Question: (please solve using excel and show the formulas) You are evaluating a set of 4 independent projects, whose annual cash flows are summarized in the

(please solve using excel and show the formulas)

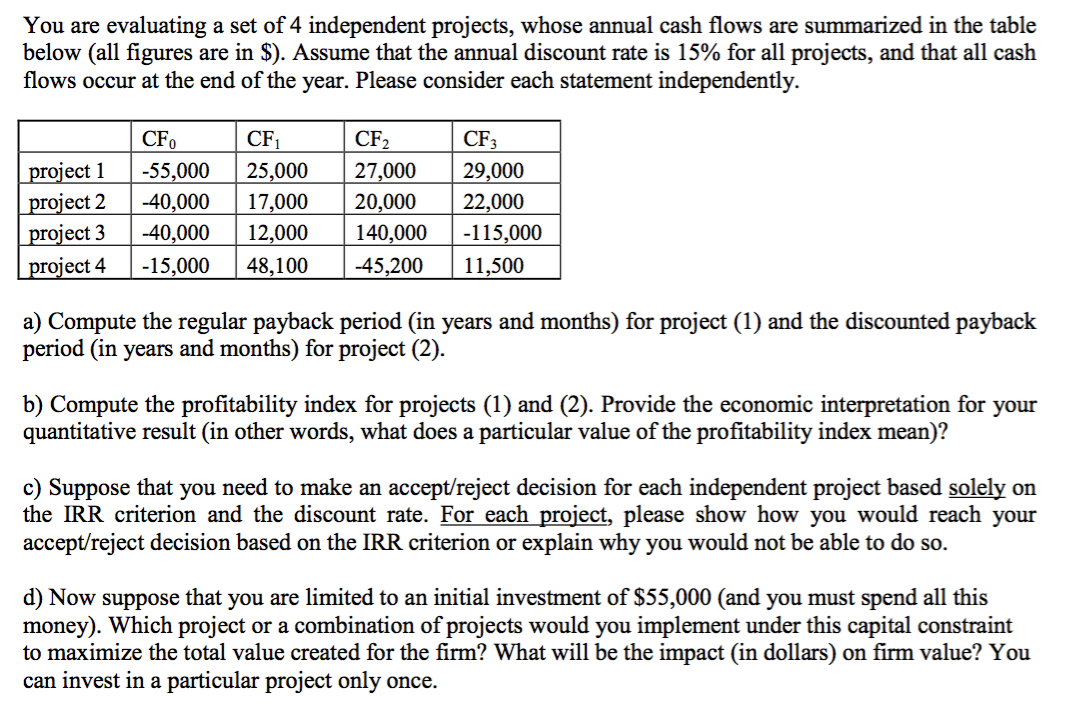

You are evaluating a set of 4 independent projects, whose annual cash flows are summarized in the table below (all figures are in $). Assume that the annual discount rate is 15% for all projects, and that all cash flows occur at the end of the year. Please consider each statement independently. project 1 project 2 project 3 project 4 CF -55,000 -40,000 -40,000 -15,000 CF 25,000 17,000 12,000 48,100 CF2 27,000 20,000 140,000 -45,200 CF3 29,000 22,000 -115,000 11,500 a) Compute the regular payback period (in years and months) for project (1) and the discounted payback period (in years and months) for project (2). b) Compute the profitability index for projects (1) and (2). Provide the economic interpretation for your quantitative result (in other words, what does a particular value of the profitability index mean)? c) Suppose that you need to make an accept/reject decision for each independent project based solely on the IRR criterion and the discount rate. For each project, please show how you would reach your accept/reject decision based on the IRR criterion or explain why you would not be able to do so. d) Now suppose that you are limited to an initial investment of $55,000 (and you must spend all this money). Which project or a combination of projects would you implement under this capital constraint to maximize the total value created for the firm? What will be the impact (in dollars) on firm value? You can invest in a particular project only once

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts