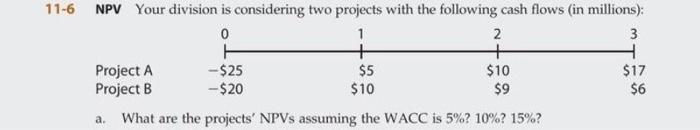

Question: please solve Using Excel. 11-6 NPV Your division is considering two projects with the following cash flows (in millions): 0 1 2 3 + +

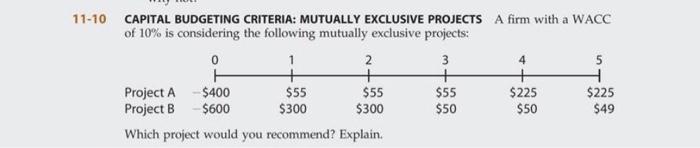

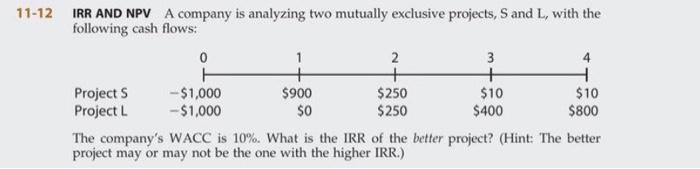

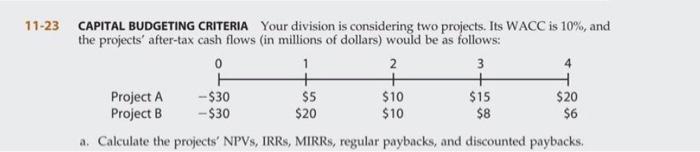

11-6 NPV Your division is considering two projects with the following cash flows (in millions): 0 1 2 3 + + Project A -$25 $5 $10 $17 Project B -$20 $10 $9 $6 a. What are the projects' NPVs assuming the WACC is 5% 10% 15%? 11-10 CAPITAL BUDGETING CRITERIA: MUTUALLY EXCLUSIVE PROJECTS A firm with a WACC of 10% is considering the following mutually exclusive projects: 0 1 2 3 4 5 + + + + Project A $400 $55 $55 $55 $225 $225 Project B $600 $300 $300 $50 $50 $49 Which project would you recommend? Explain. 11-12 IRR AND NPV A company is analyzing two mutually exclusive projects, S and L, with the following cash flows: 0 1 2 3 4 + + Projects -$1,000 $900 $250 $10 $10 Project L - $1,000 $0 $250 $400 $800 The company's WACC is 10%. What is the IRR of the better project? (Hint: The better project may or may not be the one with the higher IRR) 11-23 CAPITAL BUDGETING CRITERIA Your division is considering two projects. Its WACC is 10%, and the projects' after-tax cash flows (in millions of dollars) would be as follows: 0 1 2 3 + + + Project A -- $30 $5 $10 $15 Project B - $30 $20 $10 $8 $6 $20 a. Calculate the projects' NPVS, IRRS, MIRRs, regular paybacks, and discounted paybacks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts