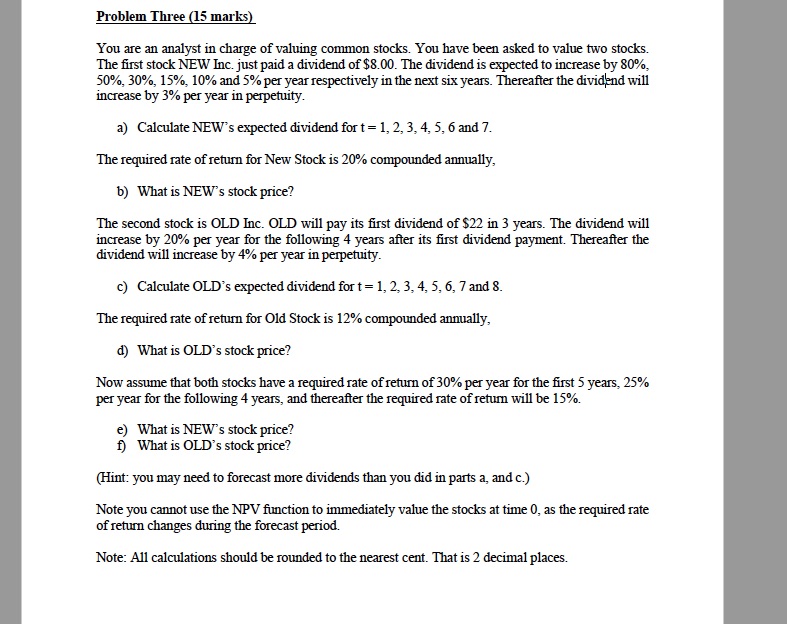

Question: Please solve using excel please and show formula used in excel please Problem Three (15 marks) You are an analyst in charge of valuing common

Please solve using excel please and show formula used in excel please

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock