Question: Please solve this without using excel and showing steps. Thankyou! 23) EBike is considering opening a new product line for its Arlington factory to meet

Please solve this without using excel and showing steps. Thankyou!

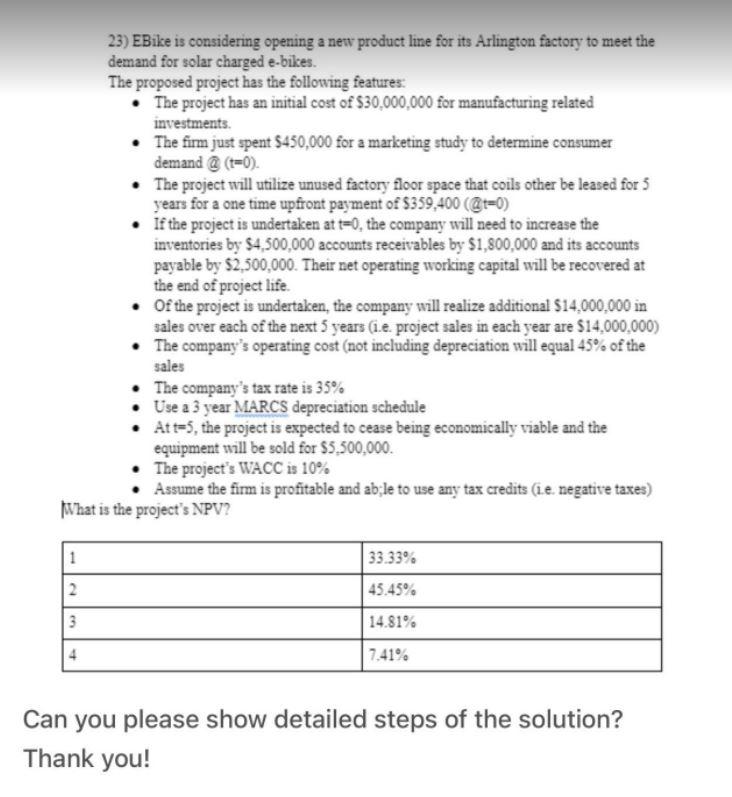

23) EBike is considering opening a new product line for its Arlington factory to meet the demand for solar charged e-bikes. The proposed project has the following features: The project has an initial cost of $30,000,000 for manufacturing related investments The firm just spent $450,000 for a marketing study to determine consumer demand @ (t=0). The project will utilize unused factory floor space that coils other be leased for 5 years for a one time upfront payment of $359,400 (@t=0) If the project is undertaken at t=0, the company will need to increase the inventories by $4,500,000 accounts receivables by $1,800,000 and its accounts payable by $2,500,000. Their net operating working capital will be recovered at the end of project life. Of the project is undertaken, the company will realize additional S14,000,000 in sales over each of the next 5 years (1.e. project sales in each year are $14.000.000) The company's operating cost (not including depreciation will equal 45% of the sales The company's tax rate is 35% Use a 3 year MARCS depreciation schedule At t=5, the project is expected to cease being economically viable and the equipment will be sold for $3,500,000 The project's WACC is 10% Assume the firm is profitable and ab;le to use any tax credits (1.e. negative taxes) What is the project's NPV? 1 33.33 2 45.45% 3 14.81% 4 7.41% Can you please show detailed steps of the solution? Thank you

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts