Question: Please solve using Excel functions Thank you and will leave a rating Taussig Corp.'s bonds currently sell for $1020. They have a 6.5% annual coupon

Please solve using Excel functions

Thank you and will leave a rating

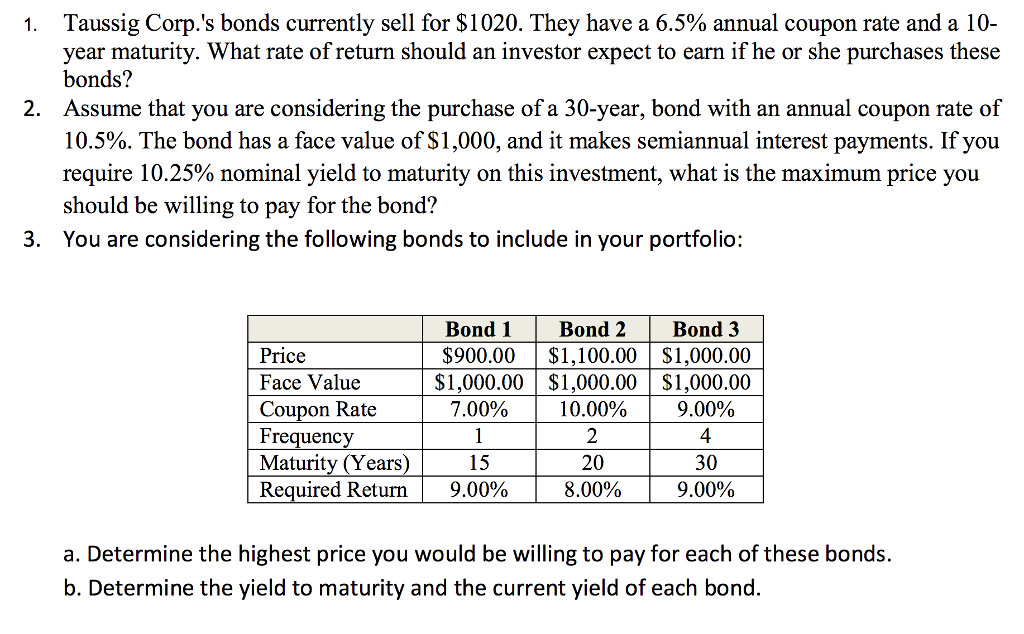

Taussig Corp.'s bonds currently sell for $1020. They have a 6.5% annual coupon rate and a 10- bonds? year maturity. What rate of return should an investor expect to earn if he or she purchases these Assume that you are considering the purchase of a 30-year, bond with an annual coupon rate of 10.5%. The bond has a face value of $1,000, and it makes semiannual interest payments. If you require 10.25% nominal yield to maturity on this investment, what is the maximum price you should be willing to pay for the bond? You are considering the following bonds to include in your portfolio: 1. 2. 3. Bond 1Bond 2 Bond3 $900.00$%1,100.00$1,000.00 $1,000.00$1,000.00$1,000.00 10.00% Price Face Value Coupon Rate Frequenc Maturity (Years) Required Return 9.00% 4 30 9.00% 7.00% 15 9.00% 20 8.00 % a. Determine the highest price you would be willing to pay for each of these bonds. b. Determine the yield to maturity and the current yield of each bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts