Question: PLEASE SOLVE USING BA II FINANCE CALCULATOR! Will Rate all Answers! 8. Given the following information regarding a replacement decision, what is the relevant cash

PLEASE SOLVE USING BA II FINANCE CALCULATOR! Will Rate all Answers!

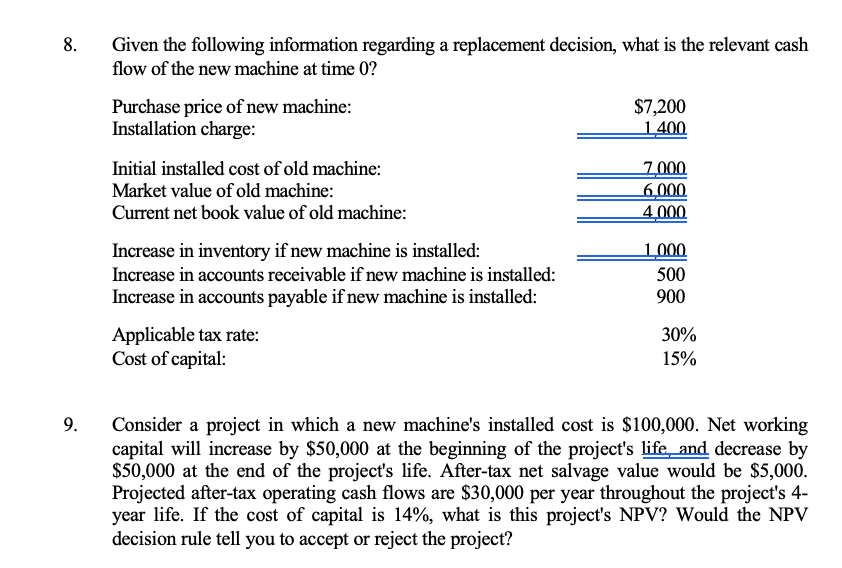

8. Given the following information regarding a replacement decision, what is the relevant cash flow of the new machine at time 0? Purchase price of new machine: $7,200 Installation charge: 1.400 Initial installed cost of old machine: 7000 Market value of old machine: 6.000 Current net book value of old machine: 4.000 Increase in inventory if new machine is installed: 1000 Increase in accounts receivable if new machine is installed: 500 Increase in accounts payable if new machine is installed: 900 Applicable tax rate: 30% Cost of capital: 15% 9. Consider a project in which a new machine's installed cost is $100,000. Net working capital will increase by $50,000 at the beginning of the project's life and decrease by $50,000 at the end of the project's life. After-tax net salvage value would be $5,000. Projected after-tax operating cash flows are $30,000 per year throughout the project's 4- year life. If the cost of capital is 14%, what is this project's NPV? Would the NPV decision rule tell you to accept or reject the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts