Question: Please solve using excel solver You have been asked to develop an initial planning model (i.e., fractional outcomes for the decisions are acceptable). (a) Determine

Please solve using excel solver

You have been asked to develop an initial planning model (i.e., fractional outcomes for the decisions are acceptable).

(a) Determine the maximum return on the portfolio. What is the optimal number of shares to buy for each of the stocks? What is the corresponding dollar amount invested in each stock?

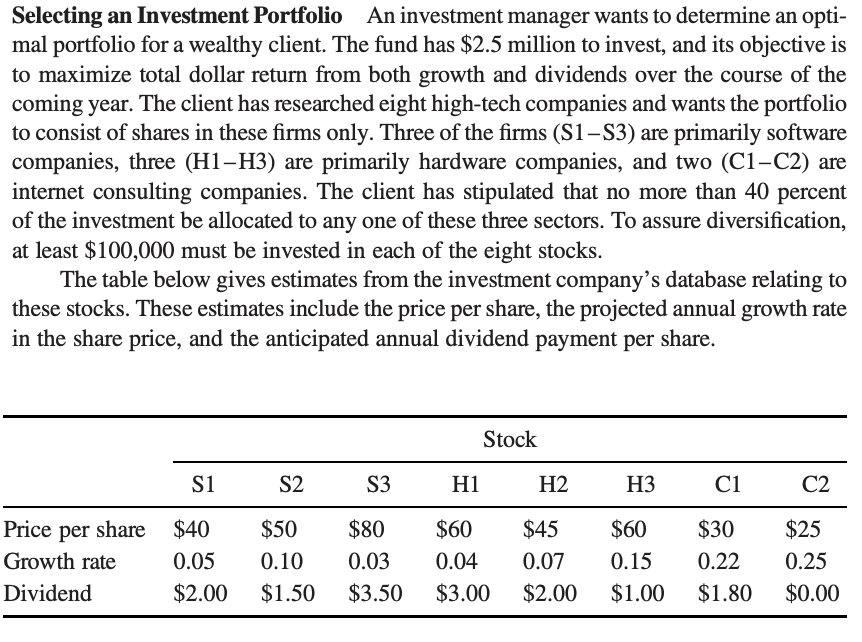

Selecting an Investment Portfolio An investment manager wants to determine an opti- mal portfolio for a wealthy client. The fund has $2.5 million to invest, and its objective is to maximize total dollar return from both growth and dividends over the course of the coming year. The client has researched eight high-tech companies and wants the portfolio to consist of shares in these firms only. Three of the firms (S1-S3) are primarily software companies, three (H1-H3) are primarily hardware companies, and two (C1-C2) are internet consulting companies. The client has stipulated that no more than 40 percent of the investment be allocated to any one of these three sectors. To assure diversification, at least $100,000 must be invested in each of the eight stocks. The table below gives estimates from the investment company's database relating to these stocks. These estimates include the price per share, the projected annual growth rate in the share price, and the anticipated annual dividend payment per share. Stock C1 S1 S2 S3 2 C2 $40 $50 $80 $60 $45 $60 $30 $25 Price per share Growth rate 0.05 0.10 0.04 0.15 0.22 0.25 0.03 0.07 $3.00 Dividend $2.00 $3.50 $2.00 $0.00 $1.50 $1.00 $1.80

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts