Question: Please solve using excel. A business executive is offered a management job at Generous Electric Company, which offers him a 5-year contract that calls for

Please solve using excel.

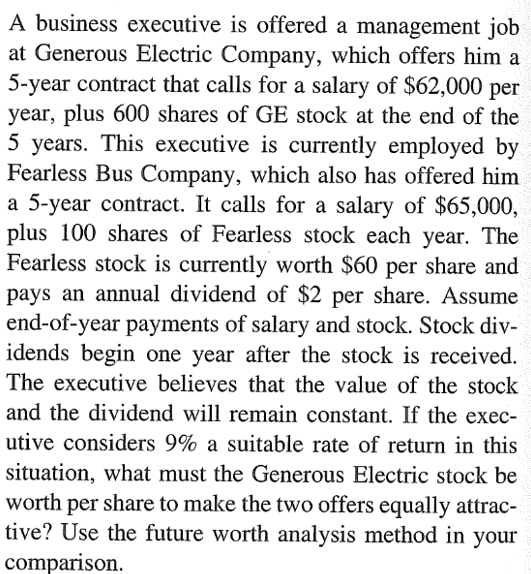

A business executive is offered a management job at Generous Electric Company, which offers him a 5-year contract that calls for a salary of $62,000 per year, plus 600 shares of GE stock at the end of the 5 years. This executive is currently employed by Fearless Bus Company, which also has offered him a 5-year contract. It calls for a salary of $65,000 plus 100 shares of Fearless stock each year. The Fearless stock is currently worth $60 per share and pays an annual dividend of $2 per share. Assume end-of-year payments of salary and stock. Stock div- idends begin one year after the stock is received The executive believes that the value of the stock and the dividend will remain constant. If the exec- utive considers 9% a suitable rate of return in this situation, what must the Generous Electric stock be worth per share to make the two offers equally attrac- tive? Use the future worth analysis method in your comparison

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts