Question: please solve using excel and show formulas for each step Consider a project with free cash flows in one year of $96,363 in a weak

please solve using excel and show formulas for each step

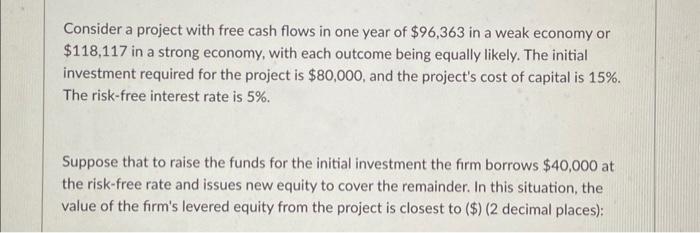

please solve using excel and show formulas for each stepConsider a project with free cash flows in one year of $96,363 in a weak economy or $118,117 in a strong economy, with each outcome being equally likely. The initial investment required for the project is $80,000, and the project's cost of capital is 15%. The risk-free interest rate is 5%. Suppose that to raise the funds for the initial investment the firm borrows $40,000 at the risk-free rate and issues new equity to cover the remainder. In this situation, the value of the firm's levered equity from the project is closest to (\$) ( 2 decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts