Question: please solve using Excel, and show/explain how you solved the questions in Excel. Thank you! 9. Today is May 5, 2008, and the continuously compounded)

please solve using Excel, and show/explain how you solved the questions in Excel. Thank you!

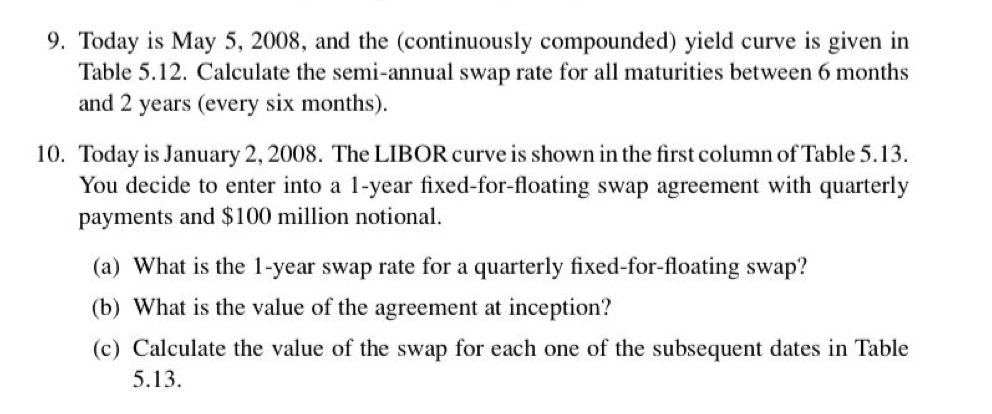

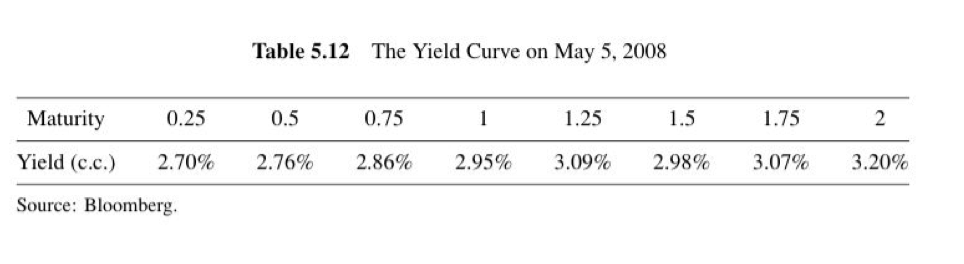

9. Today is May 5, 2008, and the continuously compounded) yield curve is given in Table 5.12. Calculate the semi-annual swap rate for all maturities between 6 months and 2 years (every six months). 10. Today is January 2, 2008. The LIBOR curve is shown in the first column of Table 5.13. You decide to enter into a 1-year fixed-for-floating swap agreement with quarterly payments and $ 100 million notional. (a) What is the 1-year swap rate for a quarterly fixed-for-floating swap? (b) What is the value of the agreement at inception? (c) Calculate the value of the swap for each one of the subsequent dates in Table 5.13. Table 5.12 The Yield Curve on May 5, 2008 Maturity 0.25 0.5 0.75 1 1.25 1.5 1.75 2 Yield (c.c.) 2.70% 2.76% 2.86% 2.95% 3.09% 2.98% 3.07% 3.20% Source: Bloomberg. Table 5.13 The LIBOR Curve: January, 2008 - October, 2008 Months 2-Jan 1-Feb 3-Mar 1-Apr 1-May 2-Jun 1-Jul 1-Aug 1-Sep 1-Oct 1 2 3 4 5 6 7 8 9 10 11 12 4.57% 4.64% 4.68% 4.65% 4.61% 4.57% 4.50% 4.42% 4.35% 4.29% 4.24% 4.19% 3.14% 3.11% 3.10% 3.07% 3.05% 3.02% 2.97% 2.92% 2.88% 2.85% 2.83% 2.82% 3.09% 3.04% 3.01% 2.97% 2.91% 2.86% 2.81% 2.76% 2.71% 2.68% 2.65% 2.63% 2.70% 2.69% 2.68% 2.66% 2.64% 2.62% 2.58% 2.54% 2.51% 2.50% 2.48% 2.47% 2.72% 2.76% 2.78% 2.82% 2.85% 2.88% 2.90% 2.92% 2.93% 2.95% 2.97% 2.98% 2.46% 2.57% 2.68% 2.75% 2.83% 2.90% 2.94% 2.98% 3.02% 3.06% 3.10% 3.14% 2.46% 2.65% 2.79% 2.89% 3.01% 3.12% 3.15% 3.19% 3.22% 3.25% 3.29% 3.32% 2.46% 2.66% 2.79% 2.89% 3.00% 3.08% 3.10% 3.12% 3.14% 3.17% 3.20% 3.22% 2.49% 2.68% 2.81% 2.94% 3.02% 3.11% 3.12% 3.14% 3.15% 3.16% 3.18% 3.20% 4.00% 4.05% 4.15% 4.09% 4.07% 4,04% 4.04% 4.04% 4.04% 4.04% 4.04% 4.04% Source: Bloomberg, 9. Today is May 5, 2008, and the continuously compounded) yield curve is given in Table 5.12. Calculate the semi-annual swap rate for all maturities between 6 months and 2 years (every six months). 10. Today is January 2, 2008. The LIBOR curve is shown in the first column of Table 5.13. You decide to enter into a 1-year fixed-for-floating swap agreement with quarterly payments and $ 100 million notional. (a) What is the 1-year swap rate for a quarterly fixed-for-floating swap? (b) What is the value of the agreement at inception? (c) Calculate the value of the swap for each one of the subsequent dates in Table 5.13. Table 5.12 The Yield Curve on May 5, 2008 Maturity 0.25 0.5 0.75 1 1.25 1.5 1.75 2 Yield (c.c.) 2.70% 2.76% 2.86% 2.95% 3.09% 2.98% 3.07% 3.20% Source: Bloomberg. Table 5.13 The LIBOR Curve: January, 2008 - October, 2008 Months 2-Jan 1-Feb 3-Mar 1-Apr 1-May 2-Jun 1-Jul 1-Aug 1-Sep 1-Oct 1 2 3 4 5 6 7 8 9 10 11 12 4.57% 4.64% 4.68% 4.65% 4.61% 4.57% 4.50% 4.42% 4.35% 4.29% 4.24% 4.19% 3.14% 3.11% 3.10% 3.07% 3.05% 3.02% 2.97% 2.92% 2.88% 2.85% 2.83% 2.82% 3.09% 3.04% 3.01% 2.97% 2.91% 2.86% 2.81% 2.76% 2.71% 2.68% 2.65% 2.63% 2.70% 2.69% 2.68% 2.66% 2.64% 2.62% 2.58% 2.54% 2.51% 2.50% 2.48% 2.47% 2.72% 2.76% 2.78% 2.82% 2.85% 2.88% 2.90% 2.92% 2.93% 2.95% 2.97% 2.98% 2.46% 2.57% 2.68% 2.75% 2.83% 2.90% 2.94% 2.98% 3.02% 3.06% 3.10% 3.14% 2.46% 2.65% 2.79% 2.89% 3.01% 3.12% 3.15% 3.19% 3.22% 3.25% 3.29% 3.32% 2.46% 2.66% 2.79% 2.89% 3.00% 3.08% 3.10% 3.12% 3.14% 3.17% 3.20% 3.22% 2.49% 2.68% 2.81% 2.94% 3.02% 3.11% 3.12% 3.14% 3.15% 3.16% 3.18% 3.20% 4.00% 4.05% 4.15% 4.09% 4.07% 4,04% 4.04% 4.04% 4.04% 4.04% 4.04% 4.04% Source: Bloomberg

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts