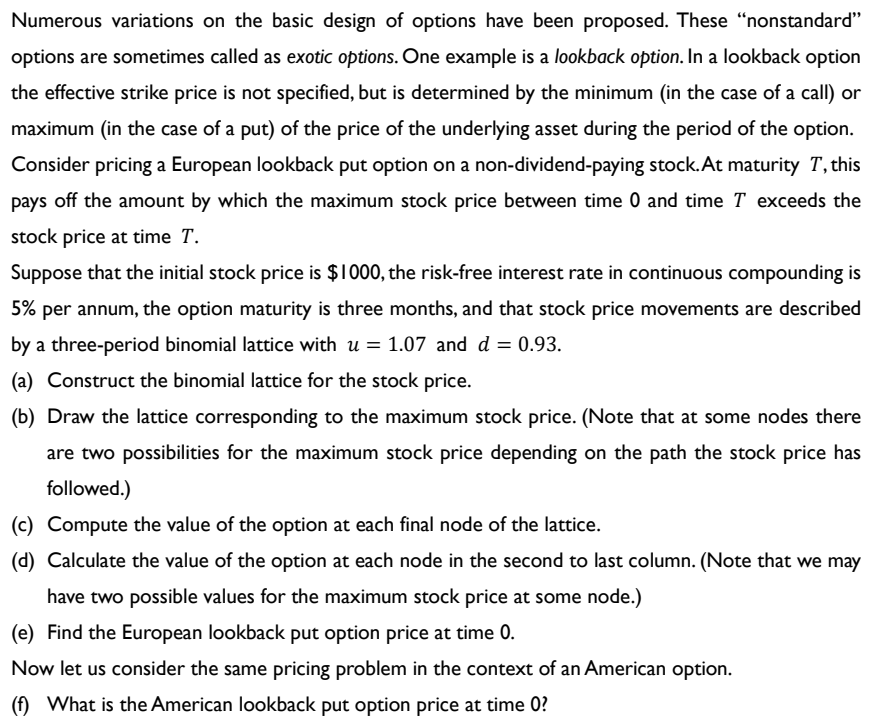

Numerous variations on the basic design of options have been proposed. These "nonstandard" options are sometimes called as exotic options. One example is a lookback option. In a lookback option the effective strike price is not specified, but is determined by the minimum (in the case of a call) or maximum (in the case of a put) of the price of the underlying asset during the period of the option. Consider pricing a European lookback put option on a non-dividend-paying stock. At maturity T, this pays off the amount by which the maximum stock price between time 0 and time T exceeds the stock price at time T. Suppose that the initial stock price is $1000, the risk-free interest rate in continuous compounding is 5% per annum, the option maturity is three months, and that stock price movements are described by a three-period binomial lattice with u=1.07 and d=0.93. (a) Construct the binomial lattice for the stock price. (b) Draw the lattice corresponding to the maximum stock price. (Note that at some nodes there are two possibilities for the maximum stock price depending on the path the stock price has followed.) (c) Compute the value of the option at each final node of the lattice. (d) Calculate the value of the option at each node in the second to last column. (Note that we may have two possible values for the maximum stock price at some node.) (e) Find the European lookback put option price at time 0. Now let us consider the same pricing problem in the context of an American option. (f) What is the American lookback put option price at time 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts