Question: PLEASE SOLVE USING EXCEL SHOWING WORK AND FORMULAS. THANK YOU!! Q 1. Today is John Tardy's 45th birthday and, despite his finance professor's advice, he

PLEASE SOLVE USING EXCEL SHOWING WORK AND FORMULAS. THANK YOU!!

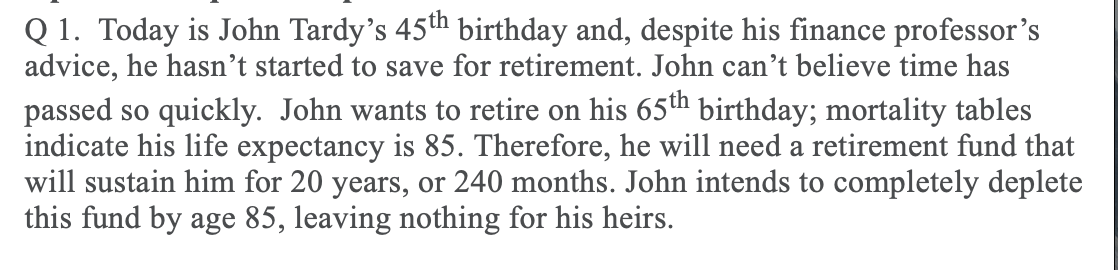

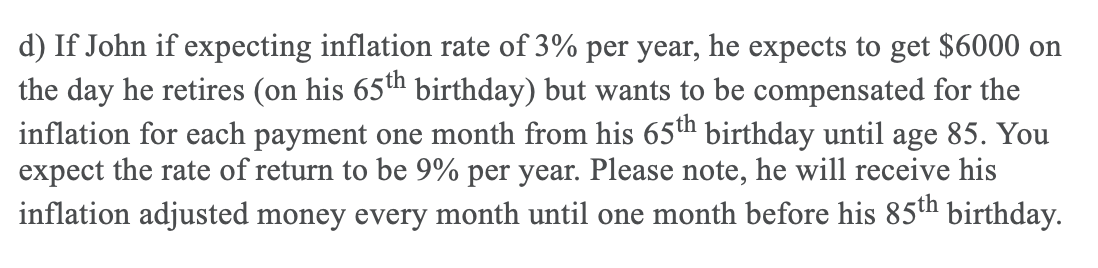

Q 1. Today is John Tardy's 45th birthday and, despite his finance professor's advice, he hasn't started to save for retirement. John can't believe time has passed so quickly. John wants to retire on his 65th birthday; mortality tables indicate his life expectancy is 85. Therefore, he will need a retirement fund that will sustain him for 20 years, or 240 months. John intends to completely deplete this fund by age 85, leaving nothing for his heirs. d) If John if expecting inflation rate of 3% per year, he expects to get $6000 on the day he retires (on his 65th birthday) but wants to be compensated for the inflation for each payment one month from his 65th birthday until age 85. You expect the rate of return to be 9% per year. Please note, he will receive his inflation adjusted money every month until one month before his 85th birthday

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts