Question: Please solve using excel & show all the work (includings excel formulas) Please refer to the attached spreadsheet, which provides dividend-adjusted end-of-month prices and Amore

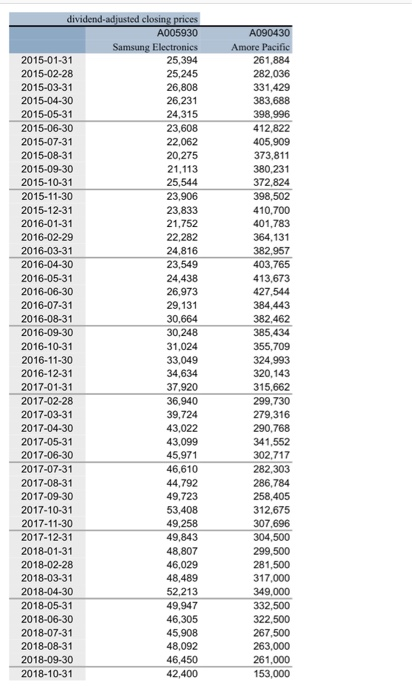

Please refer to the attached spreadsheet, which provides dividend-adjusted end-of-month prices and Amore Pacific for the time period from January 2015 to October 2018, inclusive for Samsung Electronics a) For each stock and each month in our time period, compute monthly returns (i.e. the first monthly return is for February 2015 and the last one is for October 2018). b) For each stock, compute the standard deviation (Excel function STDEV) of monthly returns and, based on this number, compute the annual standard deviation. Hint: To present the standard deviation of monthly returns in annualized terms, we need to multiply the monthly standard deviation by the square root of 12. To get the square root in Excel, you can you -sQRTO, or you can take the number to the power of 0.5 using 0.5 e)Compute correlations (Excel function CORREL) of monthly returns between Samsung Electronics and Amore Pacific over our time period. d) Using the formula for the standard deviation of a two-asset portfolio and values computed in parts (b) and (c), compute the monthly and annual standard deviations of a portfolio invested 25% in Samsung Electronics and 75% in Amore Pacific. Hint variance of a two-asset portfolio of A and B- where is the standard deviation of stock A and P is the correlation (correlation coefficient) between stock A and B For each month in our sample period, compute monthly returns for a portfolio consistently invested 25% in Samsung Electronics and 75% in Amore Pacific. Next, find the monthly standard deviation of returns on this portfolio over our time period by using the Excel function STDEV and check that your answers are the same as in part (d). Also, find the annualized standard deviation of the portfolio returns and check that your answers are the same as in part (d)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts