Question: PLEASE SOLVE USING EXCEL - THANK YOU!! #2: The ABC Corporation is considering the acquisition of a 4.7M upgrade of all machinery in the semiconductor

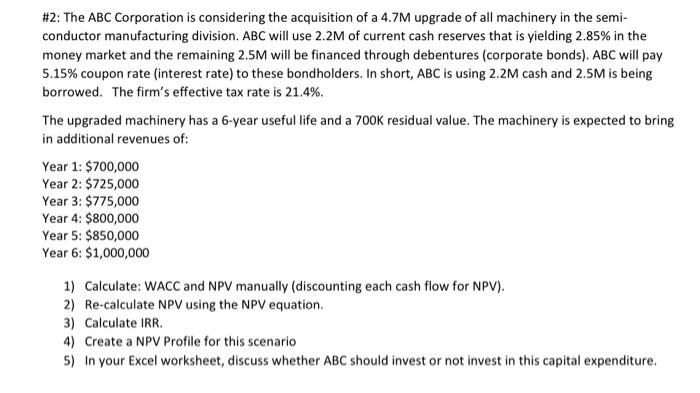

\#2: The ABC Corporation is considering the acquisition of a 4.7M upgrade of all machinery in the semiconductor manufacturing division. ABC will use 2.2M of current cash reserves that is yielding 2.85% in the money market and the remaining 2.5M will be financed through debentures (corporate bonds). ABC will pay 5.15% coupon rate (interest rate) to these bondholders. In short, ABC is using 2.2M cash and 2.5M is being borrowed. The firm's effective tax rate is 21.4%. The upgraded machinery has a 6-year useful life and a 700K residual value. The machinery is expected to bring in additional revenues of: Year 1: $700,000 Year 2: $725,000 Year 3: \$775,000 Year 4: $800,000 Year 5: \$850,000 Year 6: $1,000,000 1) Calculate: WACC and NPV manually (discounting each cash flow for NPV). 2) Re-calculate NPV using the NPV equation. 3) Calculate IRR. 4) Create a NPV Profile for this scenario 5) In your Excel worksheet, discuss whether ABC should invest or not invest in this capital expenditure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts