Question: please solve using excel 9s.12 You purchased a stamping machine that cost $60,000 five years ago. At that time, the machine was estimated to have

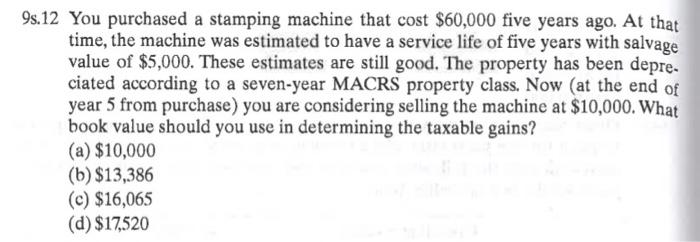

9s.12 You purchased a stamping machine that cost $60,000 five years ago. At that time, the machine was estimated to have a service life of five years with salvage value of $5,000. These estimates are still good. The property has been depre. ciated according to a seven-year MACRS property class. Now (at the end of year 5 from purchase) you are considering selling the machine at $10,000. What book value should you use in determining the taxable gains? (a) $10,000 (b) $13,386 (c) $16,065 (d) $17,520

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts